REA Group welcomes the slowdown

Recommendation

Sydney and Melbourne property prices are up by 65% and 43% respectively over the past four years. Which means that taxi drivers are once again rankling hapless passengers with tales of negatively-geared success. If you shun debt you'll be miffed that the risk-takers have benefited enormously from Australia's ultra-low interest rates – but that's a gripe for another day.

Also miffed are investors who missed out on buying REA Group, which has almost always looked expensive. Perhaps that includes you, especially if you bought REA's major shareholder, News Corporation, instead. While News Corp's share price has gone nowhere over the past four years, REA Group's has risen 138%. Sydney property looks mundane by comparison.

You can read about News Corp in its reviews but we've spent comparatively little time covering REA Group, which is now the most important part of the former's valuation. Here we want to demolish a myth: that REA Group's business has benefited from the housing boom and will suffer when it eases. If anything, the opposite might be true.

Key Points

-

REA exerting pricing power

-

Listing volumes to jump in 2018

-

Remains a superb business

Last year we named REA Group one of Australia's 10 best businesses. One of the major reasons is its pricing power, which is even more powerful than other online classifieds companies like Seek and Carsales.com.

To put it in perspective, this analyst sold his unit in 2013 and then his house in 2016, paying 0.13% and 0.14% of the sale prices respectively for listings on both realestate.com.au and Fairfax Media's domain.com.au. Compare that with the standard agent's commission and stamp duty of more than 2% and 4% respectively. REA Group's listing fees are minuscule compared to the value these advertisements deliver – homebuyers straight to your front door.

Price pusher

REA Group is exerting this pricing power. Last year it increased prices to its real estate agent customers by 10-15%. Next month it will lift prices by a similar percentage. (This pricing power isn't confined to REA either; Domain put through a 20% price rise in Sydney and Melbourne in January). Given how little a listing costs compared with a property's sale price, the advertising costs are passed on to vendors fairly easily.

In recent years REA has tweaked – or maybe even revolutionised – its business model. Through various carrots and sticks, it has encouraged agents to place more premium advertisements, particularly for higher-priced properties. As a result, subscription revenue – the company's former main source of income – has been displaced by premium advertisement revenue (these premium ads are called ‘depth products' by the industry).

The company's most expensive ad – a ‘Premiere' listing – is larger, occupies a higher position during search and displays the agent's branding more prominently. According to the company, these listings generate nine times the enquiry of its standard ad (and 20 times as many views).

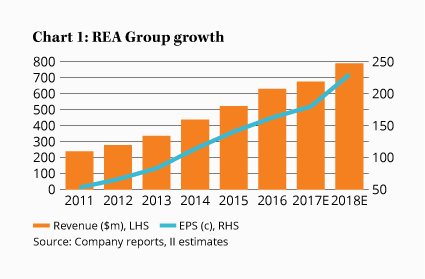

You can see how successful REA's pricing power and business model transformation has been over the years in Chart 1. With another price rise set to take effect shortly, 2018 will be another year of strong profit growth. But surely some of this growth is because of the booming housing market in Sydney and Melbourne?

It's probably true that higher property prices have made it easier for REA and Domain to push through steep listing price rises. But in the end it's listing volumes that drive most of REA's revenue.

The 20-year itch

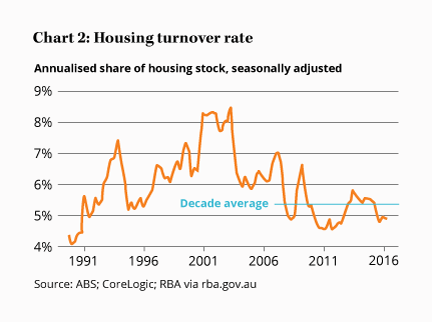

The 2013-2017 housing boom has been unusual because turnover has been relatively subdued. You can see this in Chart 2. While most booms are accompanied by rising turnover, turnover in this boom has been significantly below the decade average. Annual turnover is currently running at less than 5% of Australia's housing stock.

REA Group's recent results tell the same story. In REA Group: Interim result 2017, the company pointed to Sydney and Melbourne listing volumes falling by more than 10%. As a result, underlying interim net profit rose by just 6% despite last year's listing price increases.

In fact, a case can be made that the boom has hurt rather than helped REA Group. With buyer demand so strong, real estate agents have been selling more properties ‘off market' (without listing them on realestate.com.au or domain.com.au). Where properties have been listed, fast sales have meant fewer re-listings.

As the housing boom matures, then, REA's listing volumes should actually improve. As auction clearance rates weaken, days on market will increase, and more re-listings will occur. There are already early signs in Sydney: auction clearance rates are weakening, while stock levels have quickly jumped 15% following a long period of weakness. In 2014, a sharp increase in Perth listings presaged an 8% decline in house prices over the two years that followed.

Falling prices, lower listings?

Of course, it's possible turnover will weaken should any downturn accelerate. Recessions are usually associated with lower volumes as people decide to stay put. Chart 2 shows that turnover fell to around 4% in Australia's 1990s recession. During the US housing market downturn, turnover halved between the peak in 2006 and the low in 2010.

Returning to Australia, it's looking increasingly like a particularly weak 2017 for listing volumes will be followed by a return to more normal conditions in 2018. With listing price rises and stronger volumes coinciding for once, REA's 2018 earnings will surge. We're expecting earnings per share to approach $2.30 in 2018, up from around $1.80 in 2017, placing the stock on a price-earnings ratio of 29.

Of course, that looks sky-high – but it always does. This is a first-class business and there are many reasons why earnings growth should continue beyond 2018, although perhaps not at the same rate.

Once again, we're reluctant to pay almost 30 times future earnings for REA Group (just as we were in Corks pop at REA Group in June last year). While it has since become clearer that listings will jump in 2018, the value investor's lot is often to lag behind high-growth stocks.

We're lifting our REA price guide accordingly, with our Buy price moving from $40.00 to $50.00. That represents 22 times 2018 earnings per share and 15 times earnings before interest, tax, depreciation and amortisation. We're also lifting our portfolio weighting from 5% to 6% given the quality of the business.

With little in the way of bad news to provide a buying opportunity – unlike when we upgraded Seek back in 2015 – we'll have to hope REA's share price gets the wobbles should listings dry up again. REA Group remains a HOLD, while our recommendation on 62% shareholder News Corp remains a BUY.

Disclosure: The author owns shares in Seek and Fairfax Media.

Note: The Intelligent Investor Growth and Equity Income portfolios own shares in News Corporation. You can find out about investing directly in Intelligent Investor and InvestSMART portfolios by clicking here.

Recommendation