NAB gets shot of CYBG (almost)

Recommendation

In a tough category, NAB's purchase of Clydesdale Bank back in 1987 might be the greatest of all diworsifications. No doubt it had bright hopes of applying its skills on the other side of the world to build a thriving bank to complement its operations at home – but in the cold dark streets of Scotland and Northern England, those hopes have long since turned to dust.

This week, almost three decades later and after much pain and anguish, NAB will finally be shot of it (almost). Here's what you need to know.

What's happening?

There are two transactions taking place. The first is that 75% of CYBG is being demerged to NAB shareholders. The second is that NAB is intending to sell its remaining 25% of CYBG to institutions (mainly in London) via an initial public offering (IPO). This will result in CYBG shares being listed in London as well as on the ASX (as certificates of depository interest or 'CDIs'). One ASX CDI will be worth exactly one LSE-listed share.

Key Points

-

NAB shareholders to get 1 CYBG share for 4 in NAB

-

CYBG CDIs expected to trade around $4, making it a Hold

-

NAB shares will fall by about $1; price guide reduced

The IPO shares will be sold for between £1.75 and £2.35 (although press reports suggest it may be closer to the bottom of this range), giving CYBG a total market capitalisation of between £1.54bn and £2.07bn ($3.08bn–4.14bn) and implying a price to tangible book value of 0.56–0.76.

The final pricing will be announced tomorrow (2 Feb) and the LSE shares will start trading on Tuesday evening in London, while the ASX CDIs will start trading (on a 'deferred basis') on Wednesday. At the same time, National Australia Bank shares will start trading without their entitlement to the CYBG shares meaning that all things being equal NAB shares should drop by about a dollar in price.

What do NAB shareholders get?

For every four shares in NAB that you own at the ASX close on Tuesday 2 Feb, you will qualify for one share in CYBG.

If your registered address is in Australia or New Zealand, you'll automatically get the ASX-listed CDIs, whereas those with addresses elsewhere will get LSE-listed shares (although each can choose to get the other by making an election – which you can do via the official demerger website here – by 5pm on Wednesday 3 Feb).

If you own 2,000 NAB shares (qualifying you for 500 CDIs worth around $2,000) or less, then you can opt to use an automatic sale facility, again via the official demerger website by 5pm on Wednesday. This may make sense, for those with very small holdings because it will save on dealing costs, but it's probably best to wait until Wednesday, when we know what the price will be, before making a judgment on this – you will need to have the wherewithal to do it online and move quickly though.

What's the impact on NAB?

Given that each CYBG share is expected to be worth about £1.75–2.35, or about $3.50–4.70, and that each share in NAB will entitle holders to a quarter of that, NAB shares are likely to fall by $0.88–1.18 when they start trading without entitlement to the CYBG shares on Wednesday.

We wish we could say that that's the end of it, but as Shane says to Rufus Ryker towards the end of the western Shane: 'not quite yet'. As part of the settlement of CYBG's misselling of mortgage payment protection insurance (PPI), amongst a few other things, NAB has had to put up a further indemnity of up to £1.17bn – equivalent to about 88c per NAB share – but we think this is unlikely to be drawn.

| Date and time* | |

| Announcement of Institutional Offer Price | 2 Feb |

| Conditional trading of CYBG Shares begins on LSE | 8am (GMT) on 2 Feb |

| Deferred settlement trading of CYBG CDIs begins on ASX | 10am on 3 Feb |

| 'Ex date' for NAB shares on ASX | 3 Feb |

| Deadline for forms to participate in small shareholder sale facility | 5pm on 3 Feb |

| UK Admission of CYBG Shares: unconditional trading of CYBG Shares on LSE | 8am (GMT) on 8 Feb |

| Dispatch of holding statements and certificates | 16 Feb |

| CYBG CDIs commence trading on a normal settlement basis on ASX | 10am on 17 Feb |

| Anticipated latest date for dispatch of proceeds of small shareholder sale facility | 4 Apr |

| *AEDT unless otherwise stated |

CYBG also still owes NAB around £1.3bn ($2.6bn), although NAB plans to offload much of it to third parties this year, and we don't in any case think it's at much risk. NAB also has some derivatives exposure to CYBG, but apparently this has been significantly reduced and CYBG has established its own derivatives capabilities.

