Portfolios update - July 15

Our last quarterly update noted the difficulty in finding Buy ideas, with only 13 stocks on our Buy list at the time. Since then, the ASX Ordinaries Accumulation Index has fallen 6.2% and we're starting to see more stocks at prices which make them good value.

As a result, we've been able to add BHP spinoff South32 (see The ups and downs of South32 on 1 Jun 15 (Buy — $2.17)) and PMP (see PMP: Back from the brink on 19 Jun 15 (Speculative Buy — $0.53)) to the list. Along with IOOF and Soul Pattinson again being upgraded to Buy, there are now 20 companies on our Buy list and we hope to keep adding to them in coming months.

With events ranging from the Chinese stock market crash, the seemingly never-ending Greek debt saga and the potential increase in US interest rates creating uncertainty and even fear among investors, there should be opportunities to do so.

Key Points

New Buy ideas added and hoping to find more

Poor quarter but long-term record still good

Portfolios cleaned up to better reflect real life

Portfolio changes

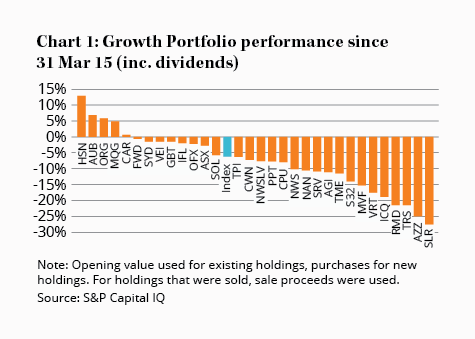

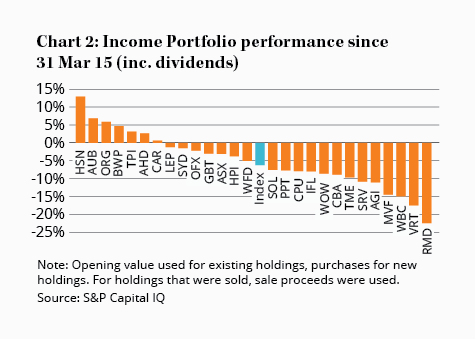

Our model Growth and Income portfolios performed poorly during the quarter, underperforming the All Ordinaries Accumulation Index by 1.2% and 0.4% respectively. Over such a short period, though, performance will always be something of a coin toss – what matters are the long-term results and on this score both portfolios are still doing well.

The Growth Portfolio has outperformed the ASX All Ordinaries Accumulation Index by 2.7% per year over the past three years and by 2.0% a year since inception, while the Income Portfolio has outperformed by 1.1% and 5.3% over these periods.

In the past, these returns have been 'notional', pegged to the returns made against the prevailing prices at the time of published fictional trades. From now on, though, as we explained in our recent article Model portfolios enter real life, the portfolios will be backed by real money. As well as investing our own company money in each portfolio, we're also allowing members to invest alongside us via 'separately-managed accounts' (SMAs). More details on the SMAs will follow in due course.

Let's look at each portfolio's performance during the last quarter in more detail.

Growth Portfolio

The Growth Portfolio fell 7.4% during the quarter compared to the 6.2% fall in the ASX All Ordinaries Accumulation Index.

We've taken advantage of the decline in the market and the resulting increase in opportunities to drastically reduce our cash weighting, from 30% to 9% at 30 Jun 15. Along with the changes discussed in Model portfolios enter real life, this meant purchases outweighed proceeds from sales during the quarter by more than $90,000 (see Table 1).

