Three stocks for your watchlist

Recommendation

FH Faulding was founded in 1845 and acquired by Mayne Group in 2001. Following various splits and acquisitions, the end result was Mayne Pharma which currently has a market value of $500m.

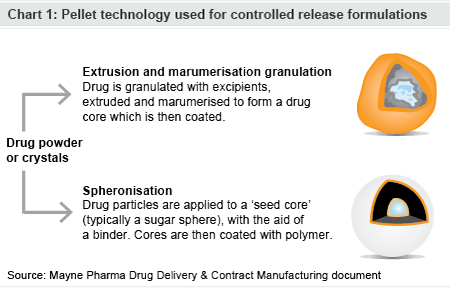

It has two major manufacturing facilities located in Salisbury in South Australia and Greenville, North Carolina, and is primarily focused on making and distributing branded and generic pharmaceuticals, such as tablets, capsules, liquids and creams.

Mayne Pharma currently spends 15% of sales on research and development but it is no CSL or ResMed. Its markets are far more competitive and its products are mostly commoditised. While revenue has been increasing swiftly due to acquisitions, earnings per share is paltry and return on equity was just 6% in 2013 (see Table 1).

Key Points

- Mayne Pharma too expensive

- Specialist knowledge required for Altium

- Tune in to Sky Network Television at a lower price

To increase profitability, chief executive Scott Richards is focused on acquisitions and new products. Mayne Pharma recently acquired several headache tablet brands from US-listed giant Forest Laboratories for up to $12m depending on performance or ‘earn-out’ payments. But the company’s poor return on equity casts doubt over the its intangible assets of $130m, which may eventually need to be written off. So far it’s not clear that more acquisitions are the answer to the company’s problems.

Current shareholders are also clearly betting that many of the 24 products currently under development for the US market and 20 products for the Australian market will pay off handsomely. Brokers have pencilled in earnings per share of five cents in 2016, a fourfold increase from 2013, which would still only reduce the price-earnings ratio to a lofty 17.

Mayne Pharma is an interesting business, but with the share price more than doubling over the past year there’s no obvious margin of safety for today’s buyer. AVOID.

| Year to 30 June | 2010 | 2011 | 2012 | 2013 | 2014F |

|---|---|---|---|---|---|

| Revenue ($m) | 36.5 | 49.8 | 52.2 | 83.5 | 148 |

| EBIT ($m) | 2.2 | 1.7 | 6.7 | 11.8 | 24 |

| U'lying net profit ($m) | 3.3 | 1.7 | 6.2 | (2.8) | 17 |

| U'lying EPS (c) | 2.7 | 1.1 | 4.1 | (0.7) | 3.0 |

| PER (x) | 32 | 76 | 21 | n/a | 28 |

| DPS (c) | 2 | 0 | 0 | 0 | 0 |

| Dividend Yield | 2.3 | n/a | n/a | n/a | n/a |

| Franking | 100 | n/a | n/a | n/a | n/a |

Altium

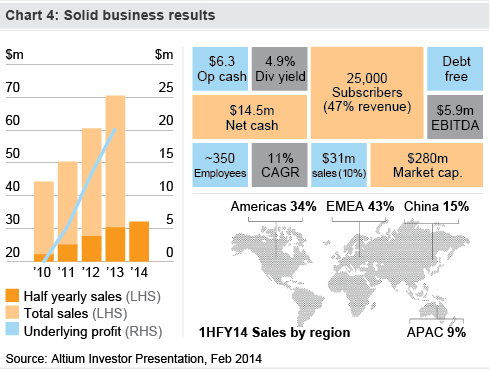

Altium’s share price has increased 58% over the past year giving the company a market value of $252m. Despite listing in 1999, it’s only recently that the company has hit its straps.

| Year to 30 June | 2010 | 2011 | 2012 | 2013 | 2014F |

|---|---|---|---|---|---|

| Revenue ($m) | 49 | 52 | 60 | 67 | 81 |

| EBIT ($m) | (7) | (5) | 5 | 7 | 18 |

| U'lying net profit ($m) | (11) | (8) | 13 | 20 | 17 |

| U'lying EPS (c) | (13) | (8) | 10 | 19 | 15 |

| PER (x) | n/a | n/a | 22 | 12 | 15 |

| DPS | 0 | 0 | 5 | 10 | 12 |

| Dividend Yield | n/a | n/a | 2.2 | 4.5 | 5.4 |

| Franking | 0 | 0 | 0 | 0 | 0 |

After the Internet came social networking, and now Altium is set to ride the wave created by the Internet Of Things. Soon every device you can think of will be connected to the internet so you can control it from a mobile device. Your fridge will be able to give you a health check first thing in the morning, and at the end of the day you’ll be able to start cooking your dinner before you leave the office.

