Time to wager on Crown

Recommendation

When James Packer's Crown Resorts announced it was bringing a casino to Sydney in 2019, Echo Entertainment's shares were hit by concerns over the impact the new casino would have on its main asset, The Star casino. Investors who bought amidst the panic surrounding Echo were rewarded handsomely.

A similar scenario is playing out at the moment, with investors fretting over how Crown will pay for its fancy new Sydney casino, on top of a bunch of other developments. Add to this some serious concerns over the impact of a Chinese corruption crackdown on its 34% stake in Nasdaq-listed Melco Crown Entertainment (MPEL), and its share price has fallen 28% since January 2014. Again, though, we think the market is getting too caught up with the negatives.

- Capital intensive business

- Developments & Macau to drive future returns

- Investor concerns overblown: BUY

No doubt it will be expensive to realise Packer's dream for Crown Sydney, but the company is spending the money for a reason and there's a great opportunity to be taken. And no doubt the Chinese crackdown will put a dent in the Macau gambling market – but over the longer term, the region should benefit from massive spending on infrastructure.

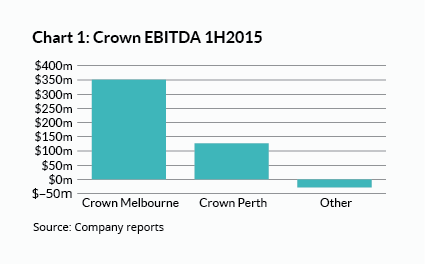

We'll come back to these investments shortly, but it's also important to recognise that they're only a part of the picture; while investors have focused their attention elsewhere, Crown's beating heart – its casinos in Melbourne and Perth – continue to pump cash into its system. As you can see from Chart 1, Crown Melbourne contributes the lion's share of the group's earnings before interest, tax, depreciation and amortisation (EBITDA) – and it's been able to increase it steadily by about 5% a year over the past five years (to $562m in 2014). Crown Perth has also been growing, but at the more leisurely rate of 3% a year (to $242m in 2014).

It's the nature of this business that Crown has had to invest heavily to achieve this growth – it has spent $1.4bn and $800m on Melbourne and Perth respectively since 2009 – but the investments have been easily justified by the low-to-mid teen return on assets made by these properties.

Crown's other assets also include majority ownership of a 35-acre parcel of land in Las Vegas (the site of a planned casino), some smaller casino-related assets in the UK and the US, as well as online gambling business Betfair Australasia and 67% of CrownBet – a sports bookmaking business. These assets are of little value compared to Melbourne, Perth, MPEL and the proposed casino in Sydney, however, so we've focused our analysis on the larger assets.

VIP v mass market

To understand how casinos work, it's important to distinguish between ordinary 'mass-market' punters and VIPs – the relatively small number of wealthy gamblers who bet large sums of money. The size of VIP bets partially compensates for the fact that they tend to be lower margin – due to the costs of flying the VIPs to the casinos and providing them with hotel accommodation, fancy dinners and other freebies.

Due to the size of individual bets, VIP revenue and profits are also more volatile. However, as the odds of all casino games are weighted in the casino's favour (card-counters tend to be excluded pretty quickly and may inspire others to try their luck), over the longer term profits from VIPs approximate to the theoretical win-rate based on the odds (less the cost of all the freebies of course). As a result, casinos typically report results based on this theoretical win rate, alongside their actual results.

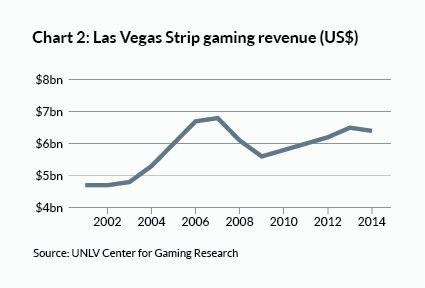

These underlying profits tend to be fairly stable, although the global financial crisis disproved the notion that they were immune to economic downturns, with total gambling revenues in Las Vegas (the world's second-largest gambling market after Macau) falling 19%. In fact, as you can see from Chart 2, they still haven't returned to their pre-GFC level.