| Stock (ASX code) | Buy / Sell | Shares (No.) | Price ($) | Value ($) | Date |

|---|---|---|---|---|---|

| Crown Resorts (CWN) | Buy | 610 | 13.15 | 8,022 | 20/4/15 |

| iCar Asia (ICQ) | Buy | 8,300 | 0.965 | 8,010 | 30/4/15 |

| Macquarie Group (MQG) | Sell | 139 | 80.39 | 11,174 | 8/5/15 |

| South32 (S32) | Buy | 7,200 | 2.20 | 15,840 | 19/5/15 |

| Virtus Health (VRT) | Buy | 1,500 | 5.69 | 8,535 | 3/6/15 |

| Monash IVF (MVF) | Buy | 4,500 | 1.46 | 6,570 | 3/6/15 |

| Soul Pattinson (SOL) | Buy | 1,000 | 13.93 | 13,930 | 4/6/15 |

| IOOF (IFL) | Buy | 2,000 | 9.17 | 18,340 | 22/6/15 |

| Austbrokers (AUB) | Sell | 800 | 9.10 | 7,280 | 22/6/15 |

| ASX (ASX) | Buy | 270 | 40.44 | 10,919 | 24/6/15 |

| Carsales.com (CAR) | Buy | 1,300 | 9.99 | 12,987 | 29/6/15 |

| Trade Me (TME) | Buy | 2,860 | 3.04 | 8,694 | 29/6/15 |

| OzForex (OFX) | Buy | 3,777 | 2.20 | 8,309 | 29/6/15 |

| GBST (GBT) | Buy | 1,200 | 5.605 | 6,726 | 29/6/15 |

| Perpetual (PPT) | Buy | 135 | 47.72 | 6,442 | 29/6/15 |

| Fleetwood (FWD) | Buy | 4,800 | 1.37 | 6,552 | 29/6/15 |

| South32 (S32) | Buy | 2,800 | 1.775 | 4,970 | 29/6/15 |

| iCar Asia (ICQ) | Buy | 6,700 | 0.75 | 5,025 | 29/6/15 |

| Transpacific (TPI) | Sell | 17,500 | 0.745 | 13,038 | 29/6/15 |

| Vision Eye Institute (VEI) | Sell | 11,466 | 0.67 | 7,682 | 29/6/15 |

| Soul Pattinson (SOL) | Sell | 450 | 13.38 | 6,021 | 29/6/15 |

| News Corp (NWS) | Sell | 300 | 18.93 | 5,679 | 29/6/15 |

| The Reject Shop (TRS) | Sell | 1,000 | 5.26 | 5,260 | 29/6/15 |

| News Corp (non-voting) (NWSLV) | Sell | 90 | 19.59 | 1,763 | 29/6/15 |

| Antares Energy (AZZ) | Sell | 13,300 | 0.105 | 1,397 | 29/6/15 |

| Silver Lake Resources (SLR) | Sell | 2,800 | 0.15 | 406 | 29/6/15 |

Crown and iCar Asia were added after being upgraded in April, while we made our initial purchase of South32 soon after it started trading on the ASX. We also added more shares of assisted reproductive service providers Virtus and Monash IVF after concerns over competition from low-price competitor Primary Health Care led to steep falls in their share prices.

Allegations in the Fairfax papers of improprieties at IOOF gave us the opportunity to upgrade the company back to Buy and also include it in the Growth Portfolio while we also added to our positions in Soul Pattinson and ASX during the quarter.

After Macquarie reported a strong annual result in May, we believed the share price no longer left any margin for error. Wanting to reduce the number of small positions in the portfolio, we sold our shares and locked in a nice gain even though it officially remains a Hold. To maintain cash levels in the portfolio, Austbrokers was also sold and has recently been downgraded to Sell.

As a result of the changes described in Model portfolios enter real life, we made numerous additional purchases and sales and they can be seen in Table 1.

With both the Growth Portfolio and overall market declining over the last three months, winners were thin on the ground (see Chart 1). Of the stocks still held in the portfolio at 30 Jun 15, Hansen ( 13%) and Origin ( 6) were the biggest winners, while Austbrokers ( 7%) and Macquarie ( 5%) also rose before they were disposed.

As you can see from Chart 1, most stocks in the portfolio declined during the quarter. Falling commodity prices led to negative returns for Silver Lake (-28%), Antares (-25%) and South32 (-14%). After being one of our biggest winners last quarter, ResMed (-21%) surrendered some of its gains, with other major losers being The Reject Shop (-21%) and iCar Asia (-19%).