CYBG is expected to have 'full standalone capabilities' within three years, but in the meantime NAB will provide some transitional services in areas such as risk, treasury, human resources and finance.

We're going to shift our price guide for NAB down from $27 to $24, reflecting the $1 or so the stock will lose on account of the demerger as well as the weaker local economy.

So is CYBG any good?

No. It's definitely not any good, which is why NAB wants rid of it. It might, however, be cheap. Perhaps the most talked about valuation measure for CYBG – and for banks in general – is the price to book ratio.

It makes sense, because the value of a bank's assets (eg mortgage loans and credit card bills) is relatively easy to estimate (although bad debts can produce ugly shocks from time to time) – as indeed are its liabilities (eg deposits and loan securities and so forth). So, the theory goes, you should be able to deduct one from the other and come up with a value for the bank.

Or at least a starting point. All banks weren't created equal and some – like CYBG's illustrious and (almost) former parent – consistently make returns on their book value (as measured by the return on equity or ROE) above what investors can reasonably hope to make elsewhere. We'd estimate that NAB should make an ROE of about 12% across the cycle, whereas a reasonable return for equity investors these days might be in the high single digits. As a result, investors are prepared to pay more than a dollar for a dollar of NAB's equity and that's fair enough. Our Buy price for NAB (see above) implies a price-to-book ratio of 1.2.

CYBG, on the other hand, has consistently made returns on equity well below what investors might earn elsewhere. In 2015, its ROE was a mere 5.1% (down from 7.7% in 2014 but up from 4.4% in 2013) – and that's on management's underlying basis and with the impairment charge at its lowest for years at 0.21% of loans outstanding.

Double whammy

CYBG suffers from a double whammy effect when we attempt to normalise its earnings across the cycle (similar, but to a greater extent than ANZ and NAB compared to their more illustrious peers CBA and Westpac). Firstly, its higher business exposure means we need to allow for a relatively high impairment ratio across the cycle. Secondly, because of its relatively low return on assets and its high cost base, that higher impairment charge eats up a bigger chunk of profits. All up, by raising the impairment charge to our estimate of 0.6% across the cycle, profits and return on equity are halved.

Unsurprisingly, CYBG management has hopes of tackling all this. Targets include getting income growing faster than costs ('positive jaws') from the 2017 financial year, reducing the cost-to-income ratio from 75% in 2015 to below 60% by 2021 and getting the return on equity into double digits by 2021.

Unfortunately, targets are two a penny and clear strategies to get there are thin on the ground, with talk of brand repositioning, reducing business banking from the current 45% of revenue, 'developing new customer-centric propositions' and 'getting the basics right, first time, every time'.

The trouble is that NAB has, of course, been trying to get it right for almost 30 years and there's no obvious reason why CYBG should find things easier on its own. For one thing, there's the cost of developing all those 'standalone capabilities'. Then there's the higher cost of funding that may come as a result of not having such a strong parent.

CYBG has certainly been going for growth in personal banking, with retail lending increasing by 9% in 2015 and plans for this to grow by 40–50% over the next five years compared to 15–25% growth in business lending.

But as with any business, sales are easy, it's making profitable sales that's hard – and with banks you don't know your profits for years to come. These high rates of growth raise a slight worry that CYBG may have been pushing a bit too hard recently to prepare itself for the IPO, sowing the seeds for trouble down the track. We're particularly alarmed by the latest deal on Clydesdale's Gold MasterCard, which charges 0% on spending (never mind transfers) for a best-in-class 26 months. Unsurprisingly, credit card issuance doubled in 2015 to 34,200.

Branch headache

It may be the deposit side of things, though, that reveals CYBG's biggest headache. The news starts off as good, because deposits make up a healthy 92% of loans, and around half of them are of the attractive low-cost current account variety. Furthermore, 78% of personal account customers have been with the bank for more than ten years.

The trouble is that this enviable personal banking network relies so heavily on its branches. In 2015, for example, 81% of CYBG's new personal current accounts were opened in one of its 275 branches. The number of branches fell 8% in 2015, but it's hard to see that continuing if CYBG is to achieve its targeted growth.

| 2012 | 2013 | 2014 | 2015 | |

| Net interest income | 806 | 768 | 785 | 787 |

| Non-interest income | 120 | 190 | 197 | 177 |

| Total op. income | 926 | 958 | 982 | 964 |

| Total op. expenses | 715 | 683 | 686 | 727 |

| Impairment charge | 173 | 144 | 74 | 78 |

| Underlying PBT | 38 | 131 | 222 | 159 |

And while CYBG is admittedly strong in its core regions of Scotland and Northern England, with a 9% share of current accounts compared to 3% nationally, these are the less affluent parts of the country.

