NAB: Interim result 2015

Recommendation

Chief executive of National Australia Bank Andrew Thorburn has handed down a mediocre interim result while taking aggressive action to finally rid the bank of its lousy UK businesses. The headline 5.4% increase in cash earnings compared to a year earlier to $3.3bn wasn't as impressive as it looked.

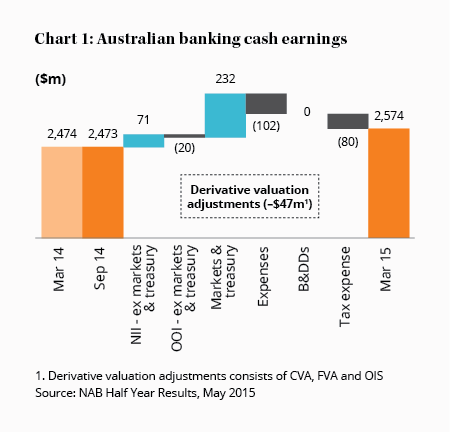

Growth was just 0.3% once bad conduct charges were stripped out of the prior corresponding period's results. It was lucky the treasury, markets and wealth divisions produced improved results otherwise profits would've fallen, as they did in comparison to the most recent six-month period.

While underlying net income increased 3.8% to $9.8bn, more than half the growth was due to favourable currency moves and a one-off profit from offloading some soured UK loans. Costs increased faster at 4.6%, as Thorburn adds more business loan managers and updates the bank's technology. Unfavourable foreign exchange rates didn't help, nor did another $40m fine in the UK.

Key Points

Mediocre interim result

Capital raising announced

Thorburn doing a good job

Bad debts also increased 30% to $455m, but they remain low. Underlying return on equity also fell slightly to 14.7%, and when taken in conjunction with the announcement of a $5.5bn capital raising it suggests return on equity for the banking sector has either peaked or soon will.

Thorburn plans to demerge or float Clydesdale Bank on the London stock exchange by the end of the year provided he can't find a buyer first. To get UK regulatory approval National Australia Bank must commit £1.7bn to cover further bad conduct charges, with the remaining proceeds from the capital raising ensuring the company can satisfy increased regulatory capital hurdles expected next year. If the conduct charges don't reach £1.7bn then any surplus will be returned.

Approximately 70-80% of the shares will be owned by National Australia Bank shareholders with the rest sold to UK institutional shareholders. With the company's ownership of US listed Great Western Bank now below 30% and the problematic UK commercial real estate loans under control, it's a sensible move that will finally rid the bank of a major distraction and weight on the bank's otherwise high return on equity.

Renounceable rights offer

While many have criticised management for not selling Clydesdale earlier, waiting a year for its performance to improve means it should fetch a better price. It's also made sense to wait to raise capital, as the bank's high share price has minimised the dilutionary impact. Around 194m shares will be issued at $28.50 a piece to raise the $5.5bn through a pro-rata 2-for-25 accelerated renounceable rights issue. The new shares won't be entitled to the interim dividend of 99 cents.

| Six months to 31 Mar 15 | Six months to 31 Mar 14 | /- (%) | |

|---|---|---|---|

| Revenue ($bn) | 9.8 | 9.5 | 3 |

| Cash Earnings ($bn) | 3.3 | 3.1 | 6 |

| Cash EPS ($) | 1.36 | 1.31 | 4 |

| Return on equity (%) | 14.7 | 14.6 | 1 |

| Dividend ($) | 0.99 | 0.99 | - |

| Interim dividend | 99 cents fully franked, ex date 15 May | ||

As the offer is renounceable you will be able to sell your rights, so whether you want to take up the offer or not you need to make a decision to preserve the value of your shareholding. Retail trading of entitlements starts on 12 May and the offer itself opens the day after on 13 May, so you've only got a couple of weeks to make a decision.

| Institutional offer | 7–8 May |

| Institutional shortfall bookbuild | 11 May |

| Retail entitlement trading begins | 12 May |

| Retail offer opens | 13 May |

| Retail entitlement trading ends | 25 May |

| Retail offer closes | 1 June |

| Retail shortfall bookbuild | 4 June |

As the company's shares on issue will increase 8% we should theoretically lower the prices in our recommendation guide accordingly, but we'd already factored in some of the dilution as all the major banks need to raise capital so we're not changing anything. The offer price is just above our Buy price so it's a marginal call as to whether we'd recommend participating based on valuation.

If you don't already have a full position in National Australia then you might buy the shares if you don't have better options, but either way just make sure you read the details of the offer documents to maximise your benefits from the raising. By ignoring it you are potentially giving money away. Though it seems any shares not taken up will be sold into the Retail Shortfall Bookbuild on 4 June, please check your paperwork to make sure you understand the process.

Thorburn also announced a reinsurance deal for the bank's life insurance division that covers about 15% of the business's embedded value, or 21% of its policies. The upshot is that it will reduce earnings by $25m per year but free up about $500m of capital. Lastly, board member Dr Ken Henry will replace Michael Chaney as chairman.

| Division | Six months to 31 Mar 15 ($m) | Change from comparable six months (%) |

|---|---|---|

| Australian Banking | 2,574 | 4 |

| NZ Banking | 391 | 7 |

| NAB Wealth | 223 | 28 |

| UK Banking | 184 | 41 |

National Australia Bank is finally on the cusp of returning to being a regular Aussie retail bank. We also like Thorburn's approach. It's bold, fixes several problems in one go and if you're going to raise money it's best to do it while your share price is high. HOLD.

Note 1: Our maximum recommended portfolio limit for the banking sector is 20%, although conservative investors might consider a limit of less than 10% at current valuations, particularly if you have other large exposures to residential property.

Recommendation