NextDC: The greatest story ever told

Recommendation

'If you're going to have a story have a big story'. That was the advice of Joseph Campbell, a scholar of myths who famously unveiled the narrative structure of the hero's tale, and few stories are bigger than the one told by data centre operator NextDC.

The past two years have yielded more data than all previous human existence and that trend is accelerating. Data is no longer an input from a propeller headed geek in an office, it's the output of almost every interaction we have from shopping and driving to banking and watching TV.

Key Points

-

Strong industry tailwinds

-

Lots of capital attracted by the narrative

-

Underlying economics better than they appear

All that data needs to be stored somewhere to allow retrieval, manipulation and analysis. And all that happens in data centres.

Data centre evangelists will tell you they lie at the intersection of some of the hottest technology buzzwords around: artificial intelligence, machine learning, cloud computing and platforms.

For many investors, this is exciting - thrilling even. Imagine the demand. Imagine the growth. For us party poopers, though, this exuberance is precisely the reason to worry.

A neat, exciting narrative is a wonderful device if you wish to be entertained. But if you want to make money, a neat narrative can be seductive, allowing rationality to give way to emotion. This makes evaluating NextDC a psychological exercise as much as an analytical one.

The analytical edge

At first glance, the case for buying NextDC appears ludicrous. Last year, it reported net profit of $6.6m and yet it boasts a market capitalisation of $2.2bn. Cheap this is not.

With a reported return on equity of under 1%, one might also question the business's quality. As a rule, you don't get rich paying 220 times earnings for a business generating an ROE of 1%. Yet the numbers deceive.

NextDC must spend huge licks of capital upfront to build its centres before they earn any revenue. Once built, operating costs are relatively low and, as utilisation rates rise so do margins.

The company's first generation of data centres - the imaginatively named B1 in Brisbane, S1 in Sydney and M1 in Melbourne - took years to fill up and, until they did, the strength of the model wasn't clear in their numbers.

Two years after it opened, B1 was just 46% full and earning $2.2m in annual operating profits. Five years after construction, utilisation was at 93% and operating profits rose to $11m. Today, B1 generates returns on capital well over 30%.

It's a similar story in each of the early data centres. Initial costs are high and it takes about five years to reach utilisation rates of 90% or more but, once that happens, earnings rise substantially and returns on capital are high - at 30% and 24% respectively in M1 and S1.

Those earnings are stable with low churn rates (about 2% a year globally) and revenues continue to rise even after the centres fill up. This is partly because of contracted price increases but mostly because of additional services provided to users. The most common are cross-connects, or paid physical connections to other servers inside the same centre.

Counting crosses

As we've previously noted, this is a key competitive advantage that encourages customer growth and retention. As the data centre network grows, so does the ecosystem of potential connections and the value of the network.

Cross-connect numbers have boomed from 500 five years ago to almost 9,000 today. Growth is accelerating even in mature centres. The average customer now has nine interconnections; three years ago they had just five.

Newer data centres - NextDC has built three large new centres to give a total of eight - don't yet show these attractive economics but, with demand growing so strongly, it's likely they will.

The analytical case isn't the hard part. The psychology is far more difficult.

Too good to be true?

Buying a business when the numbers look awful isn't the problem. Indeed, the fact that NextDC screens poorly and isn't obviously cheap could be a source of mispricing and opportunity.

No, the problem is that this is the kind of stock that invites exuberance and irrationality. The story is seductive; the growth is stunning. Management is promotional and loud. We worry about running with the herd and, because returns are so impressive, we fear those returns will invite competition.

NextDC hardly has the data centre market to itself. Equinix, the global market leader with 200 centres around the world, recently paid $1bn for Metronode, which operates 10 data centres in Australia.

Airtrunk has raised over $850m for new expansion and, after spending $200m on a giant Sydney centre, will have the greatest capacity in Australia. There are several other large competitors offering co-location, third-party centres as NextDC does.

