Primary works on image problem

Recommendation

Primary Health Care's bulk-billing medical centres would go bust if it weren't for one thing: high utilisation rates. To achieve this, the company aims to provide a ‘one-stop shop' for patients, who can walk out of a GP's office and straight to a dentist, radiologist or physiotherapist. By offering multiple services, Primary ensures people are constantly moving through its doors.

When it comes to these complementary services, the two big money spinners are pathology tests and diagnostic imaging, such as X-rays and MRI scans. Primary has a network of 146 diagnostic imaging centres – which are usually located in hospitals or its medical centres – for a market share of around 11%.

Key Points

-

Imaging is competitive and low margin

-

Medicare cuts to be delayed

-

Balance sheet to improve (slightly)

That may sound pretty decent, but this is a hellishly competitive business: Primary has two main competitors – the I-MED network, which has a 17% share of the medical imaging market, and Sonic Healthcare, which has a 13% share. The rest of the market is made up of independent clinics and smaller operators, such as Capitol Health and Integral Diagnostics.

The radio broke

Unfortunately, tough competition, rising costs and an unfavourable regulatory framework make medical imaging low-margin work.

In the 12 months to December, the imaging division had $339m in revenue, which is actually slightly more than the company earned from its medical centres. After removing expenses, though, imaging's earnings before interest and tax (EBIT) is less than a third that of the medical centres, and only accounts for around 13% of total EBIT.

Imaging isn't getting any easier either. We estimate that around 70% of Primary's costs are radiologist and technical staff salaries, which have been on the rise due to a limited supply of doctors.

Less than 100 radiologists complete the specialist training program each year, and the total number of radiologists in Australia has been growing at around 4% a year – which is below the 5% needed to keep up with volumes. That means the doctors can do plenty of arm-twisting when it comes to salary negotiations.

To make matters worse, in December the Government's Mid-Year Economic and Fiscal Outlook included various Medicare fee cuts for imaging and pathology services. The Government's expectation was to save around $650m over four years – and when it comes to bulk-billing, any time the Government outlines savings, Primary's top line is in trouble.

Management hasn't given any indication of how much the cuts might shave from Primary's profits, but we can get a rough idea from others in the industry. Listed imaging operators Capitol Health and Integral Diagnostics estimate that their revenue will fall by 5–7% and 2–3%, respectively, while Sonic Healthcare expects a 2–3% hit to revenue for its imaging division due to the Medicare changes.

So let's assume Primary will lose around 3% of imaging revenue. However, as around 80% of Primary's imaging segment costs are fixed, a 3% decline in revenue would probably translate to a fall of around 5–8% in operating earnings.

Some good news

While the cuts are still on the table, health minister Sussan Ley announced last month that the Australian Diagnostic and Imaging Association (ADIA) had accepted a deal to make the transition easier.

First, the bulk-billing cuts have been delayed by six months until January to allow for an ‘independent evaluation of the commercial pressures facing diagnostic imaging providers'. While the Government hasn't made any commitments, we'll take that as a sign that it's open to reducing the proposed cuts to imaging.

More importantly, though, the Government has agreed to end the 18-year freeze on indexation of diagnostic imaging rebates when the GP rebate indexation freeze ends in 2020.

More importantly, though, the Government has agreed to end the 18-year freeze on indexation of diagnostic imaging rebates when the GP rebate indexation freeze ends in 2020.

The freeze on imaging rebates has been a huge issue for Primary, as the cost of operating an imaging centre has grown faster than revenue for the better part of a decade. Primary's EBITDA margin for imaging has fallen from 31% in 2007 to 22% today, and that's despite growth in patient out-of-pocket costs for imaging services, which now average $100 per scan for X-rays, ultrasounds, CTs and MRIs.

The return to indexation of rebates – though still a good four years away – should help to keep scans affordable for patients and provide Primary with some needed revenue growth. Volumes, too, should soon get a kick thanks to Primary winning the imaging contract for Sydney's new billion-dollar Northern Beaches Hospital, which is due to open in 2018.

Balance sheet

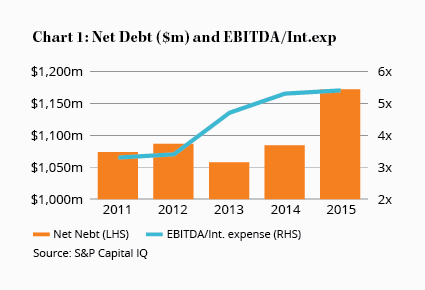

Our main point of contention with Primary has always been its balance sheet. The company's $1.2bn of bank debt – a legacy of Primary's acquisition of Symbion Health in 2007 – adds an unhealthy dose of refinancing risk and exposes the company to sizeable cuts to net profit if and when interest rates rise (see chart 1).

So we were glad to hear that Primary made a deal with Westpac for the sale of its imaging equipment, such as MRI machines, which will then be leased back. The move frees up around $60m, which will be used to pay down debt. Unfortunately, Primary also expects to write off around $98m from the value of its assets in the 2016 full-year result, though this will be partially offset by $30m of profit from the sale of its Medical Director software business and insurer Transport Health.

These moves are part of a broader strategy change by chief executive Peter Gregg that involves the sale of non-core assets (see Primary's shifting strategy). Gregg said the company is now focused on ‘cleaning up the balance sheet and taking a more conservative approach to our asset values and levels of provisioning'. Music to our ears.

Management said it expects an underlying net profit of $104m in 2016, giving Primary a forward price-earnings ratio of 21. Despite the brighter outlook for the imaging business and Gregg slowly putting the company on a more conservative footing, the balance sheet continues to make us uncomfortable. Until the debt picture is truly under control, we're sticking with AVOID.