The truth about gold stocks

Recommendation

Some blame QE; others Brexit. Some say it's because of terrorism and others because of deflation. Whatever the reason, gold prices have marched higher this year after falling for several years.

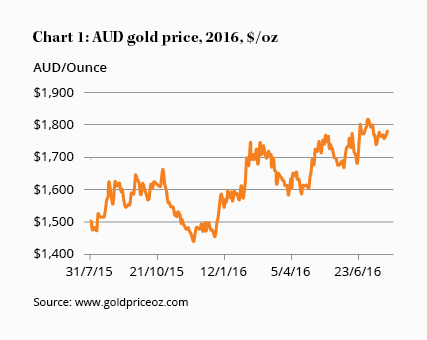

A year ago gold fetched less than US$1100 an ounce. Today prices are over US$1360, an increase of almost 25%. In Australian dollar terms, the price that matters for local gold miners, the increase is less dramatic but more significant, with prices up from $1500 to $1800 an ounce. The rise might be slower but the absolute price is a belter.

Thanks to higher gold prices, a lower currency and lower costs, Australian gold miners are enjoying unprecedented margins – perhaps the best on record. And yet we are choosing now, amid a new gold boom, to announce that we're ceasing coverage on all gold miners.

Key Points

-

Impossible to predict gold price

-

Analysis doesn't generate better outcomes

-

Ceasing Coverage of gold miners

In most circumstances, gold miners live or die according to movements in the gold price, and, in all circumstances, these movements are completely unpredictable. We don't believe analysis makes any difference to outcomes in the sector and we can offer better value to our members by spending analytical time in more rewarding areas.

Luck or skill?

What can be more rewarding than gold miners, some may ask? After all, the sector has been the best performing on the ASX over the past two years with almost all miners, especially those with Australian dollar gold exposure, soaring.

The price of gold is unpredictable and no amount of skill or sophistry can divine its direction, let alone its actual level. With revenue a mystery, we don't believe analysis of the gold miners adds value for investors. We can't pick the gold price or estimate returns or profits with any accuracy.

That is not from a lack of trying. We have had some success in the gold sector, with recommendations such as Integra Mining, Silver Lake Resources, Catalpa and Northern Star Resources delivering bonanza returns. Yet we've also had disasters, such as Kingsrose Mining, Silver Lake (again) and Beadell Resources.

We went into these situations specifically seeking exposure to gold and trying to target that exposure with analysis of important variables such as cost, revenue, processing volumes and grade. We may as well have thrown darts on a board because analysis of the sector has not proved useful or insightful.

Not once have we accurately estimated revenue, profit or cost. We have rarely estimated output correctly. Looking back at our recommendations, it's clear that both our successes and our failures were the result of circumstance rather than skill. That outcome is not unique to us. We haven't seen any investor capable of estimating any important variable that sheds light on gold miner valuation because the important variables are unpredictable.

Can't predict prices

So what about other miners? All resource businesses depend on commodity prices, so why pick on gold?

Gold is unique for two important reasons. Demand for gold is mostly fickle investment demand, while supply from mines adds just 2–3% to total stocks of the metal. This means that demand and supply are not useful tools for analysis.

Unlike every other commodity, gold isn't consumed. All the gold that has ever been mined in the history of the earth still exists above ground today. It is possible that the gold in the ring on your finger, for example, was mined by the Pharohs of ancient Egypt.

That means that annual mine supply – some 2,500 tonnes – contributes just 2–3% of total gold supply. For iron ore or copper, analysis of industry supply says something about likely prices. For gold, that just isn't true. Mined supply is so small that it's irrelevant to price.

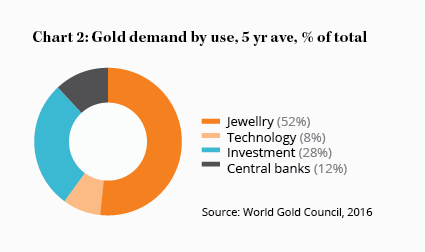

What of the demand for gold? As Chart 2 shows, over half of all demand is for jewellery and another 40% is bought by investors and central banks. Just 8% of supply is used for industrial purposes.

We would argue that the vast bulk of jewellery demand – which comes overwhelmingly from India and China – is investment driven too. Investment demand, unlike say, demand for steel or oil, exhibits no obvious utility or rationality. It is fickle and impossible to predict.

Stock implications

Small mining volumes and fragile economics makes gold miners particularly risky. Throw in a commodity price that is utterly unknowable and you're left with pure speculation. There's nothing necessarily wrong with that; intelligent speculation can have its place. We currently have four Speculative Buys on our Buy list – iCar Asia, Amaysim, Myer and PMP – but each of these offers us an opportunity for meaningful analysis and a pragmatic assessment of the odds.

With gold, we must accept that analysis gives us no advantage. If you want to roll the dice, you don't need to pay us to do it.

We will only revisit gold miners where there are company-specific factors that lead us to identify a clear mispricing. In the meantime, that's it for our coverage of gold stocks – almost. Northern Star has this morning entered a trading halt and we will comment on that when we hear more, but note that we will have more than one eye on the exit and plan to Cease Coverage when we have given our thoughts.

For Kingsrose Mining, it means a downgrade to SELL; and for it, as well as Newcrest Mining, Silver Lake and Beadell, it means we are now CEASING COVERAGE.

Disclosure: The author owns shares in Silver Lake and Northern Star Resources.