Tabcorp: the rational bet

Recommendation

If you want to win at the races, it rarely pays to go with your gut. Humans are wired for overconfidence and that bias means that we tend to misidentify a horse that's very unlikely to win as a horse that's certain to lose. These overlooked long shots are often where the real money is.

It wasn't long ago we thought Tabcorp was a terrible bet. At the company's 2016 result, we noted two factors working against it: growing competition from online operators, such as Sportsbet; and its network of TAB retail outlets that was expensive to maintain and put the company at a cost disadvantage.

Key Points

-

Rational market returns

-

New tax evens playing field

-

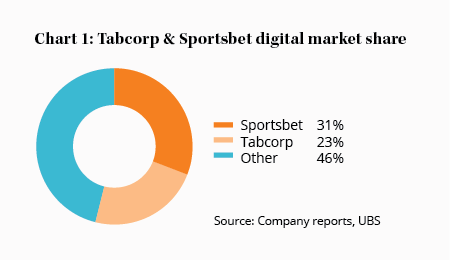

Marketing savings could materialise

Sportsbet's business model meant that punters lost around 5% in commissions, compared to the 15-20% takeout at a typical TAB. Even Tabcorp's online wagering tended to offer poorer odds, presumably to avoid pulling customers away from its lucrative tote. Sportsbet was a much better deal for punters and it had grown from a standing start to a 28% digital market share in 10 years, double Tabcorp's share at the time. What hope did the company have?

Until now, our valuation of Tabcorp factored in market share losses over the long term, as well as ballooning marketing expenses as the company tried to maintain a foothold. Profit growth was in the realm of dreams.

A different lens

Valuing companies is a fluid process. We can change our minds, sometimes rapidly, as new facts come to light or we see things from a different perspective.

The question nagging us over the past six months - with increasing intensity - is this: what if glamourous Sportsbet isn't destined to conquer the online wagering market, leaving Tabcorp in the dust? What if the fuddy-duddy wins?

There are signs Tabcorp now has the upper hand. To start, the long-serving chief of Sportsbet's parent company, Ireland-based Flutter Entertainment, left early last year. Breon Corcoran was, in our opinion, the most astute executive of any wagering business worldwide. We didn't know his replacement, Peter Jackson, so have been watching as his strategies unfold. With 18 months now past, we don't think Jackson has the mettle of his predecessor. It's hard to tell what effect this change has had on the Australian operations specifically, but Corcoran's retirement was clearly a loss for Sportsbet.

Next on the scoreboard was the merger of Tabcorp and Tatts. We won't go over the benefits again here, but due to their overlapping wagering operations, management expects $130-145m of cost-cutting benefits to flow through by 2021, with $64m of that already bagged in 2019. At least in theory, these savings can flow through to punters as better odds and promotional offers, which would narrow the advantage Sportsbet currently has (see Tabcorp: Result 2019).

One other issue helping to narrow the lead was the introduction of 'point of consumption' taxes, which came into effect in Victoria (8% rate), NSW (10%), Western Australia (15%) and the ACT (15%) earlier this year. The levy comes straight off the top line of all operators - net wagering revenue - and replaces variable taxes based on where bookmakers held a licence. The old system favoured online bookies, who typically registered in the low-tax Northern Territory, while Tabcorp was left paying higher taxes in most states due to separate licences. The new set-up evens the playing field.

Market share

The combination of Sportsbet's CEO retiring, Tabcorp's lower post-merger operating costs, and the new point of consumption taxes appear to be tipping the scales in favour of Tabcorp. August's full-year result gave us the first piece of evidence: Tabcorp's digital turnover grew 7%, compared to Sportsbet's 12%, for the six months to June.

True, Sportsbet is still gaining market share. However, the rate of gain has declined: Sportsbet's 5% lead today is well below the 27% lead it had in 2016. Tabcorp's loss of market share has slowed, and we suspect the factors listed above will keep working in Tabcorp's favour and help it win back customers.

In particular, those taxes mentioned earlier even the playing field between Sportsbet and Tabcorp - but they're a nightmare for small operators, who account for almost half of the market, due to their thinner operating margins. Both Sportsbet and Tabcorp are likely to benefit.

