Sonic Healthcare isn't an 'ageing population' investment

Recommendation

US President John Adams once said that ‘facts are stubborn things', but so too are myths. Some fairy tales are just too enchanting to abandon, and one of the more pervasive is that all healthcare stocks will benefit from an ageing population.

First, a bit of background. In the 1950s, Australia's fertility rate was more than three children per woman. Today, it's less than two. The ‘baby boomers' had fewer children than their parents, so the proportion of young people in the population has been falling while the proportion of elderly has been rising. The median age of Australians has risen from 30 in 1950 to 38 today. This is what people mean when they refer to Australia's ‘ageing population'.

Key Points

-

Ageing population of little consequence

-

Rising utilisation the real story; may not continue

-

Acquisitions still provide growth opportunities

The Australian Bureau of Statistics projects this trend to continue, with the over-55s age group expected to increase at a rate of 2.5% over the next 10 years, well above the 1.7% for Australia's population as a whole. The median age should hit 42 by 2050.

With this megatrend as a backdrop, it seems inconceivable that demand for healthcare won't increase over the coming decades. Sonic Healthcare – the country's largest pathology operator, providing almost half of all tests – is riding the wave. Or so the theory goes.

Unfortunately, the argument has its holes. For starters, while the population is ageing, the rate of ageing is slowing, not speeding up. The over 55s age group is expected to grow at 2.5% over the next 10 years, but that's down from 2.8% since 2001.

An even bigger hole in Sonic's boogie board is that it hardly benefited at all from the historic growth in that demographic.

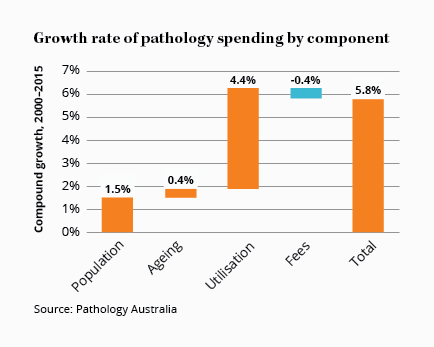

A 2016 report by Ernst & Young and Pathology Australia found that total Medicare spending on pathology services grew at 5.8% between 2000 and 2015. That's well above growth in the general economy so it's easy to pair this fact with the ageing population and conclude that it must be the latter powering the advance.

A 2016 report by Ernst & Young and Pathology Australia found that total Medicare spending on pathology services grew at 5.8% between 2000 and 2015. That's well above growth in the general economy so it's easy to pair this fact with the ageing population and conclude that it must be the latter powering the advance.

As you can see in the chart, however, once you split the growth into its different components, a new story emerges.

Only around 0.4% of annual spending growth is attributed to shifting age demographics. Sonic is not an ageing population story, it's a utilisation story. Some three-quarters of all the growth that occurred over the past 15 years was due to a rising rate of doctor referrals. In other words, the number of tests per person went up if you hold age and the other factors constant. Australians are now getting 50% more tests, on average, than they were in 2003.

Glass half-full

If you're an optimist, you might consider this good news. A big reason for the rising number of tests per person is the number of tests available. There's nothing to suggest innovation is about to end, so there'll almost certainly be an ever-lengthening menu of diagnostic services offered to patients.

What's more, doctors love referring patients to get tests. Clinicians want to avoid lawsuits and directing a patient to get every test imaginable offers protection against negligence charges. These forces mean there's a good chance that utilisation rates will continue to rise.

A clear-eyed pessimist, though, would point out that the rapid rise in utilisation over the past 15 years is not a sign of things to come because it's self-limiting. The healthcare budget can't grow indefinitely at a faster rate than the general economy because at some point it would consume all government spending. Something's gotta give.

It works like this: if utilisation rates continue to rise, the government will be forced to cut Medicare fees for those services or risk an exploding healthcare budget. Lower Medicare reimbursement means higher out-of-pocket costs for patients, which will make them more reluctant to get unnecessary tests.

We already see this happening. Unlike most areas of healthcare, growth in pathology spending hasn't been due to rising service fees. Medicare fee cuts have shaved around 0.4% a year from the growth rate – perfectly offsetting the effect of an ageing population, coincidentally. Over the past 20 years, pathology fees have declined 55% on average after adjusting for inflation, while all other Medicare fees have increased by around 10%.

Other measures are being taken to end the spike in utilisation too. The ongoing Medicare Benefits Schedule Review Taskforce is reviewing how to optimise pathology services to curtail over-servicing. The final recommendations haven't been released yet but the interim report suggested dozens of changes to fees and regulations to discourage patients from getting tests they don't need. All this should chip away at utilisation growth, if not send it backwards.

Still a growth stock

So where does that leave investors? On the plus side, Sonic will probably benefit from an ageing population in a minor way, but nowhere near to the extent many investors expect. It should also benefit from a growing menu of testing services thanks to advancing technology. Offsetting these things is a Government hell-bent on lowering reimbursement for pathology and one committed to reducing unnecessary tests.

We don't expect pathology spending to increase as fast as it did over the past 15 years, but Sonic still has plenty of potential. It is now the largest pathology provider in four countries – with a 44% market share in Australia – so it's a pivotal cog in the healthcare system. It benefits from economies of scale, is well managed, and has stable returns on capital of around 10%.

What's more, there's still plenty of growth to be had overseas and the company is successfully expanding in Europe, where the market is still mainly a collection of small independent labs. Organic revenue growth has been decent in Europe too, growing 4%, 5% and 6% in Germany, Switzerland, and the UK in the six months to December. While local growth may be slowing, we still expect long-term profits to increase in the mid-single digits, which is nothing to sneeze at. Management believes Sonic is on track to achieve operating profit growth of 6–8% in 2018, excluding acquisitions.

The bottom line is that while Sonic isn't an 'ageing population' investment the likes of Ramsay Health Care or Healthscope, it doesn't have to be. We're notching up the price guide slightly – mainly due to our more optimistic outlook for the overseas expansion and an easing of collection centre rents here at home. With a forward price-earnings ratio of 20 based on consensus estimates for 2018 earnings, the stock is hovering just above our new Buy price of $22. It's close to an upgrade but, for now, we're sticking with HOLD

Our Intelligent Investor Equity Income Portfolio is now available as a listed fund trading under ASX code: INIF. Holdings in the fund will mirror our current Equity Income Portfolio and have the same low costs, but you'll be able to buy it on the ASX. You can save yourself the broking commission by applying during the initial offer, which closes on Friday, 8 June, 2018.

Recommendation