Taking another look at Servcorp

Recommendation

Since opening its doors in 2011, co-working space provider WeWork has grown to 200 locations in 49 cities including three in Sydney and two in Melbourne. Still privately owned, WeWork's latest fundraising implies a valuation of some US$20bn (AU$25.6bn) or around AU$128m per location.

By contrast, global market leader IWG – the holding company for Regus, Spaces and other brands – has 3,000 locations in more than 100 countries and is valued at £3.1bn (AU$5.2bn) including debt or around $1.7m per location.

And Servcorp, with 155 locations in 55 cities, is valued at $475m including debt or around $3m per location.

These are rather crude comparisons, of course, but they do show the extremes at which investors are valuing WeWork.

Key Points

-

Co-working space supply growing exponentially

-

Likely to exacerbate any downturn

-

Reducing price guide

Booming investment

Investors in WeWork evidently believe the trend to more flexible workspaces in recent years will accelerate and that WeWork will eventually grow into its valuation.

Maybe they'll be proven correct but the returns generated by WeWork investors haven't gone unnoticed: new competitors have entered the shared office or co-working industry (the distinction between these terms is fairly irrelevant for our purposes) attracted by the potentially high returns on offer.

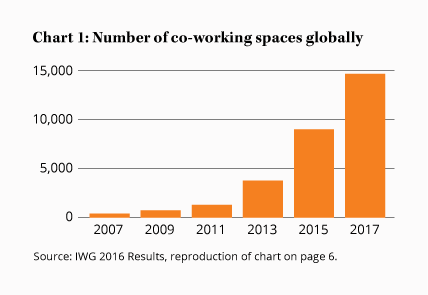

As you can see in Chart 1, the number of co-working spaces globally has risen exponentially over the past decade. In fact, you can now even choose a co-working space themed as a campsite, a hotel lobby or even a restaurant.

Even office landlords are getting in on the act, with Dexus, Australia's largest listed owner of office towers, rolling out its Dexus Places concept.

There are some good reasons to suggest demand for co-working space will increase over the medium to long term, including the rise of freelancers, consultants, ‘cloud-based' businesses and even existing businesses downgrading to shared spaces to save costs.

Yet this doesn't moderate the cyclical nature of the industry. Co-working spaces are, ultimately, just office space, the demand for which is dependent on changes in the business cycle.

And with barriers to entry to the co-working industry low and new co-working spaces requiring little capital, new competitors such as WeWork can quickly expand while existing operators can also quickly open new locations (see Table 1).

| Company | 2011 locations | 2016 locations | Change (%) |

| WeWork | - | 200 | nm |

| IWG | 1,203 | 2,926 | 143 |

| Servcorp | 103 | 134 | 30 |

| Source: Company reports and websites | |||

Unfortunately, the barriers to exit are high due to the long-term nature of the leases co-working space providers enter in with office landlords. Providers do have the option of paying out landlords to cancel their leases and close locations – Servcorp spent $3.3m doing so in the first half of 2017 – but this assumes they have the necessary cash on hand.

To its credit, Servcorp's management acknowledges this risk and has amassed a $100m cash war chest to help it through any downturn, while also giving it the opportunity to expand at the bottom of the cycle.

Also acknowledging this risk, at least in part, WeWork has gone as far as to demand new tenants in some of its Manhattan locations commit to renting space for a minimum of one year. However, we doubt this is long enough to ride out any economic downturn or fall in demand for co-working spaces.

With the property sector remaining cyclical, this boom in the co-working space could end badly, with Servcorp unlikely to be spared.

Mismatch

To see why, let's recap Servcorp's business model.

Servcorp and its competitors rent space in office towers, divide it up and then sub-let these offices for a monthly fee. Tenants receive IT services, a receptionist, printing, fancy meeting rooms and, in WeWork's case, free craft beer on tap.

Tenants don't even have to be physically present. Servcorp offers its ‘Virtual Office' service, where tenants receive ‘everything but the office': a prestigious address, a local phone number, a receptionist, and access to Servcorp's facilities should they need to meet with clients.

Co-working space providers' aim to arbitrage the difference between the cost at which they rent space from office landlords and the revenue they receive from sub-letting the space to tenants.

Unfortunately, while the agreements they enter into with landlords can run for many years – Servcorp's vary from one to 15 years in duration, with the scuttlebutt suggesting some of WeWork's London locations are leased for 25 years – and involve rent increasing each year, the contracts entered into with customers can be as short as one month in duration.

This mismatch can actually be beneficial to Servcorp if it can take advantage of cyclical downturns in the office sector and enter into long term leases with landlords then at bargain prices.

It's also not a problem when demand for co-working space is rising and supply can't keep up with demand.

However, this mismatch becomes a problem in any downturn or reduction in demand for co-working space due to changes in the business cycle. Because a high percentage of Servcorp's costs are fixed, the resulting operating leverage means falls in revenue due to lower rents and occupancy are magnified by the time they reach the net profit line.

Co-working for grown-ups

Unfortunately, the great risk from the surge of investment in the co-working space is that it will lead to an oversupply. With the high barriers to exit, this will likely lead to falls in rents and occupancy, which will be exacerbated in any economic downturn.

Servcorp's premium spaces with marble, granite, leather and original artwork – which it describes as ‘co-working for grownups' – may provide it with some protection due to the higher quality tenants it attracts.

However, we note that Servcorp's revenue fell 26% in 2010 and, due to the company's operating leverage, the net profit before tax of its ‘mature floors' fell even more, by 56%.

And we'd be surprised if many of its customers, who will presumably also be experiencing falls in revenue and profitability, don't at least consider moving to competitors' less expensive spaces in a downturn. Particularly as the short-term nature of co-working space leases and their lack of meaningful differentiation means it's easy to switch providers.

Property companies

Perhaps in a downturn laid-off employees will really become freelancers and entrepreneurs while larger companies will also seek smaller, more flexible workspaces as WeWork management suggests. Yet we remain sceptical.

Ultimately, Servcorp and its competitors are property companies and so are dependent on the business cycle.

For the moment, though, the US economy seems to be growing nicely while economic growth is picking up in Europe and Asia. This should help improve Servcorp's disappointing American division and its locations in Europe and South East Asia.

Yet even improving economic fundamentals may not help if the supply of co-working space continues to grow at exponential rates. In a sign that Servcorp management may be acknowledging the rapid increase in supply of co-working space, it has deferred further expansion to concentrate on increasing occupancy in its existing locations.

Servcorp is currently selling for a PER of 14, lower if we exclude the losses from its US division. However, as we've noted previously, while Servcorp is well-managed, its inherent cyclicality means we require a large margin of safety before considering upgrading.

As such, we're reducing our price guide, with our Buy price falling to $4.50 (from $5.50) and our Sell price also falling to $8 (from $9). HOLD.

Recommendation