SomnoMed sets new targets

Recommendation

'When you have insomnia, you're never really asleep and you're never really awake,' said author Chuck Palahniuk in Fight Club. The same could be said of sleep apnea, a disorder affecting more than a million Australians whose symptoms include long pauses between breaths or abnormally shallow breathing.

This is bad for a couple of reasons. Irregular breathing causes carbon dioxide to build up in the blood, which triggers the brain to wake and have the afflicted take a deep breath. Interrupted sleep leads to grogginess and an extra dose of irritability the next day, as many spouses would attest. The bigger issue is that a lack of oxygen causes your heart rate to speed up, which stresses the heart muscle and has been linked to several heart disorders.

Sufferers are generally prescribed a continuous positive airway pressure (CPAP) machine from the likes of ResMed or Fisher & Paykel Healthcare. These work like a leaf blower attached to your face with a mask. The increased air pressure keeps your airway open and enables you to breathe. The trouble is that wearing a mask is uncomfortable and likely to keep you awake anyway, while the bulky machines are a hassle to take on holiday. As a consequence, compliance is a paltry 40-60%.

Key Points

Higher compliance than CPAP

Sales contnue to explode

USA a large, growing market

In theory, CPAP is the most effective way to treat obstructive sleep apnea. In practice, a treatment that isn't used doesn't work at all.

Therein lies the opportunity for SomnoMed, which makes a special mouthguard that forces the lower jaw into a position that helps keep the airway open. Clinical studies have shown that, for mild or moderate sleep apnea, this treatment is only slightly less effective than traditional CPAP therapy but has compliance levels above 80%, which leads to better patient outcomes overall.

Uptake growing

Unfortunately, when it comes to adopting new products, the medical profession makes a tortoise look swift. Despite being available for more than a decade, widespread acceptance has only occurred more recently.

Several European countries are now prescribing SomnoMed's mouthguards as a first line treatment, with the cost fully reimbursed by government. In Sweden and the Netherlands, half of all new patients are now treated with oral appliances rather than CPAP machines. Expanding in Europe is the company's most immediate opportunity – European sales increased 41% in 2014, though off a low base. The USA, however, remains the big fish.

Some 20m Americans suffer from sleep apnea, with another 2m diagnosed each year. Of the freshly diagnosed, about 5% reject CPAP machines in favour of 'oral appliances' and, of those 100,000 sufferers, about 20% use products made by SomnoMed. While most patients are still prescribed CPAP, this is a huge and growing market: US spending on sleep apnea products exceeds $5bn a year and has grown at 13% per annum since 2009.

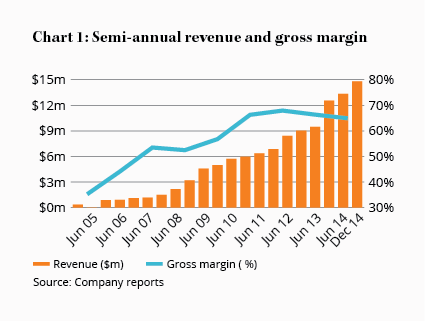

And, as Chart 1 shows, SomnoMed has done a commendable job taking advantage of it. More than 200,000 patients now use the company's mouthguards, with some 50,000 fitted over the past 12 months – double what the company sold just three years ago.

And, as Chart 1 shows, SomnoMed has done a commendable job taking advantage of it. More than 200,000 patients now use the company's mouthguards, with some 50,000 fitted over the past 12 months – double what the company sold just three years ago.

Sales and gross profit have tripled over the past five years, with growth expected to continue for some time to come. In May, executive chairman Dr. Peter Neustadt said: 'A five year plan to 2020 has been developed and budgets for 2015/16 are currently being finalized projecting a further increase in SomnoMed's growth in the next financial year and beyond. Volumes in the year ahead are expected to grow by 20-25% over 2014/15'.

Competition threat

Unfortunately, that sort of growth rate tends to attract competition, which inevitably chews into profitability over time. There are several large direct competitors, such as US-based Airway Management Inc, not to mention the CPAP manufacturers like ResMed and Philips Respironics.

SomnoMed sells its products through a network of 4,000 dentists worldwide, which fit patients with their mouthguards. The company encourages them to actively diagnose patients that may be suffering from sleep apnea rather than waiting for a doctor's referral. The time and cost needed to establish a distribution network means it is certainly an asset and a barrier to entry, but as dentists stock several devices, and their main priority is the patient's individual needs, their loyalty may be fleeting.

Guidance lowered

Management lowered its full-year sales forecast from 55,000 units to 50,000 in its third-quarter results update last month. Strangely, though, the full-year revenue forecast of $32.5m (up 25%) was left unchanged, implying management was either conservative in its initial estimate or the company will make up the difference with higher prices per unit.

Management also said: 'The commitment to capitalize on growing revenues to produce growing earnings in future years remains. However, achieving volume and revenue growth in the short term are the priority tasks set by the Board of SomnoMed.' We'll take that to mean investors shouldn't expect much in the way of free cash flow any time soon.

The stock has fallen 14% since SomnoMed's record quarter on 29 Jan 15 (Hold – $2.85) but is up 83% since we upgraded the stock in SomnoMed: A future mini-ResMed? on 5 Feb 14 (Speculative Buy – $1.33).

A rapidly expanding company like SomnoMed isn't as easy to value as more predictable businesses like a property trust or Woolworths. We're wary of false precision, so have left our Sell price high to ensure we maintain a stake should the company continue to deliver. However, we highly recommend locking in profits as the share price rises to ensure you take something away should things turn sour. We also emphasise our 2% recommended maximum portfolio weighting.

Having said that, SomnoMed is a viable competitor in an expanding niche of a large, growing market. It could easily have more than a decade of impressive growth ahead. We're sticking with HOLD.

Recommendation