The big problem with index funds

New investors and many older ones face a pretty stark choice: buy and sell shares themselves or pay someone else to do it for them. Personally, I do a bit of both, although I'm very careful about who I pay to manage money on my behalf.

If you do allocate a proportion of your portfolio to managed funds, another question soon follows: pay a small fee for an index tracker to get market returns (minus the small fee) or pay a much larger fee for potentially market-beating returns, with no guarantees.

For investors managing their own money the question is far from academic. Whether you invest in managed funds or not, the growth of the industry is almost certainly having an effect on direct investors, largely through influencing the prices we pay for many of the ASX's biggest companies.

Key Points

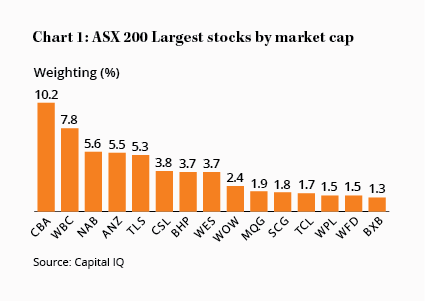

Big banks account for 29% of ASX200

Financial sector accounts for over 40%

Index funds are dangerous as a result

In the past, when asked how time-poor investors should invest, I suggested index-tracking funds. They're cheap and as long as the investment time frame was long enough, the investor could forget about the ups and downs in the market.

For most Australian investors I now suspect that advice is plain wrong. Our market is so concentrated, so devoid of variety and diversification among its largest companies, that index hugging investors are still picking stocks whether they're aware of it or not.

The All Ordinaries Index, which contains around 500 of the ASX's largest stocks, accounts for almost the entire market, despite there being over 2,183 listed companies – and the ASX 200, which includes the top 200 ASX-listed stocks by market capitalisation, accounts for almost 90% of the All Ords.

You can see the problem. In addition to their low costs (a big tick), diversity is supposed to be the other main attraction of index funds. But in Australia the index is so concentrated that index investing is effectively a bet on a few sectors.

At the end of last year the big four banks accounted for 29% of the ASX200, which easily breaches our recommended 20% weighting to the sector. Commonwealth Bank alone accounts for almost 10%. This is drastically different from the US, where Apple and Alphabet (the owner of Google) are currently vying for the title of the country's (and the world's) biggest stock, yet each only accounts for 3% of the main US index, the S&P 500. At the top, our market is highly concentrated and not at all diversified.

The problem intensifies with a broadening of the financials sector to include Macquarie Group, Westfield Corp and Scentre Group. In fact, of the top 50 stocks in the ASX200, 19 are classified as financials, accounting for 42% of the total index.

Overexposed

Many index investors think they're getting in-built diversification. What they're really getting is overexposure to financials. That point would have been true twice over a few years ago, when financials and resources were flying high.

Australia's superannuation pool has now reached almost $2 trillion. Deloitte expects this figure to increase to $7.6 trillion by 2033. Over 20% of that sum is invested in the local market, much of it by index trackers or corporate or industry funds so large in effect they're more costly index trackers.

Most of this money ends up in the big cap stocks, often without a thought paid to valuation – a subject we'll get to on Friday of this week when we'll look at the declining role valuation plays in investment decision making, and why that's a good thing for us.

What can we learn from this state of affairs?

First, if you are going to invest in an index tracker, be aware of the heavy weighting our indicies have to banks, the financial sector at large and, despite the recent price falls, the resources sector. Index funds do not deliver the kind of in-built diversification you might expect. Instead, at least in Australia, they're a form of 'high-conviction' investing, without explicit conviction.

Second, if you are looking into actively managed funds, as a general rule smaller is better than larger. The size of the Australian market means huge licks of capital generally cannot be put to work at better-than-average returns. There are exceptions (which tend not to last), but this is a good rule-of-thumb.

Thirdly, do not mistake owning a high number of stocks for proper diversification – it matters how much you have in each of them, and whether they're exposed to the same risks. In many ways the big banks are a geared play on the performance of the (mostly local) economy, and to a large extent they'll live and die with one another. We must ask ourselves whether it makes sense to have almost 30% of our portfolio exposed to the same risks. If you have a mortgage, that exposure is magnified.

How to deal with the problem

So, given that index trackers deliver these excessive positions in banks and (at least in the past) resources, how does one deal with it?

If you're really committed to giving your portfolio an index tracking base, then perhaps put 30-50% into a tracker and then supplement this with overseas funds and (low-cost) actively managed local funds with lower weightings in banks. Here we can give a plug to our own Growth and Equity Income portfolios, which are available for investment via separately managed accounts (SMAs).

On top of this, and to a greater or larger extent according to personal preference, you might fill your portfolio with some non-financial, non-resources blue chips as they find their way onto our buy list. Right now Woolworths, Crown Resorts, News Corp, and Trade Me fit the bill.

Buying a bunch of these on top of a tracker or low-cost fund base gives your real diversification at low cost. Of course, if banks happen to outperform the rest of the market, then you might well underperform the (artificially constructed) benchmark indices; if they do worse, then you'll do better. But that's the whole point of diversification: to ensure your performance isn't unduly hitched to one sector.

The final point is even more germane. For more than a decade our model portfolios steered clear of the banks, which hasn't stopped them from outperforming their benchmark indicies one bit. You simply don't need to invest in the banks to get good performance, but investing in index trackers or large funds axiomatically means you're overexposed to them.

On Friday: Why fewer and fewer trades are concerned with the price paid for a stock and why that's a great thing for small retail investors like us.