Navitas: Interim result 2017

Recommendation

Earlier this week education provider Navitas reported record interim earnings of $53m for the half year to 31 December. And yet the share price fell 6% on the day, taking the decline since the July 2016 high to more than 25%. Is this our long-awaited opportunity to buy Navitas?

The record result was thanks to a one-off gain which, ironically, highlighted a weakness in Navitas's new joint venture model (more on that shortly). Excluding the gain, net profit actually fell 14%, while revenues declined 8% (see Table 1).

Navitas's 2017 year is probably best described as ‘transitional'. As discussed in Navitas: Result 2016, the effects of the closure of the Macquarie and Curtin Sydney colleges continued into the first half of 2017. The end of these agreements – combined with some unfavourable foreign exchange movements – were behind the poor result.

Key Points

-

Result somewhat disappointing

-

Very good business

-

Growth to return this half

The two colleges previously generated almost $30m in earnings before interest, tax, depreciation and amortisation (EBITDA) for Navitas. That the company's University Programs division will essentially report flat EBITDA over the three years to 2017 proves the underlying growth the remainder of the business is delivering. Universities Programs' EBITDA fell 5% to $70m in the first half but, excluding the two colleges, earnings would have risen 8%.

| Six months to 31 Dec | 2016 | 2015 | /(–) (%) |

|---|---|---|---|

| Revenue ($m) | 478.1 | 517.5 | (8) |

| EBITDA ($m) | 76.6 | 82.8 | (8) |

| NPAT ($m) | 39.0 | 45.1 | (14) |

| EPS (c) | 10.6 | 12.0 | (12) |

| DPS* (c) | 9.4 | 9.4 | 0 |

| Franking (%) | 100 | 100 | N/a |

| * ex date 28 Feb | |||

| Note: Figures are underlying results | |||

Longstanding relationship

During the half, the University Programs division renewed its agreement with one university and converted its longstanding agreement with Edith Cowan University to a joint venture. This gave rise to a one-off non-cash gain in the half, which effectively represents a transfer of $21m of value to Edith Cowan University. It looks a little like the university held a gun to Navitas's head – who said academics weren't commercially-minded? – so it's a risk we'll watch as other partnerships come up for renewal.

SAE, Navitas's second division, also reported a weaker result, with EBITDA falling 10% to $13m. The turnaround of this business, which Navitas acquired in 2010, has been ongoing, with the result affected by the closure of four sub-scale colleges. SAE is Navitas's weakest business but Australian results have been strong and new courses in the USA should support earnings from next financial year.

Professional and English Programs – the third division – is a grab bag of English courses and vocational training colleges. EBITDA fell 3% to $11m in the half but the division has produced decent revenue and earnings growth over the past five years. The Australian Migrant English Program is a Navitas-taught government contract that is up for renewal shortly but, as the company has been involved with the program since 1998, it is confident of winning the tender.

So that's the interim result. What about the future?

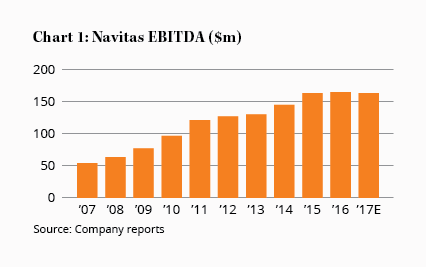

While the result looked poor and was poor, it feels like Navitas is turning the corner. The University Programs division should resume growing in the 2018 year after several difficult years. Chart 1 shows this is a growth company; it's just that the closure of the Macquarie and Curtin colleges interrupted earnings growth between 2015 and 2017.

Another lonely day?

Nevertheless, the risk of universities going their own way remains. Here we were reassured by management on the conference call. They implied that Macquarie's decision to go it alone hasn't been particularly successful, which is dissuading other universities. Management is confident about renewing the agreements with Deakin and Curtin universities at the end of the year under the royalty model.

Navitas has also signed a partnership with the University of Idaho (under the royalty model), its first North American agreement since August 2014. Reassuringly, management disclosed that it was in negotiations with about a dozen other universities, so there's still a growth pipeline.

The North American market is proving harder to crack – and there is greater competition – but there's enormous potential there given its immaturity. Only 4% of students in the USA are international, compared with 18% in Australia and the UK. If the Trump administration decides to take a hard-line attitude towards international students – and there have been rumblings in recent days – then Navitas management believes Canada and Australia will be the beneficiaries.

Returning to our original question, is it time to buy Navitas? Well, notwithstanding the disappointments of the past two years, this is a very good business. A high return on capital employed (of 37%), a negative working capital model whereby Navitas receives fees upfront and pays its teachers later, and long-term industry tailwinds mean the stock should trade at a premium.

Priced for moderation

And it does. Navitas trades on a 2017 forecast price-earnings ratio of 19 and an enterprise value to EBITDA multiple of 11 times. However, current earnings do not reflect the long-term potential of Navitas. The market is currently pricing the company as if it will achieve only moderate growth. That outcome will produce decent returns from this price but stronger growth would provide upside.

Navitas's negative working capital model means it also produces strong free cash flow (although not in the first half of 2017, due to college closures and investment in several campuses). Removing the effects of various one-offs, we conservatively estimate the stock trades on a free cash flow yield of around 5.0%. Again, no bargain but reasonable enough for a quality business.

Debt has crept up recently but mainly due to a share buyback. Over the past year management has bought back 17m shares at a cost of $86m – an average of about $5.00 a share. Notwithstanding the error in acquiring SAE in 2010, we believe management has a keen sense of value and that the buyback reflects its belief the stock is underpriced.

We're mindful of what we said in Navitas's school of hard knocks back in February 2016 (which also provides more detail about the business and the risks than we have space for here), and that there might be disappointments occasionally.

Navitas could lose the Adult Migrant English Program contract in March. Deakin or Curtin universities might not renew their agreements later this year, or they might do so on less favourable terms – as happened with Edith Cowan University. Changes to immigration and student visa policies remain an ongoing risk.

But international students will continue to want quality educations in English-speaking countries, and Navitas has shown itself to be a leader in facilitating relationships with universities. Consistent with our view in Navitas: Result 2016, the current price represents reasonable value for a very good business. We're upgrading to BUY.

Recommendation