Not ringing the bell

No one rings a bell at the top of the market but there are often smoke signals. Sometimes they dissipate, drifting skywards beyond concern; occasionally, they start a fire.

Whilst many gleefully ignore the signs - the defining quality of late market cycles - we're about to draw your attention to them; not to foretell their meaning but to warn you about something that may not happen.

Let's begin our lurch through the smoke with AGL Energy, a boring utility that recently bid for troubled telco Vocus. AGL CEO Brett Redman admitted to knowing nothing about telecommunications but was happy to spend $3bn to learn a little more. Even in a hot market, investors smelled a brain fart and the bid was ultimately withdrawn.

Key Points

-

Pockets of exuberance everywhere

-

Few buying opportunities

-

Time for patience, not panic buying

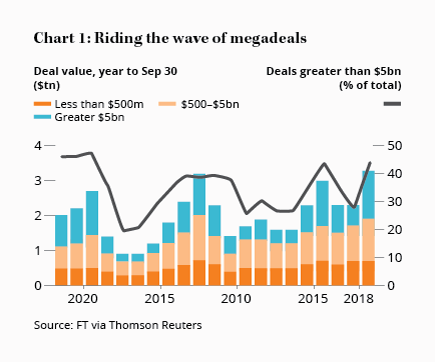

This is unusual for the times. Despite long-standing evidence that most big mergers and acquisitions (M&A) don't create shareholder value, global M&A activity hasn't been this high since 2008 (yes, you'd expect deal value to increase with stock prices). So common are these deals hedge funds are now tracking private jets to get a sniff of what's up next.

Management foolishness is ever-present in M&A but ideas like the AGL/Vocus acquisition rarely get into the boardroom, let alone out of it. In isolation, such incidents mean little. But growing M&A activity is of a piece with other areas of the market. Everyone wants in on the up.

Take a recent UBS report on Nanosonics, a former Intelligent Investor buy recommendation. We first recommended the stock on 9 Mar 14 (Spec Buy - $0.785), selling out in late February (Sell - $4.28) for a 445% gain. UBS "initiated coverage" last month with a $6.30 12-month price target. The report, a bipolar monkey amalgam of acronyms, jargon and cliche, featured the following paragraph:

"We value NAN using a DCF. Our valuation of $5.68 is derived from our base business (Trophon) valuation of $2.73 (incl. group admin., R&D and capex) and our new products valuation of $2.94 (2 new products)."

Nanosonics may be worth significantly more than the current share price but, as analyst Graham Witcomb recently wrote, "it requires an increasingly large leap of faith to justify holding on". We weren't prepared to make the jump.

UBS have no such qualms, justifying half their valuation on two new products that don't yet exist. For the record, Nanosonics is a healthcare company specialising in infection control and decontamination products. It is not Arnotts adding a little ginger to a Mint Slice. New Nanosonic products have to be, like, tested.

Foolhardy optimism is running wild among small investors too, who are blowing hard into the tinder, unwittingly doing their bit to turn smoke into fire.

Goldman Sachs research recently found that Australia's growth stocks (market caps of over $500m and forecast annual earnings per share growth of over 20% over two years) had a median PER of almost 40 compared to a global average of 23.5.

Coincidentally, the ASX is attracting listings from all over the world. There are, for example, now 20 Israeli-based companies listed locally. The official explanations include "access to growth capital", a liquid market and government-mandated super. Could a juicy multiple premium have something to do with it? Don't be silly.

Everywhere you look there are elevated highs, not just Made in Cannabis. Beyond Meat sells fake meat. On May 1, the US company listed at US$25 a share with a market capitalisation of US$1.5bn. It is now worth US$9.2bn. The market for plant-based meat maybe huge but with revenues of US$87.9m last year, the gulf between promise and price is substantial.

The same can be said of Slack, a software-as-a-service (SaaS) chat product. At the time of its recent IPO it had annual revenues of US$400m but now sports a market capitalisation of US$18.44bn. Sustained losses in promising SaaS businesses have seen the return of the price-to-sales ratio, last seen in mainstream media around 1999.

The speculative frenzy has even reached the hallowed environs of the Australian Tax Office, which is now collecting electronic records from cryptocurrency service providers to ensure punters aren't spending all their losses on dark web psychotropic substances.

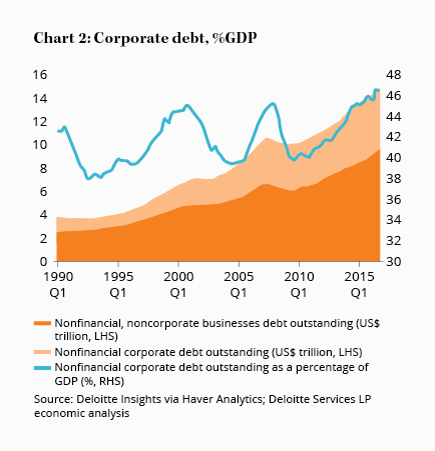

Things are also slightly unhinged in corporate debt markets. In April, Deloitte reported that US "non-financial corporations are carrying slightly more debt today than just before the great recession (as a percentage of GDP)". See Chart 2.

The big issue is the quality of the debt. In 2009, about a quarter of the global investment-grade bond universe was rated BAA, a step above junk status. Now it's twice that.

Loan quality is also declining. Kerry Craig of JP Morgan says that "In 2018, an estimated 87% of leveraged loan issuance was considered to have a lower-than-normal level of protection for bond holders." Most corporate debt is now of the covenant-lite variety, which is a bit like getting a mortgage and offering a cheese board as security.

Anne Walsh, CIO of fixed income at Guggenheim Partners, is responsible for the lending of US$180bn. Last month she told Planet Money, "normally, when you have $180 billion to lend, you get to make the rules." Not anymore. Asking for loan conditions is viewed as impertinent; the borrower simply ups and leaves, knowing they can get a no-strings deal elsewhere.

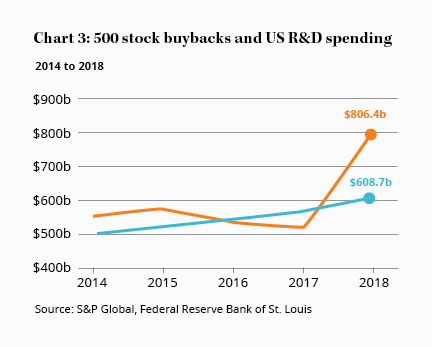

Where is all this money going? Some of it is splashed on large acquisitions but most ends up in higher stock prices, via share buybacks. JP Morgan's latest Market Insights shows that buybacks accounted for the highest share of earnings per share growth since 2007. US companies last year spent $1tn on buybacks, a figure that is likely to be beaten this year, outstripping spending on research and development, which, in the good old days of capitalism, was seen as quite useful.

In the US, the result is a cyclically adjusted price-to-earnings (CAPE) ratio double what it was during the global financial crisis and 80% higher than the historical mean.

The preponderance of smoke signals means this isn't the best time to be a value investor. Wherever one looks, from corporate debt markets and the sale of 100-year bonds to M&A activity, IPOs and broker reports, there is a gathering sense of exuberance.

Whether it is irrational or not is too early to say, although some people have already made up their minds. KIS Capital and Sigma Funds Management recently announced their closure; others are likely to follow. It is a mark of the times, as are the stories, right on queue, that value investing is dead.

Next week, we'll have a few suggestions about how to handle a market like this. If, in the meantime, you find yourself before a screen, finger hovering over the 'buy' button, make sure the stock is part of a high-quality portfolio that can withstand a tougher environment.