Sportsbet's management had this to say in August: '[There are] signs that operators are behaving rationally in the face of lower customer economic returns. We are seeing signs of reduced costs across search marketing with Google pay per click rates down year-to-date. We have also seen competitors give up the rights to certain media assets, reflecting our belief that there may be less discretionary spend in the market overall.'

Operators have increased their pricing to offset the taxes but, more importantly, marketing budgets are shrinking industry-wide as a way to save money, with fewer promotional 'generosities' being offered. This is the corporate equivalent of everyone sitting down at a parade - everyone benefits, especially the tallest.

Tabcorp and Sportsbet's marketing budgets tripled between 2011 and 2018 as they tried to build their dominance online. However, Tabcorp's 2019 marketing budget accounted for 3.0% of revenue, which is down from 3.2% last year - the first decline in 8 years. In absolute terms, Tabcorp's marketing budget was unchanged, while Sportsbet's fell $8m (a 10% decline).

This can only be a good thing. If Tabcorp maintains its marketing budget, while Sportsbet and smaller operators are pulling back, it may win a few extra eyeballs and gain market share this year. More likely, though, the company follows suit and eases off on marketing. The savings should flow quickly to profits. If Tabcorp can keep chipping away and gets marketing down to 2% of revenue (roughly where it was in 2015), then it would save at least $55m before tax, and add around $39m to net profit - a 10% increase.

Upgrade time

None of this is to say Tabcorp is out of the woods; Sportsbet still has some 50% more active online users. Then there is this morning's news that Sportsbet's parent company, Flutter, intends to merge with Canada's Stars Group, owner of BetEasy, the third-largest online betting operator in Australia. The companies haven't announced whether to retain the BetEasy brand or merge it with Sportsbet yet, but there's a good chance that they will, given the potential for cost cuts. A combined Sportsbet and BetEasy would have a market share of just over 40%.

While a merger strengthens Sportsbet and BetEasy's footing, it is as much a sign of desperation as anything else. There are many good reasons for Flutter and Stars to combine their global operations, but none more so than the fact that BetEasy has an EBITDA margin just a third that of Sportsbet, a meagre 10%. We suspect the new point of consumption taxes may have swung the company to a loss, so it was a case of merge or bow out.

We wouldn't be surprised if there are more local mergers between online operators this year. If you're not Sportsbet or Tabcorp, you're probably losing money, so Tabcorp may have some opportunities to grow its market share by acquisition.

With savings flowing through from the Tatts merger, weakening competitors, more 'rational' marketing budgets, and a slowdown in the loss of market share, Tabcorp no longer looks like the sitting duck of 2016. In fact, Tabcorp could be earning an extra $150-200m in pre-tax profits a few years from now if these trends continue. That would boost earnings per share by 25-35%.

What's more, this review has focussed entirely on the rapidly changing prospects of Tabcorp's wagering division, which accounts for just under half of operating profits - but the other half comes from an even better business, the company's money-spinning Lotteries division, which operates all the major lotteries in Australia. For more on this high-quality monopoly, please see previous reviews here, here and here.

Value investing isn't about picking winners. It's about acknowledging the future is uncertain and dealing with that fact by finding stocks where the risks are more than factored into the share price. 'The cheaper a stock is, the less you have to get right,' as the saying goes.

Tabcorp trades on a price-earnings ratio of 24 - reflecting the strength of its Lotteries business - and we expect earnings to grow around 10% a year over the next few years. We're increasing the price guide and taking our risk ratings down a notch to reflect our brightening view of the company's outlook. With multiple competitive advantages and a fully-franked dividend yield of 4.5%, we're upgrading to BUY.

Note: The Intelligent Investor Equity Income and Equity Growth portfolio own shares in Tabcorp. The Intelligent Investor Model Income portfolio is buying 12,569 shares of Tabcorp at $4.75 for a 3.9% position. The Intelligent Investor Model Growth Portfolio is buying 12,282 shares of Tabcorp at $4.75 for a 3.7% position.

Recommendation