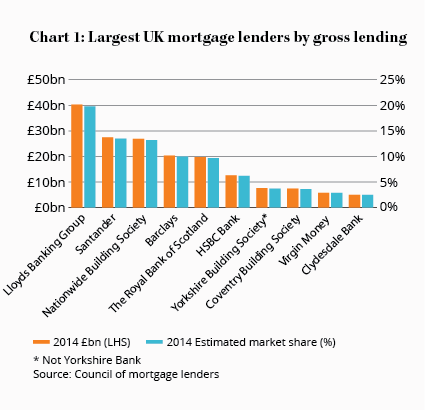

So, while Lloyds Group, for example, made an average total income of about £8.3m from its 2,200 branches in 2015, CYBG made just £3.7m. All in all, then, the growth target looks like it's at odds with the target for reducing costs.

Misconduct

To describe CYBG's misselling of payment protection insurance as a 'conduct issue' is a bit like describing its 579-page demerger document as a 'booklet' – kind of true but not really capturing the reality.

To be fair, CYBG is not alone in its misconduct in these matters – most of the UK banking sector is involved – but it doesn't paint a pretty picture and creates considerable uncertainty.

NAB will leave it with around £1bn in provisions, equivalent to more than a quarter of CYBG's £3.4bn equity value, in addition to the £1.17bn capped indemnity. However, mailouts to customers advising them of their options will only begin in early 2016 and will run for about two years, so it will be some time before the final liabilities can be calculated. If NAB's indemnity is drawn upon, then CYBG will have to chip in around 11% of anything NAB pays.

| 2012 | 2013 | 2014 | 2015 | |

| Customer loans | 27,575 | 26,424 | 27,696 | 28,783 |

| Cash & balances with central banks | 7,927 | 6,720 | 5,986 | 6,431 |

| Investments | 1,041 | 975 | 1,168 | 1,462 |

| Due from related entities | 1,256 | 1,390 | 1,487 | 786 |

| Other | 6,583 | 1,239 | 1,055 | 1,243 |

| Total assets | 44,382 | 36,748 | 37,392 | 38,705 |

| Deposits | 26,528 | 24,266 | 23,989 | 26,349 |

| Bonds and notes | 3,187 | 3,085 | 3,453 | 3,766 |

| Notes in circulation | 1,567 | 1,709 | 1,831 | 1,791 |

| Due to related entities | 7,716 | 3,036 | 2,677 | 998 |

| Provisions | 292 | 315 | 952 | 1,006 |

| Other | 2,473 | 1,888 | 1,952 | 1,352 |

| Total liabilities | 41,763 | 34,299 | 34,854 | 35,262 |

| Total equity | 2,619 | 2,449 | 2,538 | 3,443 |

Accountants being the cautious bunch they are, our guess is that the existing provisions will prove adequate and that writebacks are more likely than further provisions. However, a guess is all it is and, like the accountants, we're minded to be conservative.

Price guide

More importantly, and as already explained, we're also sceptical of CYBG's ability to get its ROE up to a tolerable level of 8–10%. On that basis we'd be interested in selling the stock if it moved closer to book value – say above 80% of book value, or the equivalent of about £2.50 a share or $5 per CDI at current exchange rates.

At the other end of the scale, there must be a floor to the bank's value, because ultimately it could be wound up, giving investors their equity back. We're not suggesting that will happen (and it would incur costs if it did, reducing that equity value) but there would be pressure to squeeze out the equity in other ways, perhaps through a takeover.

On that basis, we'd become interested if the price fell much below 50% of book value, and will start off with a Buy price of 40%, equivalent to about £1.25 or $2.50.

That's a deliberately wide gap to begin with, reflecting the uncertainties involved, and the gap may narrow as the numbers become clearer and the conduct issues get closer to a resolution. We'll post up a brief alert clarifying our recommendation on Wednesday, after the price has been set and the stock starts trading.

Recommendation