Perpetual: missing out on the FUM

Recommendation

It's not uncommon for fund managers to fall along with the markets they invest in. Indeed you expect it. But recent falls in the wealth management sector have gone well beyond that. The S&P/ASX 200 and the MSCI World index (in Australian dollars) are both down around 5% since their January peaks, but Platinum Asset Management has fallen 35%, Magellan Financial Group 19%, IOOF 13% (earning itself an upgrade to Buy last week) and Perpetual 21%.

The recent falls have no doubt reminded people of the disproportionate impact of falling markets and they've reduced the earnings multiples they're prepared to pay for these stocks. The falls have been compounded by ongoing concerns about fee margins in the industry, with lower expected returns leaving less room for fees and increased competition from low-cost alternatives like exchange-traded funds.

Key Points

-

$1.3bn fund outflow

-

Outflows likely to continue

-

Reducing price guide

Market levels and fee margins both directly feed into revenues and, with a mostly fixed cost base, the earnings impact is magnified.

Unique problems

If all that wasn't enough, the stocks in the sector have their own unique problems: IOOF is faced with risks from the largest acquisition in its history; Platinum Asset Management is dealing with the semi-retirement of Kerr Neilson; and Magellan Financial Group is dealing with question marks over its recent performance.

Perpetual's own problems were highlighted yesterday, when it reported a $2.6bn, or 8%, fall in funds under management (FUM) for the March quarter to $30.2bn. Half that fall was due to lower asset prices. That means we use a lower base level for FUM in our valuation, but it doesn't itself have any momentum – bad results don't necessarily mean more trouble to come.

The other half, though was due to net outflows – people removing their money – and that definitely does have momentum. Whether people are contributing money to Perpetual's funds or taking it out generally has to do with factors that are likely to persist – most of all, its relatively poor recent fund performance.

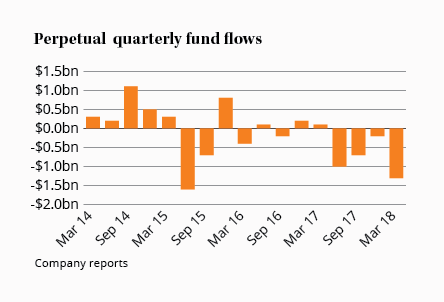

Perpetual's past few quarterly FUM numbers make the point. After a net inflow of $0.2bn in the three months to December 2016, there was a $0.1bn inflow in the March quarter of 2017, but that disguised a $0.6bn outflow from equities. That has now been followed by four successive quarterly net outflows, of $1.0bn, $0.7bn, $0.2bn and now $1.3bn.

We reduced our Buy price from $50 to $45 after the first of those outflows and said: ‘We don't want to make too much of a couple of quarters, but the flows won't have been helped by recent poor performance and we're concerned that momentum may have turned.'

Well it's now been six poor quarters, performance has continued to be poor and momentum has clearly turned.

Earnings risks

This puts a big question mark over the 2019 earnings number. If we simply roll forward the $30.2bn FUM number from 31 March as our average FUM for 2019 – assuming that any market growth is offset by further outflows, then we get an EPS figure around $2.65, compared to the $2.93 achieved in 2017, the $3.00 expected for 2018 and the $3.20 that had been the consensus for 2019 until yesterday.

Surprisingly, most brokers still seem to be factoring in some FUM growth for 2019 – to perhaps $31–32bn to give an EPS figure closer to $3. Of course we don't like to get too focused on short-term numbers. However, they do set a base for what's likely to happen over the longer term and they do reflect the current momentum of the business. We suspect that both might be weaker than people expect.

On the bright side, there's a reason we've had Buy recommendations on Perpetual in the past. We expect its value investing approach to deliver mild outperformance over the long term, so eventually we'd expect the outflows to cease and FUM to stabilise. There's just no sign of that happening at the moment.

Perpetual is also becoming less reliant on its funds management business. The strongly performing Perpetual Private and Perpetual Corporate Trust businesses now contribute almost half of group profits and provide a base for any valuation.

Based on the consensus forecast of $3, the stock is now on a price-earnings ratio of about 14. However, if we assume no FUM growth for 2019, then the multiple rises to about 16. In the interests of being conservative we're more inclined to focus on the latter and on that basis we're not quite ready to upgrade the stock. We're cutting our Buy price from $45 to $40, our Sell price from $70 to $60 and reducing our maximum portfolio weighting from 6% to 5%. As usual we'll wait for the stock to fall a little under our Buy price before upgrading. HOLD.

Intelligent Investor is loading up the van and going on tour in April and May, with events on the NSW central and north coast, the QLD mid-north coast and in Perth, Adelaide, Melbourne, Sydney and Canberra. If you'd like to hear us talk about building a portfolio to weather any storm, book your spot here.

Note: The Intelligent Investor Equity Growth and Equity Income portfolios own shares in Perpetual. You can find out about investing directly in Intelligent Investor and InvestSMART portfolios by clicking here.

Recommendation