Macau also saw a fall in gambling revenues during the first six months of 2009, even though China avoided the worst of the GFC. Australia was also relatively unscathed, so the earnings of Crown Melbourne and Crown Perth weren't significantly affected during this period. Despite their monopoly status, however, we would expect earnings to decline slightly should Australia enter recession – although we'd expect growth to at least match economic growth over the long term.

So let's get back to the company's spending plans. Over the next seven years, the company plans to spend $750m on an expansion of its Perth casino, $200m on a new hotel in Melbourne (in a joint venture with Schiavello), and about $200m for its share of its new majority-owned Las Vegas casino – all on top of its investment in Crown Sydney and potentially Crown Brisbane.

After subtracting proceeds from apartment sales – expected to be around $500m – Crown will be spending around $1.5bn on Crown Sydney. Combined with the other investments and ongoing maintenance capital expenditure, we expect capital expenditure totalling about $5.2bn over the next seven years, peaking at about $900m a year between 2018 and 2020. The company should be able to fund these commitments, however, using a combination of ongoing cash flow of around $900m a year, the $600m raised via its latest hybrid issue, and an increase in debt.

Even on our bearish assumptions, we think the interest bill on Crown's debt will remain below 30% of its cash flow. However, in this scenario we're also assuming that Crown won't receive any dividends from MPEL, and would likely reduce or cut its own annual dividend (which amounted to 37 cents a share in 2014, 50% franked, and provides a dividend yield of around 2.8% on the current price).

Cannibalisation to occur

One of the key unknowns surrounding Crown Sydney is how it will affect the flow of VIP gamblers to Australia – how much it might increase the overall market, and how many customers it might snare from The Star and Crown Melbourne. One of the concessions given to win the licence to build and operate a second Sydney casino is that it won't have slot machines or accept walk-up customers, so its focus will be exclusively on foreign VIPs and wealthy gamblers in Australia.

Australia currently represents only 4% of the worldwide VIP market, but there's scope for Crown Sydney to increase that. With the presence of both Crown Sydney and The Star, Sydney will become a much more attractive market for VIPs – particularly as Sydney is a more popular tourist destination than Melbourne and has more direct flights to and from Asian cities.

Crown Melbourne also currently shares many VIP customers with The Star in Sydney, so having the capacity to offer an all-Crown Melbourne/Sydney package should see some share taken from The Star.

No doubt Echo won't stand still defending its share of business from VIPs and wealthy Australian gamblers, however, and with current visitors to Crown's Melbourne and Perth facilities being able to visit Crown Sydney instead, we think it's inevitable that there will be some cannibalisation of Crown's existing casinos. But combined with overall market growth and some business taken from The Star, we think the profits from the new Sydney operation will easily justify any shortfall elsewhere.

Macau to revive … eventually

That brings us to the final piece of the jigsaw – Macau. Crown's 34% interest in Nasdaq-listed Melco Crown (MPEL) is currently worth about $4.6bn – about 40% of Crown's own enterprise value. But the value of the stake has more than halved from about $10bn in January 2014.

MPEL currently owns and operates two Macau casinos – Altira and City of Dreams – along with Mocha Clubs, a network of slot machine clubs. The company also recently opened 69%-owned City of Dreams Manila and plans to open 60%-owned Studio City in Macau later this calendar year.

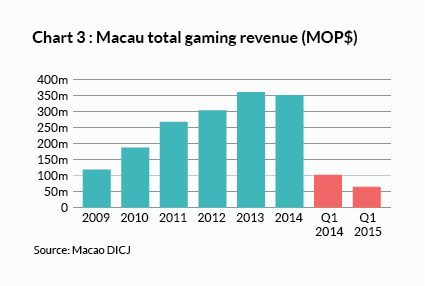

New smoking rules, visa restrictions, the ongoing Chinese government corruption crackdown and restrictions on the use of Unionpay debit cards – an easy way to get money out of China – have caused total gaming revenue in Macau to decline since May 2014. The most recent figures show it fell 37% in the first quarter of calendar 2015 compared to 2014 (see Chart 3).

