Templeton Global Growth: a value stock?

Recommendation

Like individual stocks, investing strategies tend to move in and out of favour. Since the global financial crisis, slower economic growth has made it more difficult for many companies to increase their revenues and profits and, due to ongoing low interest rates, investors have been willing to pay higher prices for those that can.

'Quality' companies – those whose strong market positions enable them to generate high returns on equity – have also done well in this environment. This explains much of the popularity of growth stocks such as Domino's Pizza, REA Group and Blackmores here and the 'FANG' stocks – Facebook, Amazon, Netflix and Alphabet (FKA Google) – overseas.

Key Points

Value has underperformed growth since GFC

TGG underperformed benchmark recently

But selling at a reasonable discount to NTA

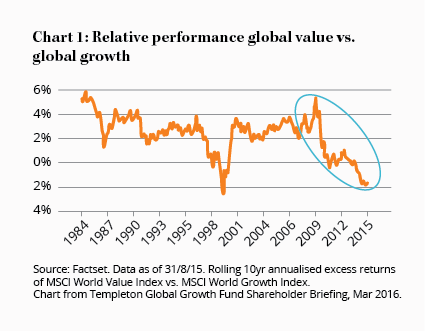

These conditions have had the opposite effect on traditional or 'deep value' stocks – those with lower growth expectations and selling at lower multiples of book value, earnings, cash flow or sales – and shown in Chart 1. Add in some recent underperformance compared to its benchmark and it's no surprise that traditional value manager Templeton Global Growth Fund (TGG) is out of favour, selling at an 12% discount to its post-tax net tangible assets (NTA) per share at 29 February.

In fact, the average price-to-book ratio for TGG's portfolio is 1.2x, down from 1.4x in June 2009. By contrast, the relevant multiples for its benchmark – the MSCI All World Free Index – are 1.9x and 1.7x respectively.

Of course, merely buying a stock because it, say, has a low price-to-earnings ratio is foolish without also considering whether the low multiple is justified. For example, if the business is highly indebted, badly managed or faces increased competition for its products, then the market may well be correct in marking down the stock.

Refusing to purchase a stock because it's selling on a high multiple is equally as foolish, as the business could still be good value based on your estimate of its growth and future cash flows.

A number of studies, though, have shown that traditional value stocks have tended to outperform growth stocks over the long term, albeit with occasional periods of relative weakness. As you can see from Chart 1, growth last significantly outperformed value during the technology, media and telecommunications ('TMT') boom of the late 1990s.

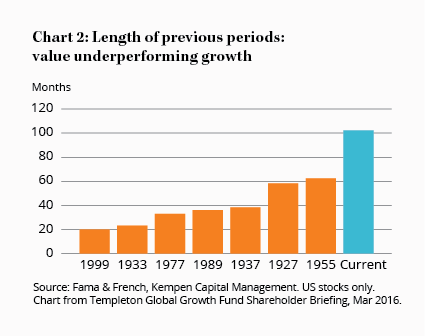

Then, like now, traditional value investors argued that value would eventually reassert itself but, also like now, they couldn't tell us when that would occur. History subsequently proved them right, of course, and the same is likely to happen in relation to the current period of underperformance which, whilst not as extreme as in the late 1990s, is nevertheless now the longest period of underperformance on record (see Chart 2).

Diversified portfolio

Unlike the more concentrated portfolios of a PM Capital Global Opportunities Fund or Magellan Flagship Fund, portfolio manager Peter Wilmshurst manages a portfolio of over 100 stocks spread across the world (34% in the US, 31% in Europe and 14% in the UK).

Such a diversified portfolio means outsize returns (and outsize losses) are unlikely. Nevertheless, as the fund rarely invests in Australian stocks, this is a good way to obtain international exposure.

Furthermore, TGG doesn't hedge currency risk and, whilst the Australian dollar is now more reasonably valued than a few years ago, this gives investors the opportunity to profit from any further declines in the Australian dollar.

After raising capital in June 2015 to take advantage of what Wilmshurst believed were cheap European equities, the fund has recently renewed its buyback authorisation. Up to 10% of its shares will be bought back over the next year 'if the Directors and Management consider that [its] shares are trading at an excessive discount to their net tangible asset backing'. Along with a partially franked 4% forward yield (the franking should rise as tax losses are utilised), this provides a good deal of downside protection while we wait.

Not quite a Buy

That looks pretty reasonable. However, before we recommend buying any stock, we need to see a decent margin of safety.

| Portfolio | Benchmark | |

|---|---|---|

| Price-earnings | 13.3x | 17.3x |

| Price-to-cash flow | 5.1x | 10.0x |

| Price-to-book value | 1.2x | 1.9x |

| Dividend yield | 3.0% | 2.7% |

| Note: figures at 31 Jan 16 | ||

As we've noted before (see An Introduction to Listed Investment Companies), this is why we suggest you only purchase listed investment companies (LICs) at a discount to their post-tax net tangible assets (NTA). This also compensates investors for the fees charged by the investment manager that eat away at investors' returns.

TGG charges a 1% management fee and no performance fee and so, capitalising this fee say at 10%, would lead us to require at least a 10% discount to post-tax NTA before buying.

The NTA figure, though, also needs some adjustment, to account for changes in markets and currencies since it was last reported (on 29 February). All up, this still leaves the stock a little above where we'd be happy to upgrade. We'll keep monitoring it but won't put a price guide on the stock as its underlying value changes based on movements in markets and currencies. HOLD.