TPG's biggest byte

Recommendation

There can't be many more spectacular corporate success stories than TPG Telecom. From a single shop selling computer hardware back in 1986, it has morphed into a $9bn juggernaut that connects a quarter of Australian households onto the internet. Its ascent has been relentless, swift and we completely missed it.

The business released full-year results this week that confirm that financial success has followed stunning gains in market share. As you can see from Table 1, this was an impressive result.

Over the past five years, earnings per share has rocketed 250%, a record aided by some terrific acquisitions. The purchase of Pipe Networks in 2009 and AAPT in 2013 have been instrumental in TPG's success, delivering vital fibre-optic networks and infrastructure.

Key Points

Another stellar result

iiNet purchase complete

Could enter mobile market

Ownership of infrastructure has been a key competitive advantage. Resellers such as M2 have had to rent fibre from Telstra and Optus and, as a result, their businesses don't scale as well; new customers require higher costs.

| 2014 | 2015 | Change, % | |

|---|---|---|---|

| Revenue | 971 | 1271 | 31 |

| EBITDA | 364 | 485 | 33 |

| NPAT | 172 | 224 | 31 |

| EPS (cents) | 21.6 | 28.2 | 31 |

| DPS | 9 | 12 | 33 |

| Op cash flow | 300 | 382 | 27 |

By contrast, TPG maintains a vast network of backhaul infrastructure allowing it to chase new customers aggressively, plug them into its own network and squeeze ever more data from those existing assets.

Every customer TPG collects contributes to stronger margins, which helps explain why its EBITDA margin is far higher than peers such as M2 and iiNet (see Table 2). Even after accounting for depreciation of all that equipment, TPG's EBIT margins remain at least twice as high as peers.

By sweating its assets harder, the business has been able to lower prices and expand margins at the same time to deliver bonanza profits.

Suit up

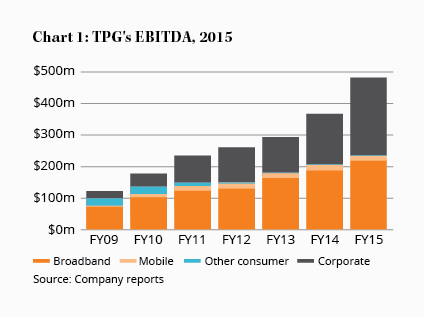

The AAPT deal was particularly important, positioning it in the corporate segment where it has grown rapidly; TPG now makes more money selling to companies than to households (see Chart 1). While its consumer market share is about 25%, corporate market share is under 10% suggesting there is further room to grow.

Growth in the consumer segment has been hastened by a swift take-up of bundle deals that include broadband and fixed-line services. Sales of bundles now represent 66% of total sales, up from half of sales two years ago.

| TPG | M2 | iiNet* | Amaysim | |

|---|---|---|---|---|

| EBITDA margin (%) | 37 | 15 | 18 | 7 |

| EBIT margin (%) | 26 | 11 | 10 | 7 |

| EV/EBITDA (x) | 18 | 12 | n/a | 25 |

| *pre acquisition |

As a result, TPG collects more cash from every customer – its average revenue per user (ARPU) is over $50 compared to just $41 from broadband alone and $7 from home phone customers. Since marketing, billing and service expenses are the same for each product, increasing bundle sales increases margins. It has been a key strength of the business.

Biggest buy yet

The strategy of aggressively pursuing customers to push through its network has continued with the $1.5bn acquisition of iiNet, TPG's largest purchase to date. The combination of TPG and iiNet makes it the second-largest provider of broadband in Australia with 1.7m customers, compared to 3m for Telstra and 1m for Optus.

This purchase is, however, slightly different from past acquisitions. iiNet holds little valuable infrastructure but it does have a valuable brand, especially on the west coast where TPG is relatively feeble. TPG will move iiNet customers onto its own network where it can, but it will also retain the iiNet brand which will make the company a multi-brand business.

There is some risk here. TPG is a price-led business whereas iiNet is service-led. Management will have to nurture two very different cultures while trying to tie both businesses closely together to cut costs. We think the acquisition is a good one at a decent price but it is more challenging than previous deals.

Mobile opportunity

If there was one disappointment in TPG's result, it was the poor performance of the nascent mobile division, which suffered a net 12% loss of customers for the year. Unlike in broadband, there is no advantage wielded here. TPG is a pure reseller and rents Telstra's mobile towers to provide a mobile service. Margins are commensurately lower; at 20%, they are less than half those generated from broadband sales.

While the mobile business is yet to prove a success, we suspect TPG could target the area to match Optus and Telstra in offering home, mobile and broadband bundles.

It's no secret that hapless Vodafone Australia is the laughing stock of Vodafone Worldwide and suffers a brand problem. Buying that business and rebranding it could be an option for an emboldened TPG. The business doesn't have the balance sheet to do that yet but, as the iiNet deal closes and cash starts flowing, TPG will again be flush with ammo.

For the moment, TPG carries about $1.8bn in debt, a little higher than we would like but it is supported by healthy cash flows. We estimate that operating cash flows of $370m will rise to over $500m next year. With dividends still low and capital expenditure of about $120m a year, the combined group should generate copious cash flows to lower debt.

Too high to buy

This has been an excellent business to date but will it continue to be one in an NBN dominated world? We aren't so sure. Although ownership of backhaul infrastructure will still matter, it could be less of an advantage and growth rates, we expect, will also slow. With the ACCC hinting that it won't allow further industry consolidation, a lot will depend on success in new markets such as mobile.

That uncertainty wouldn't matter if the price was right but, trading at an enterprise value to earnings before interest, tax, depreciation and amortisation (EV/EBITDA) multiple of 18 times already bakes in a lot of optimism. This is an excellent business, but it is priced as such. HOLD.

Recommendation