Taking leave of Lendlease

Recommendation

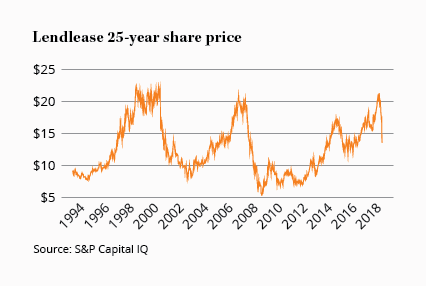

We've always been put off by earnings volatility in Lendlease's construction business. Indeed after downgrading to Sell in 2001 at $11.39, it was Sells and Avoids all the way until we switched back to Hold last year. During this time we've mostly looked too cautious, but with the occasional dramatic vindication. Most recently, the company reported another sharp setback when it revealed problems on its NorthConnex project.

Key Points

-

$350m writedown on NorthConnex

-

Shows risks of construction business

-

Overshadows rest of group

Having a construction business gives Lendlease an edge over rival developers that rely on third-party builders and engineers in terms of winning development projects (such as Sydney's Barangaroo). But it carries huge risks as construction projects are often quoted for a fixed price, so delays and cost overruns can cause profitable projects to swing into a loss.

NorthConnex goes South

In 2018 the problem project has been the NorthConnex tunnel linking the Pacific Highway to the M2 Hills Motorway in northern Sydney, which will be Australia's longest road tunnel project. Lendlease recently announced a $350 million post-tax provision for the $3 billion, 9km tunnel, due to wet weather, access and design problems. A large part of this will likely go to the owner of the project - Transurban - to compensate for revenue lost due to a delayed opening.

Lendlease currently has two other major tunnelling projects on its books: the $6bn Melbourne Metro tunnel and Sydney's 7.5km WestConnex tunnel. Both are at relatively early stages and, while there's so far nothing to suggest they're going to cause similar problems, investors are clearly worried that might change.

Thankfully, Lendlease is in a strong financial position with gearing of only 8%. That's prudent for a construction and development company, given the feast or famine nature of the industry. The $350 million provision won't be fatal to Lendlease, but it will put it under some stress and probably cause it to abandon its on-market share buy-back, under which $188m worth of stock was expected to be purchased over the next year.

Beset by mishaps

The volatile contribution from the construction business is all the more galling as it contributes a relatively small proportion of profits (only 5% in 2018, though it has been larger in the past), and the investment and development businesses have performed well over the years. Unfortunately, though, mishaps like at the NorthConnex project are a feature of the construction industry.

It's also very hard to have an edge in analysing these types of businesses from the outside - and yet they can absorb a lot of time that's better spent on other opportunities. On that basis, we're CEASING COVERAGE.