Rising blood pressure bodes well for CSL

Recommendation

‘History is a vast early warning system,' wrote political journalist Norman Cousins. ‘Wisdom consists of the anticipation of consequences.'

In the mid-1990s, the world experienced a major shortage of antibodies, or ‘immunoglobulins' if you favour extra syllables. These special proteins are extracted from human blood plasma and are used to treat a variety of infections and immune system diseases.

Between 1995 and 1997, several producers failed inspections by the US Food & Drug Administration (FDA), which led to widespread product recalls and a 30% dip in supply. Doctors were turning patients away unless they had the most serious illnesses requiring antibody treatments.

Key Points

-

Industry plasma collections inadequate for demand

-

CSL has largest, fastest-growing collection network

-

Well placed to increase sales, take market share

Not content to learn from its mistakes, the industry did it again in the mid-2000s – this time by being too conservative when forecasting demand following the approval of several new plasma-derived products. Plasma collections couldn't keep up.

Ironically, it took the financial crisis of 2009 to get the industry back on track – rising unemployment in the US, where most of the world's plasma is collected, led to a flood of paid donations. Donors typically receive $20–40 per visit.

A decade on and all signs point towards another plasma supply shortage. If history is anything to go by, that's great news for CSL.

Mistaken forecasts

The plasma market is a classic case of supply and demand imbalance. Rarely is the market in sync.

Global demand for plasma currently runs at around 41 million litres, which is collected at 600 or so collection centres. Most are located in the US due to a quirk of regulations: donors can be paid, and plasma-derived products sold in the US must be sourced from US-based clinics. Throw in economies of scale and the fact that the US is the largest market, and what you get is 70% of the world's plasma needs being met by US collection centres.

But here's where things get tricky for CSL and other plasma companies.

It takes seven to nine months to collect the plasma, hold it for safety testing, transport it to the fractionator, then process it into an end product. Syringe to shelf takes the better part of a year, and getting a new collection centre licensed and operational can add another two years to that.

Plasma companies need to predict demand 9–24 months in the future to know how much plasma to collect today. Sometimes manufacturers overshoot, which results in too much being collected. Sometimes they undershoot, resulting in a rush to collect more. Recency bias being what it is, plasma forecasters tend to extrapolate current conditions into the future, so oversupply in one period can lead to a lack of investment in collections, which brings on the next period of undersupply.

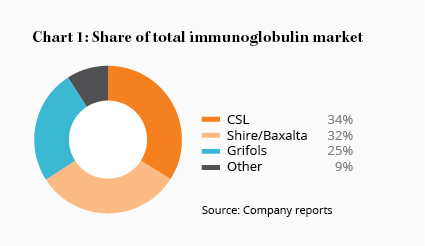

Thankfully, the booms and busts are getting smaller and less frequent. The industry has consolidated significantly into a tight oligopoly: no new firm has entered the sector in 20 years (bless barriers to entry) and several mergers have reduced the number of plasma companies from 13 in 1990 to just six today — CSL, Baxalta/Shire and Grifols, which together account for roughly 90% of the market, and three small European firms that share the rest.

As far as collections go, there's a high level of information sharing between the three lead firms. This makes gauging current industry production easier, but there's no getting around the need for long-term forecasting. The supply-demand rollercoaster is here to stay.

Market share gains

Over the past two years, industry collections have grown at around 6%, while demand has increased at around 8%. However, collection growth has been heavily skewed in CSL's favour: the company increased its count of collection centres by more than a third over the past two years, whereas Baxalta and Grifols increased collections by only 15% and 5% respectively. Smaller companies were in the red.

CSL is also increasing the rate of openings. The company recently said it would increase targeted collection centre openings from 24 to 30 per year. CSL is also part way through a $450m expansion of its manufacturing facilities in Melbourne and Kankakee, USA, and it began construction of a new fractionation facility in Switzerland in 2015. CSL intends to double fractionation capacity by 2024.

All this suggests that CSL is the best positioned of the big three plasma companies to take advantage of the next period of undersupply. And it may already be here.

All this suggests that CSL is the best positioned of the big three plasma companies to take advantage of the next period of undersupply. And it may already be here.

CSL's large base of collection centres and expanding fractionators – a significant competitive advantage – meant that production kept up with the sharp increase in demand for antibodies in the six months to December, whereas Grifols and smaller competitor Kedrion experienced supply constraints.

Though shortages are bad for patients, they give CSL more pricing power. When plasma shortages occur, companies reallocate antibodies to the higher margin US market, which exacerbates shortages in the rest of the world. Governments and hospitals are then forced to pay higher prices at large tender auctions. History suggests that the weighted average sale price of CSL's antibody products will increase over the next couple of years if the supply constraints last, supercharging revenue growth.

Sales of Privigen – already CSL's top-selling product – increased an astonishing 34% in the six months to December after removing the effect of currency fluctuations. This was thanks to increased demand, higher prices, and the fact that Grifols and Kedrion had reduced availability of antibodies.

Capacity constraints at competing firms, rising selling prices, and industry collection centre growth trailing demand growth for several years all suggest the next period of undersupply is here, and we expect CSL to pick up market share. ‘History is a vast early warning system'.

Quality has a price

Management expects net profit to increase 18–20% in 2017, while earnings per share should grow slightly faster due to the company's ongoing share buy-back. CSL's share price has more than tripled since our initial buy recommendation on 20 Jan 10 (Long Term Buy – $31.30) and now trades on a forward price-earnings ratio of around 32.

If that strikes you as a high multiple, you're right. Still, CSL is the world's largest blood products maker and second largest flu vaccine maker – a title that comes with economies of scale and many competitive advantages in research, pricing, manufacturing and distribution.

Growth differs by division, but it's realistic to expect long-term volume growth of around 4–5% for CSL's key products, and as high as 7–9% for antibodies.

CSL has significant pricing power over many products, which are medical necessities without substitute. That cocktail of volume and price growth should ensure revenue growth in the high single digits. When you throw in widening margins thanks to a large proportion of fixed manufacturing costs and the ongoing share buy-back, it doesn't take too much creativity to imagine annual earnings per share growth above 10% over the medium term.

What's more, this says nothing of the sales that could materialise if the company successfully commercialises a key product in its research pipeline – dubbed CSL-112 – which is designed to flush out ‘bad cholesterol' from the body. It's a long shot but, as we explained previously, CSL-112 could add US$1bn to net profit if it makes it through the final stages of the clinical trial process.

Given the nature of drug development and the company's above-average growth prospects, the range of potential outcomes is wide. There's lots to like about CSL and we're happy to hold it for the long term. We'd hate to be remembered as the guy who sold Manhattan for a few measly beads.

We're increasing our recommended maximum portfolio weighting from 6% to 7%. Nonetheless, there are still risks, such as product recalls, and if your weighting in the stock has become too large, we recommend taking profits to bring it back into line. HOLD.

Recommendation