Sydney Airport's debt to shareholders

Recommendation

Sydney Airport is a bit of a darling at Intelligent Investor. We've had on-again, off-again buy recommendations on the stock going back all the way to 2002, when it first listed at $1. Yet judging by its financial ratios alone, no-one in their right mind would look twice – or even once – at Australia's largest airport. The stock has a debt-equity ratio of 476%, earnings per share are lower than dividends and the company sports a price-earnings ratio of 209. Looks, however, can be deceiving.

The first thing to note about Sydney Airport is that it's a stapled security. When you buy listed securities in Sydney Airport, you actually receive two separate instruments joined at the hip: one share, which represents equity in the company, and one unit trust – known inspiringly as SAT1 – which provides a loan to the airport. You become, in effect, both an owner of Sydney Airport, as well as one of its creditors.

At first glance, stapled securities seem counter-intuitive. Wouldn't investors be better off if the individual components weren't stuck together, so they had the option to chose which security best suits their investment needs?

Key Points

Statutory numbers are useless

Underlying earnings significantly higher

Debt-funded capex an issue, but not for a while

In fact, Sydney Airport investors are much better off under this structure due to a tax advantage. As your unit trust provides a loan to Sydney Airport, you receive interest. The Australian Taxation Office (ATO) treats this interest as an expense, which is tax deductible for the airport.

Over the past five years, Sydney Airport has made more than $2.7bn in earnings before interest and tax (EBIT), yet paid only $62m in tax. After removing the portion of interest expense that is paid to external creditors, the airport's underlying tax rate over the past five years was just 5.6%.

But this also makes for an ongoing source of confusion due to the complex accounting. Most brokers or financial data providers – such as Commsec and Google Finance – don't distinguish between different accounting policies at companies. They take the reported statutory figures in the annual report and call it a day.

Sydney Airport's statutory net profit in 2014 was $59.1m. But remember the airport is actively trying to reduce that number by distributing its earnings to shareholders as tax-deductible 'interest expense'. To put it bluntly, the figures you read on Commsec are about as representative of Sydney Airport's underlying profitability as your telephone number.

Free cash flow

So if we can't rely on statutory net profit, what is Sydney Airport actually earning?

To figure it out, you'll need to bypass the annual report and head to the investor presentations. On page 11 of the 2014 results investor presentation, you'll see Sydney Airport's statutory income statement and the gloomy net profit of $59.1m on the bottom line. On page 12, however, you can see a step-by-step reconciliation to 'net operating receipts' of $525m, or 23.7 cents per share (see Table 1).

| Year to 31 Dec | |

|---|---|

| Revenue ($m) | 1,163.5 |

| Operating expenses ($m) | 214.1 |

| EBITDA ($m) | 948.3 |

| Depreciation ($m) | 326.4 |

| EBIT ($m) | 621.9 |

| Finance costs ($m) | 518.7 |

| Profit before tax ($m) | 115.7 |

| Net profit ($m) | 59.1 |

| Profit before tax ($m) | 115.7 |

| Add back depreciation ($m) | 326.4 |

| Underlying profit before tax, D&A ($m) | 442.1 |

| Add back non-cash expenses ($m) | 100.9 |

| Subtract cash reserves movements ($m) | -17.9 |

| Net operating receipts ($m) | 525.1 |

| Net operating receipts per share (cents) | 23.7 |

| Dividends per share (cents) | 23.5 |

Net operating receipts is a proxy for Sydney Airport's free cash flow (not quite, but more on that later). This figure is the most accurate measure of the airport's underlying earnings and is what management uses to determine distributions to shareholders. Just under 100% of the airport's net operating receipts are paid to shareholders as dividends.

But you may have spotted something fishy in Table 1: why are we adding back depreciation without deducting capital expenses, such as renovating terminals or building new car parks? These are genuine costs and Sydney Airport expects to invest $1.2bn into the business between now and 2018.

The reason Sydney Airport doesn't deduct capital expenditure in arriving at its distributions is that it funds its investments entirely with debt. This juices up returns but it also means that year in, year out, Sydney Airport's debt pile is growing. Net debt increased 5% to $6.6bn in 2014.

