Reece Australia: Result 2015

Recommendation

'Don't risk it, use a licensed plumber.' Most of what you need to know about Reece Australia can be gleaned from that trademarked slogan.

Reece is a mainly a plumbing supplies company. While the company may have diversified into bathroom showrooms – Bathroom Life is its retail brand – most sales still come from supplying plumbers with items ranging from pipes, pumps and valves through to taps, cisterns and baths.

Wholesalers play a significant role in helping their small business customers succeed, and Reece is no exception. Successful customers buy more products, after all. While Reece's slogan reassures its plumber customers, it also takes aim at the do-it-yourselfers undertaking often illegal plumbing work with items bought from Bunnings.

Key Points

Benefiting from a strong housing market

Actrol looks like a good acquisition

Growth potential improving

Reece's 2015 results were much-improved. Sales rose 17% to a record $2.1bn and net profit jumped 35% to $166m (see Table 1). Net profit rose by 24% if you exclude the effect of movements in foreign exchange contracts.

Sales growth resumes

Results over the past two years have been markedly different from the five-year period that preceded it. In 2009 Reece reported sales of $1.5bn but that figure grew just 0.1% a year over the following five years. With sales jumping by more than $500m between 2013 and 2015, have Reece's glory days returned?

The strong housing market has certainly helped. Between June 2013 and June 2015, the number of residential dwellings approved rose by 38%. As most plumbing work takes place towards the end of construction – bathrooms and kitchens are fitted late in the process – Reece should benefit from higher activity for a while yet.

| Year to 30 Jun | 2015 | 2014 | /(–) (%) |

|---|---|---|---|

| Revenue ($m) | 2,085 | 1,776 | 17 |

| EBITDA ($m) | 282 | 228 | 24 |

| NPAT ($m) | 166 | 123 | 35 |

| EPS (c) | 166 | 124 | 34 |

| DPS (c) | 76* | 64 | 19 |

| Franking (%) | 100 | 100 | N/a |

| * 52 cent final dividend, 100% franked, ex date 6 Oct. | |||

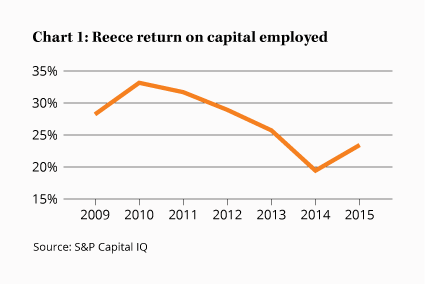

The tailwind of stronger market conditions has helped Reece's operating margin expand from 11.2% to 11.9% over the past two years. But what about the long-term deterioration in return on capital employed (ROCE), which was a key concern of our last review, Reece Australia: AGM 2013 from 4 Nov 13 (Sell – $28.50)?

Chart 1 shows that ROCE has been trending down for years. Reece has looked like a mature business but it has continued to spend capital on opening new outlets and distribution centres, refurbishments, product development and technology upgrades. The long-term decline suggests that either the benefits are taking time to materialise, or that the capital isn't being spent wisely. The latter seems unlikely but the trend in ROCE has been clearly down.

So it was pleasing to see ROCE tick up from 19% to 23% in 2015. Housing market strength was one factor but something else was more important, something that reinforces just how good a business Reece is.

Actrol acquisition

In January 2014 Reece acquired Actrol, a wholesaler specialising in supplying parts and systems to the heating, ventilation, air conditioning and refrigeration industry (which goes by the ungainly acronym 'HVAC&R'). The acquisition saw Reece add 79 branches and 5 distribution centres to its existing 480-strong branch network.

The total purchase price of $300m didn't seem particularly cheap, particularly as Reece bought Actrol from Catalyst Investment Managers, a private equity firm. But Actrol's annual sales had grown from $110m to $280m under Catalyst's ownership and the business was obviously profitable.

The Actrol acquisition builds on Reece's existing small position in the HVAC&R industry. It also complements the plumbing supplies business because the customers and distribution strategies are similar. Greater regulation means technicians will require increasing support from their suppliers, which plays to Reece's strength in customer service.

What makes Actrol even more appealing is that the HVAC&R wholesaling industry is fragmented, with a large number of relatively small players. By contrast, plumbing supplies is dominated by Reece, Fletcher Building's Tradelink and Wesfarmers' Bunnings and Blackwoods divisions.

Over time, Reece should increase its share of the HVAC&R industry. Some market share might come organically from competitors, although other acquisitions are possible. As a similar business but with greater growth potential than Reece's existing operations, Actrol is a very sensible diversification.

Reece's strong balance sheet provides it with plenty of flexibility too. Only $90m of net debt sits on the balance sheet, equating to a net debt-to-equity ratio of 10%. Management is typically conservative, but Reece could fund another acquisition the size of Actrol easily.

So what conclusions can we draw?

First, while Reece's plumbing supplies business is largely mature, its newer HVAC&R division has decent growth potential. And second, it's fair to say we underestimated Reece's ability to expand into adjacent industries.

Valuing Reece

This realisation has implications for our valuation. At the current price, Reece is trading on an underlying price-earnings ratio of 22 (excluding foreign exchange gains). For a well managed business with greater growth potential than originally believed, it's not super-expensive. Using a multiple of enterprise value to earnings before interest and tax, depreciation and amortisation (EV/EBITDA), Reece is trading on 13 times.

Reece's high spending has traditionally suppressed free cash flow but there might be signs of improvement. Apart from a one-off jump in 2013, capital expenditure has remained stable at around $65m annually over the past five years. With operating cash flow creeping higher thanks to Actrol and better industry conditions, free cash flow improved from $84m in 2014 to $107m in 2015. It equates to a free cash flow yield of 3%, a little better than in Reece Australia: AGM 2013 from 4 Nov 13 (Sell – $28.50).

What this all means is that we were somewhat hasty in downgrading Reece two years ago. It's a well-managed company with an impressive track record and better-than-expected growth potential.

Closer to $28, we'd consider Reece a Buy (which equates to an EV/EBITDA multiple of approximately 10 times). At $45, we'd likely downgrade to Sell again. With the share price in the middle of that range, we're returning the recommendation to HOLD.

Recommendation