Servcorp: Interim result 2015

Recommendation

Servcorp has a relatively straightforward business model. It rents office space on medium-term leases (from one to 10 years), fits it out as serviced offices, and then rents these out monthly. It adds value in the services it can provide – postal addresses, receptionists, meeting rooms and, increasingly, technology.

Key Points

PBT up 30% over prior year, but only 1% over previous half

Accounting quirk will knock about 5% off PBT this year

Growth is slowing, but shares not overpriced

Simple enough. But in terms of financial reporting, it can get very complicated and, after the switch at last year's interim result from 'mature'/'immature' floor to 'like-for-like' reporting, we now have something new to worry about – fixed rent increases.

Accounting standards require that where a lease contains fixed increases, these must be 'straight-lined' across the term of the lease. This has the effect of bringing rental expense from the back end of a lease to the front, but it takes no account of the fact that Servcorp should itself be able to increase rents over the years.

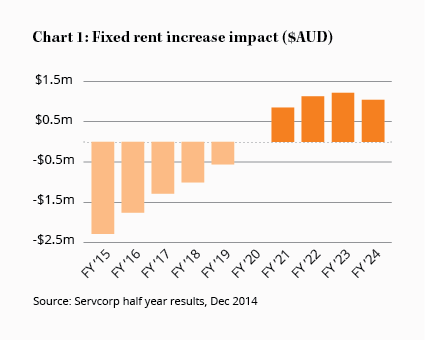

In the past the impact from this has apparently been insignificant, but the company has just entered 10 new leases with fixed increase clauses and it's now making a big difference, so management has chosen to spell it out.

Growth slowing

The anticipated impact over the next 10 years is shown in Chart 1. For 2015, it breaks down as $1.1m for the first half and $1.2m for the second. And finally we're getting to the punch line, because without this impact the company looks like it has all but stopped growing. First-half profit before tax (PBT) may have been up 30% on the first half of 2014, but it was only up 1% sequentially. And management's guidance for full-year PBT growth of 'not less than 15%' implies second-half sequential growth of (not less than) 2%.

If we add back the impact of fixed rent increases, though, the first half of the current year is up 7% sequentially and the second half should increase (not less than) 3% (see Table 1). These numbers are less than we'd have expected given the fall in the Australian dollar (about 80% of Servcorp's revenues are earned offshore) and they're a lot lower than Servcorp has achieved during its rapid expansion over the past few years, but they're better than 1% and 2%.

| H1 14 | H2 14 | FY 14 | H1 15 | H2 15 | FY 15 | |

|---|---|---|---|---|---|---|

| PBT($m) | 15.1 | 19.4 | 34.5 | 19.6 | 20.1 | 39.7 |

| Seq. growth (%) | 0 | 28 | 25 | 1 | 2 | 15 |

| Fixed rent adj. ($m) | n/a | n/a | n/a | 1.1 | 1.2 | 2.3 |

| Adjusted PBT ($m) | 15.1 | 19.4 | 34.5 | 20.7 | 21.3 | 42.0 |

| Seq. growth (%) | 0 | 28 | 25 | 7 | 3 | 22 |

Allowing for a bit of management wiggle-room, in fact, and the growth may be more like 7% and 5%. Bear in mind also that as the impact of the fixed rent increases reduces over the next seven years, it will add about $0.5m (around 1%) to reported PBT each year.

Now this is all very convenient, of course, and it's always smart to take a step back when there's this degree of financial manoeuvering and look at the overall picture. The picture here is that Servcorp management has proved itself to be smart and candid over the years and still owns more than half the company, so it has little reason to gild the lily.

Sydney, Perth weak

Elsewhere in the result, like-for-like (LFL) occupancy increased to 80% from 79% last June and 78% the previous December, but is still some way from management's target of 82–85%. Stand-out performances came from North Asia (LFL PBT up 43%) and Europe and the Middle East (LFL PBT up 59%), while Australia, NZ and South-East Asia disappointed, with LFL PBT falling 35% due to a management restructure in Malaysia and Singapore and weak performances in Sydney and Perth.

| Six months to Dec | 2014 | 2013 | /– (%) |

|---|---|---|---|

| Op. revenue ($m) | 124.5 | 113.7 | 9 |

| PBT ($m) | 19.6 | 15.1 | 30 |

| NPAT ($m) | 16.0 | 11.8 | 36 |

| EPS (c) | 16.3 | 12.0 | 23 |

| Interim dividend | 11c (up 22%), 20% franked, ex date 3 Mar | ||

The full-year guidance should translate to earnings per share of about 32 cents, which would be about 19% up on 2014. But the growth rate is slowing and we'd guess that 2016 will probably only bring about 10%.

The stock is up 8% since Servcorp: Result 2014 on 2 Sep 14 (Hold – $5.68) and has almost doubled since our last Buy recommendation on 25 Jun 13 (Buy – $3.08). That puts it on a forward price-earnings ratio of about 19, which is no longer obviously cheap, but nor is it overpriced for a quality company that should keep growing, albeit at a more sedate pace.

Keep in mind our maximum recommended portfolio weighting of 4% and consider taking some profit if you're reaching those levels. Otherwise, we recommend you continue to HOLD.

Note: Our model Growth and Income portfolios hold shares in Servcorp.

Disclosure: The author, James Carlisle, owns shares in Servcorp.

Recommendation