Sirtex Medical: The bull and bear case

Recommendation

Radiotherapy maker Sirtex Medical's share price has fallen roughly 45% since early December. We've spent the last month pulling on informational threads, adjusting forecasts and throwing out old theories – trying to work out whether the price fall is an opportunity to buy, or an accurate reflection of the company's changing prospects.

If Pascal's Wager teaches us anything, it's that you shouldn't only consider the alluring probabilities of being right – you need to weigh that against the consequences of being wrong. With this in mind, let's examine both Sirtex's bull and bear cases.

Key Points

-

Large potential market

-

New competitor no threat

-

Management actions shake trust

What's going right

Sirtex isn't your ordinary biotech rabble. Most biotechs on the ASX are still in the research phase of development, whereas Sirtex already has regulatory approval in the US, Europe and Australia.

Better yet, SIR-Spheres – the company's lone product – has relatively good reimbursement coverage. While doctors are making the clinical decisions, governments and insurers are generally the ones holding the purse strings. Most biotechs – particularly those with an expensive therapy – have trouble getting payers on board, but Sirtex is already out of the woods. Medicare and private insurers cover SIR-Spheres in the US and Australia, and the National Health Service reimburses patients in the UK if they meet certain criteria (the rest of Europe is patchy).

Investors aren't taking a punt on whether a new therapy could one day bring home the bacon: SIR-Spheres are already generating around $230m in revenue each year (see Is Sirtex's $20,000 teaspoon enough?). And even if that revenue suddenly evaporated (we'll get into some of the reasons that might happen in a moment), the company has net cash of $107m, providing a nice cushion. The stock could drop materially from here, but it won't go to zero.

Big market

What's more, Sirtex is currently serving just a fraction of its potential customers. Let's do the maths.

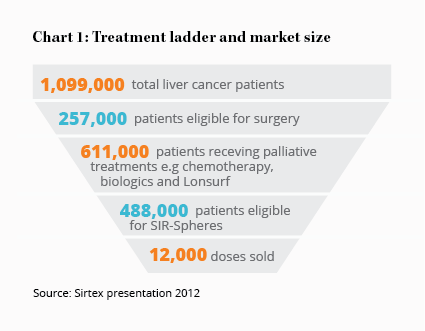

Each year, roughly 1.1 million people are diagnosed with liver cancer in Sirtex's main markets (either primary liver cancer or where it has spread from another organ). Surgery is the favoured treatment, but it's only suitable for 25% of patients. Other options in the ‘treatment ladder' include chemotherapy and other drugs (see Chart 1).

A bit under half of those patients diagnosed with liver cancer might benefit from SIR-Spheres, but most patients never receive it. SIR-Spheres are a last resort treatment because they generally only add months to a patient's life and because they carry a high risk of complications. Sirtex is fighting against time because, sadly, most patients die while taking other therapies. Liver cancer has a 5-year survival rate of just 15%.

But here lies the opportunity. Sirtex sold 11,931 doses in 2016, yet the total potential market is around 488,000. If the company can convince doctors to use SIR-Spheres earlier in the treatment ladder, there's potential for blockbuster sales growth. The company is currently spending tens of millions on clinical trials to demonstrate that SIR-Spheres are a valuable first-line treatment, and if those trials are successful, the stock could be worth multiples of the current share price.

New competition

Ironically, to finish explaining the bull case, we need to touch on why the stock was pummeled by investors in December when the company announced dose sales would grow a lacklustre 4–6% in the first half of the 2017 financial year.

Sirtex said the result was due to increasing competition from a new drug. But, here's the thing: the drug in question, Lonsurf, isn't a direct competitor to SIR-Spheres in the sense that it's an oral medication, rather than a microsphere radiotherapy.

Sirtex said the result was due to increasing competition from a new drug. But, here's the thing: the drug in question, Lonsurf, isn't a direct competitor to SIR-Spheres in the sense that it's an oral medication, rather than a microsphere radiotherapy.

