Ramsay offers poor value

Recommendation

- Centralised purchasing improves margins

- French medical system faces headwinds

- Good company but too expensive

As the saying goes – price is what you pay, value is what you get. And no one disputes that Ramsay Health Care is an extremely valuable company.

Its 50-year track record is second to none. Ramsay now operates just under 10% of all hospital beds in Australia, treating 1.3m patients per year, and it recently became the largest hospital operator in France, too. Since listing in 1997, Ramsay's share price has increased 30-fold for a 22% annual return.

The real value of Ramsay, though, lies in its economies of scale – as it expands, the centralised purchasing of medical supplies means a little more juice can be squeezed with each acquisition. The company's profit margin has increased from 2.8% to 5.7% over the past decade and, all things being equal, we would expect margins to continue to expand along with Ramsay's footprint.

Vive la France

In fact, Ramsay has recently been on an acquisition binge. Late last year, the company's French outfit, Ramsay Santé, acquired a controlling interest in Générale de Santé, which operates 75 hospitals, employs 19,000 people, and has revenue of around €1.7bn. It was a big fish, even for Ramsay: the fifth largest hospital operator in the world.

This was Ramsay's fifth major French acquisition since 2010 and Ramsay Santé now operates 15% of France's commercial hospitals. The French division is expected to contribute more than a third of total revenue in 2015, up from 10% last year.

France has the largest commercial hospital sector in Europe – but also one of the least efficient. Patients pay upfront but Fr ance's universal healthcare coverage ensures virtually all the money is reimbursed. As they're never out of pocket, they have an incentive to visit the doc for even the slightest bump or tingle. For instance, the French have almost three times as many MRI scans per capita as Australians and French mothers stay in hospital for an average of 4.2 days after giving birth; in Australia, the average is just 2.7.

ance's universal healthcare coverage ensures virtually all the money is reimbursed. As they're never out of pocket, they have an incentive to visit the doc for even the slightest bump or tingle. For instance, the French have almost three times as many MRI scans per capita as Australians and French mothers stay in hospital for an average of 4.2 days after giving birth; in Australia, the average is just 2.7.

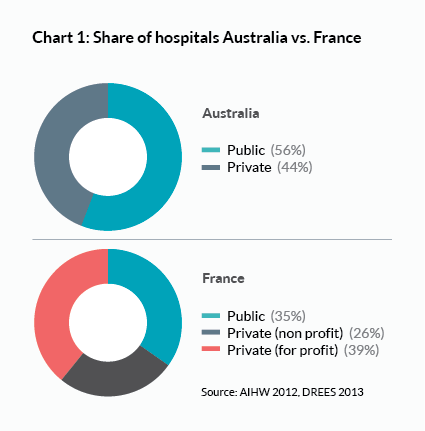

All that extra demand should be a boon for Ramsay, except that the government imposes equal pricing for public and private operators and doesn't restrict a patient's choice of provider. Commercial hospitals in France must compete against the private not-for-profit and public hospitals, which make up about 60% of local operators.

This puts more pressure on Ramsay to be efficient and prudent in managing costs. Générale de Santé had an operating margin of 12% prior to the acquisition, well below the 16% Ramsay makes in Australia. Ramsay's size means it can put pressure on Générale de Santé's suppliers to improve margins, but we doubt the French hospitals will reach Australia's level of profitability any time soon.

Regulatory risk

We also have some concerns with regulation. The private health insurance industry is very small in France, accounting for 13% of healthcare funding compared to 49% in Australia. Overwhelmingly, it's the government that pays the bills. However, the French Government is expected to run a budget deficit of €95bn in 2015 and has said it aims to cut healthcare expenditure by €10bn by 2017.

Other countries are facing similar pressure from healthcare spending and are addressing the issue in different ways – we could see downward pressure on regulated price increases, as in Australia; a shift to greater private health insurance coverage, as in America; or higher taxes, as in Russia.

It's hard to know what the French will do, but it's clear its current medical system is unsustainable which raises the risk of adverse government reform.

The situation at home may also be deteriorating. Private health insurers, such as Medibank and NIB, account for most of Ramsay's Australian revenue and they're facing several hurdles.

| Six months to Dec | 2014 | 2013 | /(–) (%) |

|---|---|---|---|

| Revenue ($m) | 3,341 | 2,360 | 42 |

| EBIT ($m) | 378 | 286 | 32 |

| Net profit ($m) | 204 | 172 | 19 |

| EPS (cents) | 91.1 | 74.4 | 22 |

| DPS (cents) | 40.5 | 34.0 | 19 |

| Div yield (%) | 1.3 | 1.6 | n/a |

| Franking | 100 | 100 | n/a |

The Department of Health seems increasingly reluctant to let insurers pass on sky rocketing hospital costs to the public via regulated premium increases. So insurers will be more aggressive when negotiating with Ramsay over the rates for hospital stays and this would ultimately put pressure on Ramsay's margins.

Valuation

Ramsay Health Care has defensive earnings, good returns on capital and is benefiting from an ageing population with solid private health insurance participation. A great company can go from strength to strength for a long time, but it wouldn't take much of a speed bump to wipe some shine from the current price-earnings ratio of 42, and paltry dividend yield of 1.3%.

The iron law of investing is that every stock is a claim on a future stream of cash flows, and the return an investor gets depends on the value of that stream of cash relative to the price paid for it.

Even if Ramsay kept increasing earnings at 15% a year for another five years, if its price-earnings ratio fell to the average for the healthcare industry – around 20 – investors would only just come out even.

Management expects earnings per share to grow by an impressive 18–20% in 2015, mainly due to the recent acquisitions. However, the current share price leaves no margin of safety and we recommend you SELL.

Recommendation