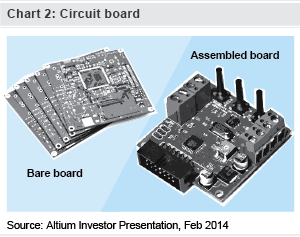

Altium provides the software to design and build printed circuit boards (PCBs), which connect the different components in an electronic device. They are extraordinarily complicated and it’s taken many years for the design software to catch up with what’s possible.

After a slightly troublesome history, Altium’s financials are finally looking up (see Table 2), as more electronics go into things like cars and other high tech developments, such as medical equipment.

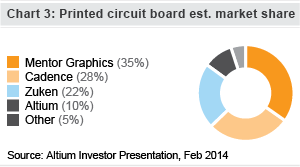

Altium mostly services the middle to lower end of the market, but its lofty aim is to become the world leader in PCB design software by increasing the sophistication of its own software to support large teams of PCB designers.

This will not be easy. Altium is dwarfed by several larger competitors, as the market has consolidated over the years (see Chart 3).

As Altium develops new software, management will need to expand its sales network, which includes third-party distributors. Getting distributors to favour your software at the expense of rival services around the world is time-consuming and difficult, not to mention the difficulty of getting PCB designers to undergo the training and other adjustments necessary to switch software systems.

Altium doesn’t look expensive on forecast numbers, particularly if it continues to grow at current rates. But trying to judge what this company may be worth in such a fast-moving industry is difficult. We'd need to understand the PCB software development market better to gauge Altium’s chances of long-term success, but if you’ve got specialist knowledge we’d love to hear from you in the comments section below.

Until further research puts Altium in our circle of competence we’ll stick with AVOID, but if you’ve got special insight into the industry or you’re a bit more speculative Altium could make an interesting bet with the move towards the Internet of Things in its infancy.

Sky Network Television

| Year to 30 June | 2010 | 2011 | 2012 | 2013 | 2014F |

|---|---|---|---|---|---|

| Revenue (NZ$m) | 742 | 797 | 843 | 885 | 906 |

| EBIT (NZ$m) | 175 | 197 | 202 | 219 | 248 |

| U'lying net profit (NZ$m) | 103 | 120 | 124 | 137 | 160 |

| U'lying EPS (NZc) | 26 | 31 | 32 | 35 | 41 |

| PER* (x) | 25 | 21 | 21 | 19 | 16 |

| DPS (NZc^) | 14.0 | 43.5 | 54.0 | 24.0 | 28 |

| Dividend Yield* | 2.1 | 6.6 | 8.2 | 3.6 | 4.2 |

| Franking | 0 | 0 | 0 | 0 | 0 |

| *Based on NZX share price ^Includes special dividends | |||||

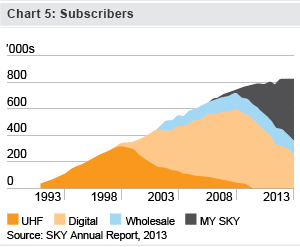

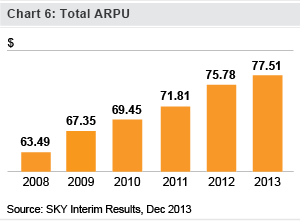

Unfortunately it’s very rare these days, but occasionally you find a chief executive that’s prepared to give a forthright and candid assessment of his business. Reading the shareholder letters of John Fellet, chief executive of New Zealand’s only Pay TV operator Sky Network Television, makes you feel like he’s the kind of guy you want to go into business with.

Sky TV is exactly the kind of company we look for. It has a dominant market position in an industry with high barriers to entry. It produces plenty of cash and is extremely shareholder friendly. Management is upfront and has an excellent track record, being ruthless on costs and prepared to lose content if the numbers don’t stack up. It also paid large special dividends in 2011 and 2012.

The company has also continued to innovate by being a ‘fast follower’. This means quickly implementing new products and services even if it means cannibalising existing revenue streams to stay relevant, but taking a wait-and-see approach for developments like 3D that don’t have a high chance of success.

In June 2013 the company’s share price fell 20% as investors discounted low growth prospects, a regulatory investigation and increased competition from internet entertainment providers. The share price has since bounced back as the company reported strong profit growth and escaped with a warning from the regulators as the problematic contracts are now obsolete due to changes in the industry.

On a forecast price-earnings ratio of 16 the stock isn’t particularly expensive for such a dominant business that produces plenty of free cash flow. But the influx of competition from internet services based at home and abroad is very real so we’re prepared to wait for a larger margin of safety before adding Sky to our buy list.

| Sell | Above $8 |

| Hold | Up to $8 |

| Buy | Below $5 |

Australian investors also need to bear in mind the exchange rate risk, with the company's revenues and earnings being in New Zealand dollars, but the company does top up the dividend to compensate for the lack of franking credits.

We’ll be following this company closely and we’ll try to get Fellet on the phone for a Boss Talk podcast. We’re initiating coverage with HOLD.

Recommendation