Lots of demand and high rates of return tend to attract lots of capital. That capital is here. The question now is whether new capital will dent rates of return. In other words, are the returns made from NextDC's early data centres sustainable and repeatable?

That's the gamble we're being asked to take.

Holding up

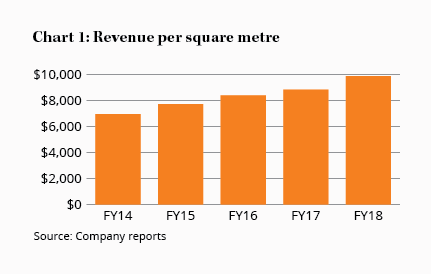

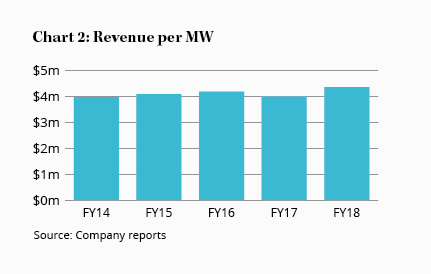

So far, revenues have held up well. Charts 1 and 2 count NextDC's revenue by square metre and by megawatt. In both cases, there are no signs of falling prices or excessive discounting which we would expect if supply were outstripping demand.

Just because we haven't seen it yet, of course, doesn't mean we won't. NextDC's second centre in Melbourne - M2 - alone has 40MW of capacity it is trying to sell, about the same capacity as the whole of the existing fleet. Sales have been a little slow but they can be lumpy at first so it isn't necessarily a warning sign.

Oversupply is an obvious risk and, should it crunch margins or slow sales, NextDC will be left with expensive overcapacity and debt to service - while investors will be left with red faces for falling for a seemingly obvious trap.

Is there value?

But what might the company be worth if things work out OK? To assess this, we need to make some assumptions about the profitability of the completed portfolio and then decide on an appropriate price to pay now for those profits.

The current portfolio consists of 46MW of capacity. Assuming $4m per MW and 60% earnings before interest, tax, depreciation and amortisation (EBITDA) margins, the existing portfolio could make about $100m in EBITDA (at 90% utilisation). Including the company's $300m cash pile suggests value of about $4 a share at an EV/EBITDA multiple of 12 times.

Yet that's not the end of the tale. In addition to the Melbourne expansion, the company is also expanding aggressively in Sydney and elsewhere. All counted, capacity should rise to 85MW in quick time with some forward sales already committed.

To count the additional 39MW, we keep our revenue assumptions but lower margins to 50%. That suggests another $70m in EBITDA is possible at 90% utilisation.

Adding this to the existing portfolio suggests a longer-term EBITDA target of $170m. With today's balance sheet that might be worth over $6 a share but we expect debt to climb which will knock a little off that value.

The real upside, however, comes from recently announced plans to take capacity to 300MW. This is a vast, ambitious target that surprised us and may have spooked the market. If successful, it could make the shares worth about $15 a share.

Yet it's hard to make estimates for such a huge expansion, with the revenues more distant and the industry structure and underlying technology changing quickly. We'd prefer to treat this as a free option rather than as value we expect to realise.

Buying well

So to buy NextDC well today means buying somewhere around $6.

We have a few sanity checks against this number. The first is the Metronode acquisition last year. Metronode generated revenue of $60m which, assuming a margin of 60%, valued it at 28 times EBITDA, exactly the same as today's forward multiple for NextDC.

Secondly, we note NextDC's net tangible asset value of $2.60. If we expect a return on equity of 20-25%, then a price of 2-3 times NTA would seem reasonable, suggesting a fair price of $5-8.

For those more comfortable with risk or less demanding of return, it might make sense to start building a position now. However, for conservative and demanding investors - and we count ourselves in both groups - the stock's recent fall isn't yet tempting enough. HOLD.

Recommendation