| Stock (ASX code) | Total return since 31/3/15 (%) | Most Recent Reco. | Shares (no.) | Price ($) | Value ($) | Weighting (%) |

|---|---|---|---|---|---|---|

| Ainsworth Game Tech (AGI) | -11 | Buy | 4,370 | 2.57 | 11,231 | 3.0 |

| ASX (ASX) | -3 | Buy | 670 | 39.90 | 26,733 | 7.1 |

| Carsales (CAR) | 1 | Buy | 2,200 | 10.19 | 22,418 | 5.9 |

| Computershare (CPU) | -8 | Hold | 1,190 | 11.71 | 13,935 | 3.7 |

| Crown Resorts (CWN) | -7 | Buy | 610 | 12.20 | 7,442 | 2.0 |

| Fleetwood (FWD) | -1 | Spec. Buy | 8,000 | 1.37 | 10,960 | 2.9 |

| GBST (GBT) | -1 | Buy | 4,000 | 5.73 | 22,920 | 6.1 |

| Hansen Technologies (HSN) | 13 | Hold | 5,000 | 2.62 | 13,100 | 3.5 |

| iCar Asia (ICQ) | -19 | Spec. Buy | 15,000 | 0.71 | 10,575 | 2.8 |

| IOOF (IFL) | -2 | Buy | 2,000 | 8.99 | 17,980 | 4.8 |

| Monash IVF (MVF) | -15 | Buy | 8,000 | 1.28 | 10,240 | 2.7 |

| Nanosonics (NAN) | -11 | Hold | 5,000 | 1.70 | 8,500 | 2.2 |

| Origin Energy (ORG) | 6 | Hold | 650 | 11.97 | 7,781 | 2.1 |

| OzForex (OFX) | -2 | Hold | 6,777 | 2.22 | 15,045 | 4.0 |

| Perpetual (PPT) | -8 | Buy | 375 | 48.36 | 18,135 | 4.8 |

| ResMed (RMD) | -21 | Hold | 3,000 | 7.27 | 21,810 | 5.8 |

| Servcorp (SRV) | -11 | Hold | 1,636 | 5.84 | 9,554 | 2.5 |

| Soul Pattinson (SOL) | -6 | Buy | 1,120 | 13.44 | 15,053 | 4.0 |

| South32 (S32) | -14 | Buy | 10,000 | 1.79 | 17,900 | 4.7 |

| Sydney Airport (SYD) | -1 | Hold | 5,072 | 4.98 | 25,259 | 6.7 |

| Trade Me (TME) | -11 | Buy | 7,500 | 3.02 | 22,650 | 6.0 |

| Virtus Health (VRT) | -18 | Buy | 3,000 | 5.37 | 16,110 | 4.3 |

| Cash | 32,657 | 8.6 | ||||

| Total | 377,987 | 100.0 | ||||

Income Portfolio

The Income Portfolio declined 6.6% during the quarter, better than the Growth Portfolio but still slightly worse than the 6.2% fall in the All Ordinaries Accumulation Index.

| Stock (ASX code) | Buy / Sell | Shares bought/ (sold) | Price ($) | Value ($) | Date |

|---|---|---|---|---|---|

| Amalgamated (AHD) | Sell | 675 | 12.05 | 8,134 | 21/4/15 |

| Virtus Health (VRT) | Buy | 1,000 | 5.69 | 5,690 | 3/6/15 |

| Monash IVF (MVF) | Buy | 3,000 | 1.46 | 4,380 | 3/6/15 |

| Transpacific Industries (TPI) | Sell | 11,100 | 0.82 | 9,102 | 4/6/15 |

| Soul Pattinson (SOL) | Buy | 300 | 13.93 | 4,179 | 4/6/15 |

| IOOF (IFL) | Buy | 700 | 9.17 | 6,419 | 22/6/15 |

| Austbrokers (AUB) | Sell | 500 | 9.10 | 4,550 | 22/6/15 |

| ASX (ASX) | Buy | 110 | 40.44 | 4,448 | 24/6/15 |

| Carsales.com (CAR) | Buy | 900 | 9.99 | 8,991 | 29/6/15 |

| Trade Me (TME) | Buy | 2,478 | 3.04 | 7,533 | 29/6/15 |

| OzForex (OFX) | Buy | 2,500 | 2.20 | 5,500 | 29/6/15 |

| Perpetual (PPT) | Buy | 90 | 47.72 | 4,295 | 29/6/15 |

| ResMed (RMD) | Sell | 2,300 | 7.18 | 16,514 | 29/6/15 |

| Westfield Corp (WFD) | Sell | 900 | 9.07 | 8,163 | 29/6/15 |

| Soul Pattinson (SOL) | Sell | 250 | 13.38 | 3,345 | 29/6/15 |

We bade farewell to Amalgamated Holdings in May after it exceeded its Sell price, delivering a total return of 77% since we upgraded it two years ago – far above our expectations at the time. Despite Transpacific remaining a Hold, its projected low dividend yield contributed to our decision to sell it in this portfolio.

