QBE: Transformation or turnaround myth?

Recommendation

QBE Insurance is having a moment. Two years ago we had no shortage of things to fret over, with a failing workers' compensation unit in Argentina, the risk of a capital raising, and growing competition in the USA and Australia. But the company's prospects have improved and the stock is up more than 25% since its February lows.

Yes, Australia experienced relatively kind weather last year and so catastrophe claims were low. That certainly helped. But management still deserves a gift basket – QBE's turnaround is due to more than luck.

Key Points

-

More focused operations

-

Improving profitability

-

Fairly valued

The company's big problem wasn't a lack of customers. In 2013, it had US$18bn in gross written premium (an insurer's measure of revenue). The big problem was a lack of profitable customers. QBE's sprawling operations had spread into niches where competition was intense and the company had no advantage in underwriting.

To remedy this, QBE has shed more than $3bn in unprofitable business over the past couple of years by selling subsidiaries such as its Italian medical malpractice outfit, the Argentine workers compensation business, and US Mortgage & Lender Services division.

Underwriting profits

Together, the sale of these businesses put a bit over US$500m in QBE's coffers, though this was unfortunately around US$120m less than their book value.

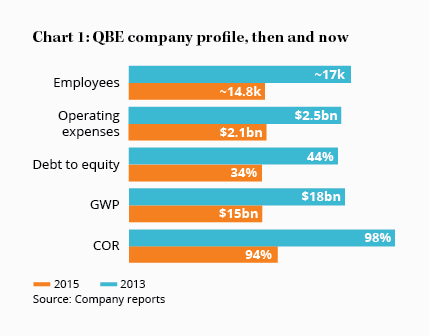

QBE's workforce has fallen from around 17,000 in 2013 to 14,800 today and total gross written premium from US$18bn to $14.5bn. Normally we like to see companies get bigger, but for QBE we're happy to see it shrink.

The ‘combined ratio', which expresses total claims and expenses as a percentage of premiums, is the most important measure of an insurer's profitability. A ratio below 100% means an insurer is making an ‘underwriting profit' – that is, it's making money from its insurance business before adding the returns from its investment portfolio; a ratio above 100% means it's making an ‘underwriting loss'.

In 2013, more than 40% of QBE's policies had a combined ratio above 100% and so weren't profitable. Now that figure is below 10%. Overall, the company's combined ratio has improved from 98% to 94% since 2013, helping underwriting profit to increase from US$341m to US$629m.

It's hard to disentangle how much of this is due to favourable weather, but given the diversity of QBE's product lines and that the company operates in 37 countries, it's unlikely to be the only factor. Tides may help, but it takes an able captain to turn a ship this big.

QBE is now focused on its core markets where it can add value. Roughly 80% of revenue is now from commercial and speciality insurance lines – evenly spread across North America, Europe and Australia/New Zealand – where QBE is a dominant player and has a strong reputation.

Expenses disappoint

The business sales have reduced the company's operating expenses from US$2.5bn to US$2.1bn – but that's actually where the ‘transformation' argument starts to fall apart.

Although operating expenses have come down in dollar terms, as a percentage of net earned premium they are unchanged at 17%, and that's a good two percentage points higher than the median of 15% for QBE's peers. Management has been quick to trumpet various ‘cost reduction initiatives', but if the company has been getting more efficient, it hasn't shown up in the financial statements.

Although operating expenses have come down in dollar terms, as a percentage of net earned premium they are unchanged at 17%, and that's a good two percentage points higher than the median of 15% for QBE's peers. Management has been quick to trumpet various ‘cost reduction initiatives', but if the company has been getting more efficient, it hasn't shown up in the financial statements.

Management believes it can cut US$300m of costs between now and 2018, which would reduce the operating expense ratio by two percentage points. Hopefully this round of cost cutting is more tangible than the last.

The balance sheet, however, is in much better shape. In 2014, the company issued $1.5bn of shares and subordinated debt to replace senior securities and fan the ratings agencies. Net debt has fallen from US$3.4bn in 2013 to US$2.9bn today, while the net debt-to-equity ratio has improved from 44% to 34%. Operating earnings now cover interest payments a good five times over, compared to an uncomfortable 2.6 times in 2013.

What's more, QBE now has a US$2.0bn capital cushion before rating agency Standard & Poor's might reconsider its A credit rating, compared to no cushion back in 2013. This gives the company some wiggle room should natural disasters cause a surge in claims.

Time to buy?

So at what price might we be interested in buying QBE? Management expects net earned premium of US$11.6–12.0bn in 2016 and a combined ratio of 94–95%, both of which we consider a reasonable underlying level over the medium term. That implies an underwriting profit of around US$650m, or US$450m or so after tax.

Given the volatility of QBE's underwriting profit and its exposure to catastrophe risk, we wouldn't want to be caught overpaying, so an earnings multiple of around 10 is as far as we're willing to go. That would value the insurance operations at US$4.5bn.

But there's more to QBE's value than underwriting. When people take out an insurance policy, they pay their premium upfront but generally only make a claim months or years later. In the meantime, QBE gets to invest the money for the benefit of shareholders. This ‘float' amounts to US$16bn and equity contributed by shareholders brings QBE's total investment portfolio to US$27bn.

Many insurance companies have a large proportion of their portfolio invested in growth assets, such as equities or property. Not so QBE. Its riskier insurance policies means it invests 90% of its portfolio in cash and short-term fixed interest securities. Unfortunately, though, with interest rates low, these ultra-safe holdings mean the portfolio only yields around 2% a year.

It's impossible to justify paying full book value for such miserly returns. Consequently, we need a substantial discount to bring those returns up to something adequate for investors. We value the investment portfolio at around US$5bn.

Combined, then, the most we'd pay for the company is around US$9.5bn or about $9 a share given a USD-AUD exchange rate of 0.75.

With a current share price of $12.03 and price-earnings ratio of 18, there isn't enough on the table to whet our appetite – and the company's large exposure to a decline in Aussie property prices through its mortgage insurance division continues to makes us nervous.

Still, QBE's turnaround has gone much better than we expected and we're pleased to say the business is in a healthier state today than in 2013. We're upgrading from Avoid to HOLD.

Recommendation