Sell Woolworths, buy Coles?

Recommendation

Imagine a supermarket group with weak sales, falling profits and lame duck management. Add to that worries about international competitors taking market share, and what do you have?

Well, three years ago you had supermarket giant Woolworths. Today you have Coles, the second-ranked grocery company that Wesfarmers will soon throw to the ASX wolves.

In 2015 we upgraded Woolworths to Buy. At the time Woolworths' first quarter same-store sales for its food and liquor business had slumped to 1.0%. Management's decision to lower prices and boost service meant that underlying first-half earnings were expected to fall by up to 35%. In the end, underlying net profit for the 2016 financial year fell by a whopping 39%.

Key Points

-

Woolworths lagged three years ago

-

Now it's Coles's turn

-

Be ready for an opportunity in Coles

In late 2015 former managing director Grant O'Brien was still warming the seat while new chairman Gordon Cairns searched for his replacement. Multiple directors resigned as Cairns put a broom through the board. Losses at Masters continued to mount.

Inauspicious start

We saw some of these problems mounting back in 2014, but we were behind the curve and ultimately decided to hang on in any case. Our upgrade the following year, after the problems became clear to all, has done better, with the stock up 21% – not too shabby for a plodder. Including dividends the average annual return has been just under 10%, somewhat higher than the mid-to-high single-digit return anticipated at the time (over a five-year period rather than shorter period here).

The outcome shows, once again, that the market is rarely able to tolerate uncertainty or bad news. But over time Woolworths' issues have faded and the strength of the business has reasserted itself.

A new managing director – Brad Banducci – was appointed in early 2016. He did a good job attracting customers back to the stores, although price cuts and better service aren't exactly retailing rocket science.

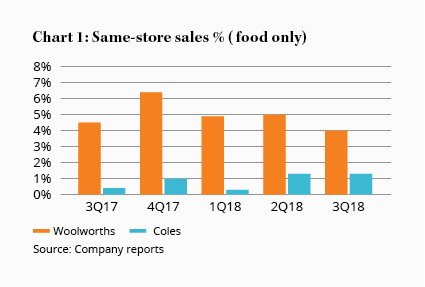

While Woolworths' earnings fell again in 2017, they'll be up more than 10% in 2018 and then again in 2019. Same-store sales growth has now beaten Coles for the past six quarters.

All this has occurred despite persistent worries about Aldi and Costco taking market share from Woolworths. A cold analysis of the facts back in 2016 – borne out by Woolworths' subsequent sales recovery – showed that Aldi wasn't taking significant share. Had Aldi been encroaching on the majors it would have been winning sales from Coles as well, rather than just Woolworths.

WOW factor

What does all this mean for Woolworths? Well the stock is no longer underpriced, trading as it does on a 2018 forecast price-earnings ratio of 23. There's some risk of disappointment if the company doesn't deliver decent earnings growth when it reports its results in a few weeks.

Longer term we'll be watching margins. The source of Woolworths' problems before 2015 was that management let margins creep ever higher over time. In 2018 the company's food division operating margin is likely to be about 4.5% (down from around 8% in 2015).

If the operating margin rose to more than 5.0% it would be a red flag, although that's unlikely any time soon. In the long term, Woolworths' shareholders should expect earnings growth in the mid-single digit range. Much more would imply unsustainable margin expansion.

If you're looking for buying opportunities, then, Woolworths is well and truly out of the running. But, with Coles suffering from many of the same afflictions as Woolworths three years ago, could there be a switching opportunity when Coles joins the ASX in November?

Just as Woolworths' sales growth lagged Coles three years ago, now the opposite is true (see Chart 1). Unlike Woolworths, Coles won't cut prices to stimulate sales but the pendulum is likely to swing back eventually. While Coles's sales growth has been livelier recently, it's unlikely to gain much momentum before the company lists on the ASX in a few months.

Double dose

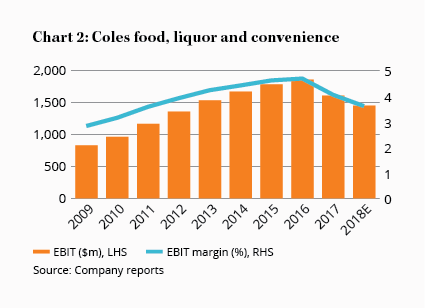

Weak sales and increased investment means Coles's earnings will fall again in 2018 (see Chart 2). As we saw with Woolworths, it takes several years of pain before earnings can recover.

Weak sales, check. Falling profits, check. Now what about management uncertainty? Check. Coles is currently waiting on Steven Cain's gardening leave to expire before he can commence as managing director in September.

John Durkan, Coles's current managing director, is something of a lame duck until Cain starts. His heart wasn't really in it during Wesfarmers' recent Strategy Day presentation.

The market is rarely keen on retailers stepping up their capital expenditure programs either – it's cash out the door after all. Coles invested around $1bn a year on capital expenditure during its period of Wesfarmers' ownership, but in 2019 the figure will step up to around $1.2bn.

Three years ago the market was worried how Aldi and Costco would affect Woolworths. This year it's all about Amazon and Kaufland. There will always be new competition in retail but Woolworths and Coles will remain the leading Australian grocery chains a decade from now.

Woolworths is now priced for a recovery in earnings growth and, unlike three years ago, offers little value. However, we're lifting our price guide slightly to reflect the successful turnaround, and because sales growth could drive profit growth for a time yet. HOLD.

If you're looking for a potential buying opportunity, the demerger of Coles could offer value given its status as the sector laggard. When the demerger documentation is released in a few months, we'll provide a full analysis of Coles including the price at which we'd buy the stock once it lists on the ASX. Wesfarmers itself remains a HOLD.

Note: The Intelligent Investor Equity Growth and Equity Income portfolios own shares in Wesfarmers, while the Equity Income Portfolio owns shares in Woolworths. You can find out about investing directly in Intelligent Investor and InvestSMART portfolios by clicking here.

Disclosure: The author owns shares in Wesfarmers.

Recommendation