Similar to the Growth Portfolio, we disposed of Austbrokers to maintain cash levels while we added to our positions in Monash IVF, Virtus, Soul Pattinson, IOOF and ASX. We also refer readers to the additional purchases and sales listed in Table 3, made as a result of the changes discussed in Model portfolios enter real life.

Also like the Growth Portfolio, most stocks in the Income Portfolio fell during the quarter (see Chart 2). The biggest gainer was Hansen ( 13%), followed by Austbrokers ( 7%) and Origin ( 6%). BWP Trust bucked the general decline in the A-REIT (listed property) sector by eking out a small 5% gain.

ResMed (-22%) had the largest negative return during the quarter while declines among the banking sector helped push our small holding in Westpac lower by 15%. Virtus (-18%) and Monash IVF (-14%) also declined, allowing us to increase our positions in them, while Ainsworth Game Technology (-11%) also fell after issuing a warning on sales.

| Stock (ASX code) | Total return since 31/3/15 (%) | Most Recent Reco. | Shares (no.) | Price ($) | Value ($) | Weighting (%) |

|---|---|---|---|---|---|---|

| Ainsworth Game Technology (AGI) | -11 | Buy | 1,840 | 2.57 | 4,729 | 1.9 |

| ALE Property Group (LEP) | -1 | Hold | 2,770 | 3.69 | 10,221 | 4.2 |

| ASX (ASX) | -3 | Buy | 430 | 39.90 | 17,157 | 7.0 |

| BWP Trust (BWP) | 5 | Hold | 2,600 | 3.06 | 7,956 | 3.2 |

| Carsales (CAR) | 1 | Buy | 1,500 | 10.19 | 15,285 | 6.2 |

| Commonwealth Bank (CBA) | -9 | Hold | 60 | 85.13 | 5,108 | 2.1 |

| Computershare (CPU) | -8 | Hold | 740 | 11.71 | 8,665 | 3.5 |

| GBST (GBT) | -3 | Buy | 1,800 | 5.73 | 10,314 | 4.2 |

| Hansen Technologies (HSN) | 13 | Hold | 3,000 | 2.62 | 7,860 | 3.2 |

| Hotel Property Investments (HPI) | -4 | Hold | 3,000 | 2.57 | 7,710 | 3.1 |

| IOOF (IFL) | -8 | Buy | 1,500 | 8.99 | 13,485 | 5.5 |

| Monash IVF (MVF) | -14 | Buy | 4,400 | 1.28 | 5,632 | 2.3 |

| Origin Energy (ORG) | 6 | Hold | 450 | 11.97 | 5,387 | 2.2 |

| OzForex (OFX) | -2 | Hold | 4,500 | 2.22 | 9,990 | 4.1 |

| Perpetual (PPT) | -8 | Buy | 250 | 48.36 | 12,090 | 4.9 |

| Servcorp (SRV) | -11 | Hold | 1,800 | 5.84 | 10,512 | 4.3 |

| Sydney Airport (SYD) | -1 | Hold | 3,280 | 4.98 | 16,334 | 6.6 |

| Trade Me (TME) | -10 | Buy | 5,000 | 3.02 | 15,100 | 6.1 |

| Virtus Health (VRT) | -18 | Buy | 2,000 | 5.37 | 10,740 | 4.4 |

| Soul Pattinson (SOL) | -8 | Buy | 750 | 13.44 | 10,080 | 4.1 |

| Westpac (WBC) | -15 | Hold | 140 | 32.15 | 4,501 | 1.8 |

| Woolworths (WOW) | -9 | Hold | 400 | 26.96 | 10,784 | 4.4 |

| Total stocks | 219,640 | |||||

| Cash (Lifetime dividends received) | 137,753 | |||||

| Cash (Available for investments) | 26,574 | 10.8 | ||||

| Total | 246,215 | 100.0 | ||||