Telstra: Interim result 2015

Recommendation

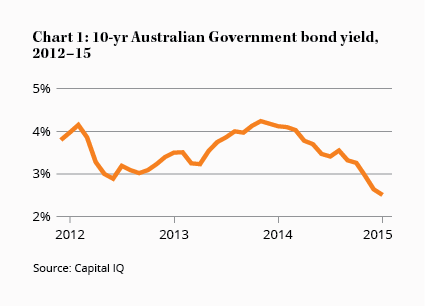

Two factors can explain the near-doubling of Telstra's share price over the past three years. The first – the collapse in prospective returns on other investments, led by government bonds – is shown in Chart 1. The second – that its dividend is now well and truly safe and may even start to show some growth – was evident in last week's interim result.

Key Points

Strong performance from Mobile

Fixed Voice continues decline

Raising Sell price to $7

Where next for the stock will depend on how you see these two factors developing from here. We'll come back to this, but first let's take a detailed look at the result.

Although the headline numbers were uninspiring, with sales and earnings before interest, tax, depreciation and amortisation (EBITDA) each up 1%, on an underlying basis (excluding CSL, which was sold last year) those numbers were up 6% and 4%. Management maintained full-year guidance for 'broadly flat' EBITDA, which would amount to 3% growth excluding CSL.

iPhone 6 shows the way

Leading the way, as ever, was Mobile, which gave an excellent showing, helped by the launch of the iPhone 6, which chief executive David Thodey described as Telstra's 'best iPhone launch ever'. With its bigger screen the iPhone 6 encourages people to use more data, causing them to move to bigger data plans and boosting average revenue per user (ARPU). The number of 4G devices – at 6.7m out of total services in operation (SIOs) of 16.4m – has also now overtaken the number of 3G devices, again encouraging greater data usage. ARPU rose 6% for the lucrative postpaid (ie contracted) users and a whopping 14% for prepaid users.

There was also a handy 4% increase in the number of SIOs, to 16.4m. The biggest jump here came from 'machine to machine' or M2M, which increased the number of services by 28% to 1.4m, due to the 'signing of some key deals in the transport and logistics category'. The ARPU from M2M fell 10% to $6.93 in the half, however, and is by far the lowest of the product groups, and we continue to be sceptical of this area, despite Telstra's high hopes. We don't doubt that machines will want to communicate with each other, but we can't see them sharing videos off YouTube and data rates and ARPU are likely to remain low.

The one blot in the Mobile performance was increased churn, with postpaid handheld churn rising by 1.4 percentage points to 12%, owing to more competitive offers from Optus and Virgin.

The Mobile EBITDA margin edged up one percentage point to 40%, with higher promotional expenses due to the iPhone 6 launch almost offsetting the increases in ARPU. Putting it all together, mobile logged another excellent performance, with EBITDA increasing 12% to $2.1bn.

Fixed decline

As ever, Fixed was going the other way, with a 2% revenue decline to $3.5bn and an EBITDA decline of about 6% to $1.8bn. Within this, Voice continued its decline, with EBITDA falling 14% to $1.1bn, but Data did a fine job of almost making up for it, with a 6% rise in lines in service, a 2% rise in ARPU and a three percentage point margin increase leading to a 16% rise in EBITDA to about $494m.

The addition of 127,000 bundled packages in the half was a highlight, driven by the launch of 'Entertainer' bundles which include an expanded Foxtel offering. 69% of the Fixed Data customer base is now on a bundled plan. The trouble is of course that Data still makes only half the profits of Voice, which explains the overall EBITDA decline.

Elsewhere, declines in legacy products such as ISDN offset gains in IP Access to leave Data and IP Access revenues down 3% at $1.5bn, while Network Applications and Services (NAS) delivered another excellent performance, with an overall 18% revenue increase to $1.0bn. Highlights were Cloud Services, up 32% to $120m, and Industry Solutions, up 48% to $251m. These are impressive performances, but it will be some time before the move the dial.

Big licks of capex

The cash performance reflected one of the big problems with the telecoms industry – the big licks of capital expenditure needed to get all the networks up and running. On top of $1.4bn of capital expenditure, Telstra capitalised $464 of intangibles in the half and stumped up $1.3bn for the mobile spectrum licences it won at auction in 2013, almost wiping out the operating cash flow and leaving the interim dividend uncovered.

Management doesn't like to talk about spectrum payments too much – to the point of excluding them from its free cash flow guidance – but they're a real cost. In essence the company needs to rent the spectrum it uses from the government, and that rent is set at auction and reflects the profits the market can make from it.

The bad news is that all things being equal it should therefore be hard to achieve returns in excess of the cost of capital. The good news for Telstra is that all things aren't equal and, having the most users it can make better use of the spectrum (and the capital expenditure on its network). It's hard to put a value on this competitive advantage, not least because it depends on the utilisation of future technologies, but the spectrum payments can certainly put a dent in cash flows.

Even so, even after spectrum payments of $1.3bn, full-year free cash flows of around $3.3–3.8bn should almost cover the annual dividend which we expect to come in at the top of that range, or 31 cents per share, assuming an increase in the final dividend from 15 cents to 16 cents.

So that dividend now looks safe – at least for the time being – but with the yield now down to 4.6%, from 8.2% three years ago, the question now is less about its safety and more about how much it might grow.

Sceptical of growth

Here we remain sceptical. For Telstra to grow it will need Mobile to more than offset declines in Fixed revenues. But with Mobile already boasting a market share of more than 50%, growth in SIOs will likely get progressively tougher. We also suspect ARPU will be prove hard to shift, particularly in the short term, with increased competition and a weakening local economy.

We'd say that growth in the low to mid single digits is about the most you can hope for from Telstra, with the risks – regulatory, technological and competitive – firmly on the downside.

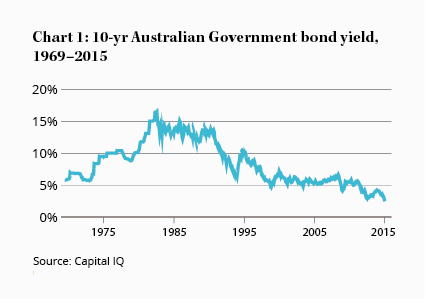

So what of the government bond yield? Well we're generally pretty reluctant to second-guess the bond markets, but Chart 2 at least provides some context. You'll now get 2.5% a year from lending to the government for 10 years – less than half what you'd have got at any time in the past 45 years, other than the past five. For five years in the 1980s the yield stood at around five times current levels. Again, in our best broker's voice we'd say the risks appear to be on the downside.

So at best you've got a fully franked yield of 4.6%, growing at perhaps 5% a year, while at worst the dividend might come under pressure again if growth dries up. How attractive you consider this scenario will depend on how you see the bond yield developing and the opportunities you can find elsewhere.

On balance, we're going to raise our Buy price from the current $4.25 to $5 and our Sell price to $7, which is just enough to keep it in Hold territory, but we're unlikely to stretch much beyond that. Note also our maximum recommended portfolio weighting of 7%; if the stock's surge has taken you beyond that, then we'd urge you to consider taking some profit. HOLD.

Recommendation