The truth about Cochlear's market share

Recommendation

We love ambitious managements with a knack for marketing. Sometimes, though, executives need to tone it down – especially when they start promoting to shareholders. Management's job is to ensure that investors are fully informed, without the coating of sugar.

At every financial result in recent years, Cochlear's management has proudly made the investment case: ‘360 million people worldwide suffer from hearing loss. 37 million could benefit from a cochlear implant. Less than 5% market penetration'.

The company pitches itself to investors as an untapped market opportunity – in other words, the potential demand for Cochlear implants is huge but the company has only scratched the surface.

Key Points

-

Smaller market than claimed, but still large

-

Competitive pressure to rise as customers age

-

Close to downgrade but Hold for now

Cochlear has a problem, though. An implant and the necessary surgery costs as much as an Audi A3: $40–50,000, or more if you're in the US. And that's why management's untapped market pitch is a half-truth at best.

Hearing loss worldwide is irrelevant. Two-thirds of the world population live on less than $10 a day, so the majority of people with hearing loss will never be able to afford a cochlear implant. Cochlear does have a large market opportunity but it's limited to developed countries where the company can viably sell its products.

True market

To understand Cochlear's true market, we need to filter for a few more variables, such as household income, regulatory approval and insurance coverage. After accounting for these, Cochlear's potential market whittles down to around 7.5 million people. Just over half-a-million people worldwide currently have a Cochlear-branded implant, so the company's true penetration rate is closer to 7%.

Don't get us wrong, that's still a large untapped market (making management's exaggerated claims even more unnecessary). Unfortunately, though, we need to take our filtering process one step further.

The likelihood of someone getting a cochlear implant often comes down to one factor: age. Two children for every adult receive the necessary insurance funding. A cochlear implant can be the difference between a child developing language and a lifetime of silence, so insurers and parents are more willing to pay the high price of surgery.

But here's the thing: if we narrow down that potential market of 7.5 million people to just children, we wind up with a figure of around 750,000. For this demographic, Cochlear's penetration rate is roughly 60%. For seniors and adults, it's only 3%.

Lower research hurdle

That split is a bigger deal than it may at first appear because it could have a significant effect on the company's competitive position and growth path.

Firstly, it means adults and seniors are the real untapped market – but they're a much harder market to crack. Insurers are less likely to fund treatment, meaning out-of-pocket costs are higher. This then restricts sales to a small group of high-income earners.

Secondly, Cochlear's business model is similar to that of shavers. The implant itself (would you believe) is sold cheaply relative to its cost of production. It's in the trailing revenue stream from external processor upgrades that the company earns the highest margins (see Cochlear: The perfect razor and blade). For children, that trailing revenue can last 70 years. Selling to 60-year-olds, on the other hand, offers a shorter horizon of future upgrade sales. The ‘lifetime value' of Cochlear's customers will decline as it runs out of young patients.

Finally, selling to adults requires a different research emphasis. A cochlear implant almost inevitably damages the ear and residual hearing when it's inserted, so Cochlear has focused its research on making smaller implants. The strategy has worked: its latest Profile Series implant has an electrode less than half the volume of its predecessors. It's the thinnest implant available on the market, which makes it particularly attractive for use in children because slim electrodes cause less damage to the ear.

Finally, selling to adults requires a different research emphasis. A cochlear implant almost inevitably damages the ear and residual hearing when it's inserted, so Cochlear has focused its research on making smaller implants. The strategy has worked: its latest Profile Series implant has an electrode less than half the volume of its predecessors. It's the thinnest implant available on the market, which makes it particularly attractive for use in children because slim electrodes cause less damage to the ear.

Adults, on the other hand, want more than just a thin electrode: they want comfortable, stylish and feature-rich external processors. Imagine that both a parent and child need an implant – for the child, the parent will usually opt for the least damaging device at any price, so Cochlear is the unbeatable choice. But for themselves, once a certain level of safety and function is reached, they're probably more concerned with price and which manufacturer's processor will pair with their iPhone or better match their hair colour.

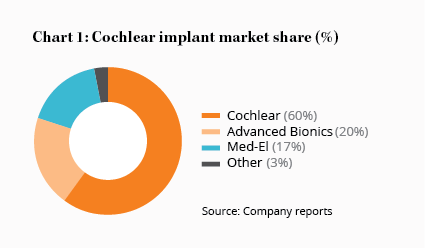

Cochlear has a 60% market share of new implant sales, which is more than three times larger than its nearest competitor, Advanced Bionics (owned by Swiss-based Sonova). The company has maintained this lead because its research budget is much larger and it can invest in the most advanced implants. However, as processor features become more valuable to customers, the company's competitive advantage in research will be less relevant – it's easier for Sonova to make a more attractive processor than to develop a thinner implant.

Growth ahead

Congenital hearing loss affects around 1–2 children per 1,000 births and the total number of patients requiring cochlear implants is growing steadily at around 2–3% a year.

Cochlear's revenue, however, will probably grow faster than this once you factor in rising prices and increasing sales to the adult market. Assuming stable margins, we expect earnings growth in the high-single digits, though there's room to exceed this if Cochlear continues to increase its market share or margins benefit from operating leverage.

The stock trades on a forward price-earnings ratio of 46 based on consensus estimates for 2018 earnings. Even for a company of Cochlear's quality and growth outlook, that's a steep valuation – and especially so relative to Sonova, which has a forward price-earnings ratio of 26.

We're of two minds when it comes to Cochlear. On the one hand, sales are growing nicely, the company is taking market share, has mouth-watering margins, and has 500,000 or so people already with Cochlear implants locked into buying processors for several decades.

On the other hand, even the best companies in the world aren't worth an infinite price. With the stock up 30% over the past year and trading close to our recommended Sell price, now is a good time to check that your portfolio weighting is within our recommended limit of 7%. We'll review the price guide when Cochlear reports its full-year result in August. For now, HOLD.

Recommendation