Normally we would consider this a huge red flag but Sydney Airport deserves some leniency. It's probably a pretty sensible strategy, at least for the next 50 years. The reason Sydney Airport gets away with it is that it has significant operating leverage. The costs of running the airport are mostly fixed, which means that as revenue grows due to an increasing number of passengers, operating earnings grow faster than revenue and costs. In 2014, revenue increased 4% compared to the prior year, but as expenses only increased 1%, earnings before interest, tax, depreciation and amortization (EBITDA) was 6% higher.

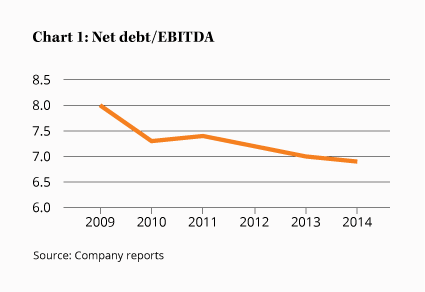

Like a mortgage

Sydney Airport operates a bit like an interest-only mortgage on a house. You can borrow a little more each year for improvements, so long as rental income is growing faster than your interest bill. And that's what's happening at Sydney Airport: net debt may be increasing, but the airport is actually deleveraging at the same time (see Chart 1). It's not the most conservative approach, but as debt becomes a smaller issue each year and the airport is a high-quality asset, we'll grin and bear it.

The plan, however isn't without risk. For one thing, Sydney Airport shareholders only have a lease on the airport, expiring in 2097. Although the lease was bought upfront and the airport doesn't pay rent, come 2097, the airport – every building, runway and overpriced car space – will revert back to government ownership.

The plan, however isn't without risk. For one thing, Sydney Airport shareholders only have a lease on the airport, expiring in 2097. Although the lease was bought upfront and the airport doesn't pay rent, come 2097, the airport – every building, runway and overpriced car space – will revert back to government ownership.

At some point, Sydney Airport will need to pay off the debt it has been accumulating. Much as adding debt allows distributions to grow disproportionately fast, when the airport starts paying it off, distributions will shrink. There's no free lunch, but shareholders can put off paying the bill for another 50 years or so.

Refinancing

The other risk is one of refinancing. Every year, the airport puts its hands out to creditors and asks that they renew the loan.

Management has a good track record of successfully refinancing well in advance, such as the $2.5bn refinancing in the Australian bank and European bond markets in May 2014, but it's still conceivable that if a crisis were to hit, creditors could pull their funding.

However, we don't see this as particularly likely due to the long-term resilience of passenger numbers and revenue. Sydney Airport's competition watchdog, the ACCC, doesn't set aeronautical prices directly or impose pricing caps, unlike the respective bodies for most European and American airports. The airport negotiates prices directly with airlines on a commercial basis, subject only to monitoring. As the only international airport serving Sydney – and accounting for 40% of Australia's international traffic – the airport is a monopoly and has significant pricing power. Unfortunately, though, its customers – the airlines – generally have poor financial positions, so there's limited ability to raise charges much above inflation. Still, it's the kind of high-quality asset that creditors love to lend to.

Furthermore, Sydney Airport's debt structure consists mainly of bullet maturities, which are spread over many years with good terms and an average maturity of 7 years. The next substantial debt renewal is only in 2020, with some maturing as far out as 2030.

A financial crisis could push up financing costs, not to mention debt being a real issue if there was a large catastrophe like a terrorist attack. All up though, we're comfortable that the current level of debt is unlikely to present much of a problem.

The share price of Sydney Airport has risen 8% since Sydney Airport: Result 2015 from 2 Mar 15 (Hold – $5.19) and 46% since we last upgraded the stock in Sydney Airport upgraded to Buy on 6 Dec 13 (Buy – $3.82). Management expects 25 cents of distributions to be paid in 2015, giving an unfranked yield of 4.5%. That's no steal and we'd need a larger margin of safety before buying, but it's still reasonable for a stable asset that could grow earnings by at least 5% a year over the long term. HOLD.

Note: Our Income and Growth portfolios own securities in Sydney Airport.

Recommendation