Sirtex does have one direct competitor, Theraspheres, but research shows SIR-Spheres to be more effective, so we aren't too concerned.

Lonsurf is also inferior to SIR-Spheres, in that it adds an average of two months to patients' lives compared to around nine months for SIR-Spheres. What Lonsurf does have going for it, though, is that it's a convenient oral medication with little risk of complication – and that means it sits higher in the treatment ladder. When Lonsurf hit the market last year, what essentially happened is that the treatment ladder was extended by a rung.

That delay has caused this year's dose sales to ‘skip a beat', but – at least in theory – sales should normalise next year.

The Bear Case

Though our current view is that the release of Lonsurf won't impact Sirtex's long-term growth potential, it is a reminder of the big risk: new cancer therapies showing up higher in the ladder that are more effective than SIR-Spheres. As a last resort therapy, SIR-Spheres are reserved for a very small pool of patients, and that means that small improvements to survival rates higher in the ladder can have a big impact on the number of patients reaching the bottom of the ladder.

It's also possible that someone develops another direct competitor to SIR-Spheres or that Theraspheres are shown to be more effective. Phase III clinical trials are in progress to examine the effectiveness of Theraspheres when paired with other therapies. If these trials are successful, while Sirtex's own trials fail, it could mean doctors shift their allegiance to Theraspheres.

That risk, however, is nothing new. What is new is the risk of poor management. Management has downgraded growth forecasts twice in eight months, which suggests it has an inclination towards overoptimism.

Then, last week, the board fired chief executive Gilman Wong after suspicious share trading activity. Wong sold roughly a fifth of his holding in the company last October, just two days after he confirmed prior forecasts for double-digit growth in sales. By avoiding the share price crash that occurred when guidance was revised downwards in December, Wong saved himself around $1m. That doesn't look good.

Whereas previously we held management in high esteem, our faith has been shaken and that makes us wonder if Lonsurf really is the main cause of slowing sales. Without more thorough prescribing and survival data, we can't distinguish at this point between slowing growth due to the introduction of Lonsurf or slowing growth due to the company reaching a ceiling in doctor acceptance for SIR-Spheres (which may not improve without the ongoing clinical trials being successful). To some extent, we have to take management's word.

What's more, Wong led Sirtex for more than a decade and gradually built his stake in the company. Why sell now? Sirtex has missed sales targets before with accompanying share price falls, so it seems unlikely he would abandon ship over temporary factors. Wong says it was to pay a large tax bill, but we have to wonder whether he sees a long-term change in the company's fortunes.

Though it seems unlikely, we also must factor in the possibility that the chief executive's departure damages Sirtex's reputation with clinicians and insurers. There may be operational fallout. The recent share trading fiasco aside, Wong was undoubtedly a master at marketing, and at negotiating with governments and insurers. A sudden management change always adds risk, and Wong's is quite the skill set to live up to.

Bottom line

So where does that leave us? Any investment in Sirtex has a wide range of possible outcomes. The bull case scenario – rapid expansion of the market for SIR-Spheres following positive clinical trial data – hasn't changed much. Indeed, even our base case – reasonable growth prospects, but with SIR-Spheres remaining a last resort therapy – hasn't been affected by the uptake of Lonsurf.

However, the chances of a severely negative outcome have increased thanks to the possible fallout from the departure of Gilman Wong, the difficulty the board will have finding an equally qualified replacement, and the possibility that slowing growth is due to a ceiling in acceptance among doctors, rather than the introduction of Lonsurf.

Management expects earnings before interest, tax, depreciation and amortisation (EBITDA) to be $30m–32m for the six months to December 2016, with consensus estimates for earnings per share of 84 cents in the year to June 2017, putting the stock on a forward price-earnings ratio of around 18.

Although our bull and base case haven't changed, the potential for a bad outcome has increased and that drags down our overall valuation – not quite as much as the share price fall, but the margin of safety still isn't there to warrant an upgrade.

With an approved product, $107m of net cash to fund its clinical trial program, and still decent sales growth in the mid-single digits, we're sticking with HOLD.