Navitas's homeground advantage

Recommendation

If you've ever stepped off the plane after an overseas trip and thought ‘Gee, I love Australia*', you're not alone. International students love the sunburnt country too.

Forget our revolving door of prime ministers and members of parliament who struggle with basic paperwork – and really, what else is there to complain about? Australia is warm, welcoming and wealthy. Who wouldn't want to live or study here?

Navitas's student enrolment figures for the third semester of 2017 reflect this Australasian utopia. Underlying enrolments in the University Partnerships division – excluding closed colleges – increased by 18% in Australia and New Zealand.

Key Points

-

Strong enrolments in Australasia

-

Some concern about Curtin renewal

-

Founder stepping down

For Navitas though there are two sides to this happy story. While student enrolments have been rising in Australia and New Zealand, they've been falling elsewhere. The trends are related – Brexit and the Trump administration have made the UK and US seem less welcoming to students. Australia is the beneficiary.

In North America, third semester enrolments fell 4%. If it weren't for Canada, where enrolments have risen, the decline would have been much worse. North America accounted for 27% of Navitas's enrolments this semester, so it's a significant issue. Navitas's US division produced a loss in 2017 and probably will in 2018.

Brexit bounce

While the UK has been weak for several years, the third semester of 2017 provided a welcome respite. UK enrolments rose 11%, driven by European Union students taking advantage of favourable fee arrangements in the short term. Nevertheless the UK outlook might be improving, with expectations growing that the government might relax immigration restrictions currently applying to international students.

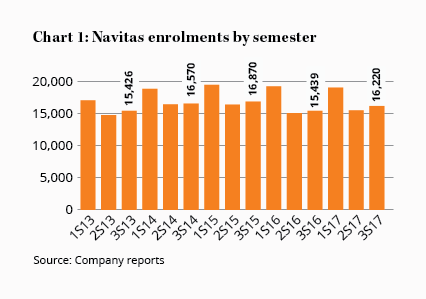

Total underlying enrolments in the third semester rose 8%. Even including closed colleges – see Chart 1 – Navitas is once again producing growth in student numbers, with actual enrolments up 5% on last year.

It's great news. Decent enrolment growth in Australasia has been enough to offset weakness in the US. And it has contributed to the share price rising 24% since we first upgraded the stock in Navitas: Interim result 2017.

In 2017 Navitas renewed various agreements with partner universities. Deakin was the most significant, with the agreement extended out to 2027. More recently, Navitas has renewed agreements with Anglia Ruskin and Swansea universities in the UK although the latter will convert to a joint venture.

Producing results

Each renewal is further evidence that Navitas is delivering international student revenue for partner universities.

But if no news is bad news – and it often is in the sharemarket – then we have some concerns about Navitas's partnership with Western Australia's Curtin University. The agreement was due for renewal by the end of calendar 2017 and, thus far, the silence has been deafening.

A cryptic line in Navitas's 28 November ASX announcement mentioned that enrolments were biased to east coast universities. That implies Curtin and Edith Cowan universities haven't benefited from the recent surge in Australian enrolments.

If Navitas loses Curtin as a partner, then the stock will fall. With Curtin accounting for more than 5% of Navitas's student numbers, our valuation will fall by at least that percentage. As we've said before, the occasional university will take its pathway program in-house – the key issue will be whether Navitas can replace that volume over time. So far the evidence is it can.

With few major agreements up for renewal over the next two years, Navitas can come up for air. It's probably why founder and managing director Rod Jones has chosen 2018 to hand over the reins. Thankfully Navitas won't lose Jones's experience – he will rejoin the board of directors in 2019.

Succession plan

David Buckingham, Navitas's chief financial officer, will become chief executive in March next year. It's an internal appointment although only just – Buckingham joined Navitas in early 2016. It appears he was being groomed for the managing director role – which he previously held at iiNet – so it's pleasing that the company's succession planning is working.

We're still expecting Navitas's earnings per share to fall this year, although not by much. From 2019 growth should return and, over time, we'll be looking for Navitas to reach agreements with other universities. Unfortunately the market with the best long-term growth potential – the US – will remain problematic for a while.

With the stock now trading on a forward price-earnings ratio of 26, it's some way from Buy territory. But Navitas is a high-quality business that deserves a premium, which is why we're sticking with HOLD.

*Admittedly this thought is more likely to occur before you run the gauntlet of duty-free outlets at our rapacious airports.

Note: The Intelligent Investor Growth and Equity Income portfolios own shares in Navitas (and Sydney Airport). You can find out about investing directly in Intelligent Investor and InvestSMART portfolios by clicking here.

Disclosure: The author owns shares in Navitas (and Sydney Airport).

Recommendation