Likely compounding the short-term pain, MPEL and other casino developers will open six new casinos by December 2017, increasing hotel rooms by 68% and gambling tables by 54%.

Yet while warning Macau that it needs to become less reliant on gambling, the Chinese government is spending heavily on infrastructure, building a bridge connecting Hong Kong and Macau, and improving rail services, Macau's ferry terminal and the main border gate with mainland China.

We don't know when the decline in Macau gaming revenues will stop, let alone reverse. Yet the prospects are positive for Macau over the longer term, due to the improved infrastructure, the Chinese cultural attachment to gaming, increasing tourism from mainland China as its standard of living rises, and the ongoing diversification of both Macau and nearby Hengjin Island's economies into non-gambling businesses.

If China continues to restrict legalised gambling to Macau, then the move by casino operators including MPEL to rely more on mass market punters rather than VIPs should also minimise the impact if VIP business is permanently reduced by the corruption crackdown.

Valuation

To value Crown, you need to look beyond the current situation and estimate what the company will earn in coming years.

By necessity, though, this means we have to take our valuation assumptions a long way into the future – to 2022 in fact, by which time Crown Sydney and other developments should be fully operational and the situation in Macau should (hopefully) have stabilised. Needless to say, that adds to the risks of the situation, and to try to understand how it might play out, we've looked at three possible scenarios – a 'bear' case, a 'base' case and a 'bull' case.

First, a word on our approach. Casinos require fairly constant capital expenditure to keep their gaming and non-gaming facilities up to scratch. This means they're asset heavy and debt is typically a permanent feature of their capital structure.

We've therefore taken an asset-based approach to valuation, rather than one based on revenue and margins. To do this, we've estimated total assets in 2022 for both companies, by combining today's asset values with announced investment plans and our estimate of maintenance capital expenditure, offset by anticipated depreciation.

We've then estimated a return on assets (ROA) for each casino, based on historical ROA, the returns generated by other casinos around the world, the competitive dynamics of the relevant gambling markets and other factors.

This enables us to estimate earnings before interest, tax, depreciation and amortisation (EBITDA) under our three scenarios and, ultimately, net profit. We've performed this exercise separately for both Melco Crown (MPEL) and Crown (excluding its investment in MPEL) and then combined the two values along with expected dividends to estimate returns from the current price.

In estimating the value of Crown's investment in MPEL – which is listed on Nasdaq but does business in Macau and the Philippines – we've assumed exchange rates remain at current values, for the simple reason that we have no idea where exchange rates will be in 2022.

Three scenarios

Table 1 below shows our estimated valuations under the three scenarios.

| Bear | Base | Bull | |

|---|---|---|---|

| Crown ex-MPEL ($ per share) | 6.32 | 13.54 | 19.95 |

| Investment in MPEL ($ per share) | 2.78 | 9.33 | 14.31 |

| Total ($ per share) | 9.10 | 22.87 | 34.25 |

| Annual cap gain/(loss) (%) | (5) | 8 | 15 |

| Avg dividend yield (%) | 0 | 3 | 4 |

| Total annual return/(loss) (%) | (5) | 11 | 19 |

Our base case would deliver a total annual return of 11%, consisting of 8% capital gains and dividends of 3%, while the bull case would deliver 19% a year (15% a year from capital gains and 4% from dividends).

In our bear case, however, investors would face average annual losses of 5%, as the share price slumped to $9.10, with nothing from dividends, which we've assumed are axed.

Of course there are better or worse potential outcomes, but we think these scenarios give a flavour of what can be expected and point to an attractive, albeit risky, proposition.

All in all, we think the operational and financial risks are more than balanced by the opportunities for growth. Due to the risks, though, we've given the stock fundamental and share price risks ratings of high and we recommend you keep your portfolio weighting below 4%. It may also make sense to stagger your purchases to leave room to increase your holding if the price declines further. BUY.

Recommendation