News and REA: Results 2019

Recommendation

If there was one management comment that stood out from News Corporation's 2019 results, it was this: 'We are acutely focused on simplifying the structure of the company and making clear the full value of the sum of our parts'.

There you have it. Management has effectively admitted News Corp is too complex, and that the complexity obscures the value of its businesses. It's belated recognition, especially as we lost faith recently, but at least management now admits value needs to be unlocked. We maintain there's significant value hiding in News Corporation, even though we no longer recommend the stock.

In our view it's this belated focus on highlighting the value of the company's assets that is responsible for the 26% increase in the share price since Taking stock of News Corp.

Key Points

-

New management focus on value

-

Dow Jones performing well

-

Foxtel still struggling

Management's first move is to clean up the odds and sods. It has put the coupon and in-store marketing business News America Marketing, part of the News & Information Services (NIS) division, up for sale. The company has apparently received 'material interest' in News America Marketing but, as it's a challenged business, the proof will be a sale agreement.

The end is nigh

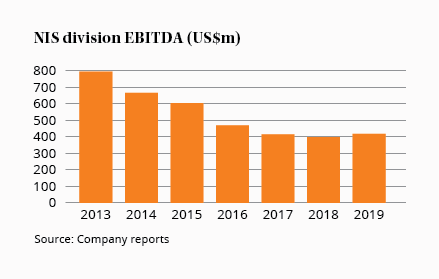

The NIS division has been one of News Corp's serial disappointers. But perhaps the savage earnings decline is nearing its end, as the chart indicates. In fact, in 2019 divisional earnings before interest, tax, depreciation and amortisation (EBITDA) increased for the first time since listing in 2013.

Cost cuts helped, particularly in News Corp's Australian newspaper business. But within the NIS division management also reported higher earnings from Dow Jones. This is the division that contains the Wall Street Journal and the professional information businesses, which we referred to as the 'best of the bunch' last year.

We suspect that management's decision to highlight the 'sum of the parts' might involve providing more information about the underlying profitability of the Dow Jones assets over time. With the Wall Street Journal having subscription revenue of about US$1bn, the 'newspaper' - 69% of subscribers are online only - could be worth our NIS division valuation.

While the worst may have passed for NIS, former star division Digital Real Estate stalled in 2019. EBITDA fell 4% but, excluding foreign exchange movements and investment in recent acquisition Opcity, underlying EBITDA rose 11%. Move's revenue increased 8% although, as we mentioned recently, the US digital real estate market is in a state of flux.

Safe as houses

REA Group, 62% owned by News Corp, reported its weakest earnings growth for years. Asia and its new mortgage broking division went backwards, although once again the Australian residential business saved the day.

| Year to 30 Jun | 2019 | 2018 | /(-) (%) |

|---|---|---|---|

| Revenue ($m) | 875 | 808 | 8 |

| EBITDA ($m) | 501 | 464 | 8 |

| NPAT ($m) | 296 | 280 | 6 |

| EPS (c) | 224.3 | 212.5 | 6 |

| DPS (c) | 118* | 109 | 8 |

| Franking (%) | 100 | 100 | n/a |

| * 63 cents final div, up 2%, ex date 29 Aug | |||

| Figures are underlying results | |||

The main issue for REA - as it will be for Domain when that company reports on Friday - was that listings were weak during 2019. Sydney and Melbourne, which are the company's most profitable markets, were particularly weak. Nevertheless, price increases and the ongoing shift to premium advertisements still resulted in revenue and EBITDA growing by 9% and 8% respectively.

There's no doubt that REA looks expensive but it has also been demonstrably resilient. That the company still managed to grow earnings during a poor year for listings demonstrates what a remarkable business it is. We have to wonder whether News Corp's decision to simplify its structure might involve it acquiring the remainder of REA at some point.

We're going to take a much closer look at REA - separately from News Corp - following reporting season. However we think a lift in the price guide is justified by the 2019 performance, so our Buy price moves to $75 and our Sell price to $125 (subject to further analysis). REA is a HOLD.

Bad sport

Elsewhere in the News Corp empire, the Subscription Video Services division - mainly Foxtel - reported weak earnings as expected. On a pro forma basis, revenues fell 13% while EBITDA fell 30%. It was the usual story, with higher sports programming costs and marketing costs related to the launch of Kayo.

| Year to 30 Jun | 2019 | 2018 | /(-) (%) |

|---|---|---|---|

| Revenue ($m) | 10,074 | 9,024 | 12 |

| News & Inform. (NIS) | 417 | 397 | 5 |

| Book Publishing | 253 | 239 | 6 |

| Digital Real Estate | 384 | 401 | (4) |

| Subscription Video (SVS) | 380 | 173 | n.m. |

| Other | (190) | (139) | 37 |

| EBITDA ($m) | 1,244 | 1,071 | 16 |

| NPAT ($m) | 155 | (1,514) | n.m. |

| EPS (c) | 0.26 | (2.60) | n.m. |

| DPS (c) | 20* | 20 | 0 |

| Franking (%) | 0 | 0 | n/a |

| * US 10 cents final div, unchanged, ex date 10 Sep | |||

It wasn't all bad news, however. So far streaming services Kayo and Foxtel Now don't appear to be cannibalising Foxtel's broadcast service significantly, although that may change. Despite recent media reports about Foxtel doing deals for broadcast subscribers, average monthly revenue per user (ARPU) fell just 3% during the year to $78.

Our other concern with Foxtel remains that its collapsing earnings are making refinancing its debt difficult. News Corp is using its own balance sheet to provide funding to Foxtel, with a total of $500m in shareholder loans extended during 2019.

Foxtel's woes notwithstanding, it's pleasing to see management taking some action to highlight the value within News Corp. Of course, it's possible it's all talk and that cash will end up being diverted from strong businesses to weak ones.

It's also possible we may have waited six years to see all the value be delivered in the seventh. Such is the nature of investing.

At this stage we're comfortable with our News Corp price guide, although we'll be watching management's efforts to reveal the 'full value of the sum of our parts'. The stock remains a HOLD.

Recommendation