Model portfolios: Benchmarking performance Pt 2

Key Points

- Funds industry misleads with its comparisons

- We’re using three separate measures so you can assess us

- It’s very early days but portfolios travelling well

The funds management industry will tell you that portfolio performance is all about beating an index. Our volatility does not equate to lower risk, it does mean a restful night.

Fine-tuning

One of the key objectives of our model portfolios is to keep them simple and easy to follow. But there’s likely to be a trade-off between simplicity and performance.

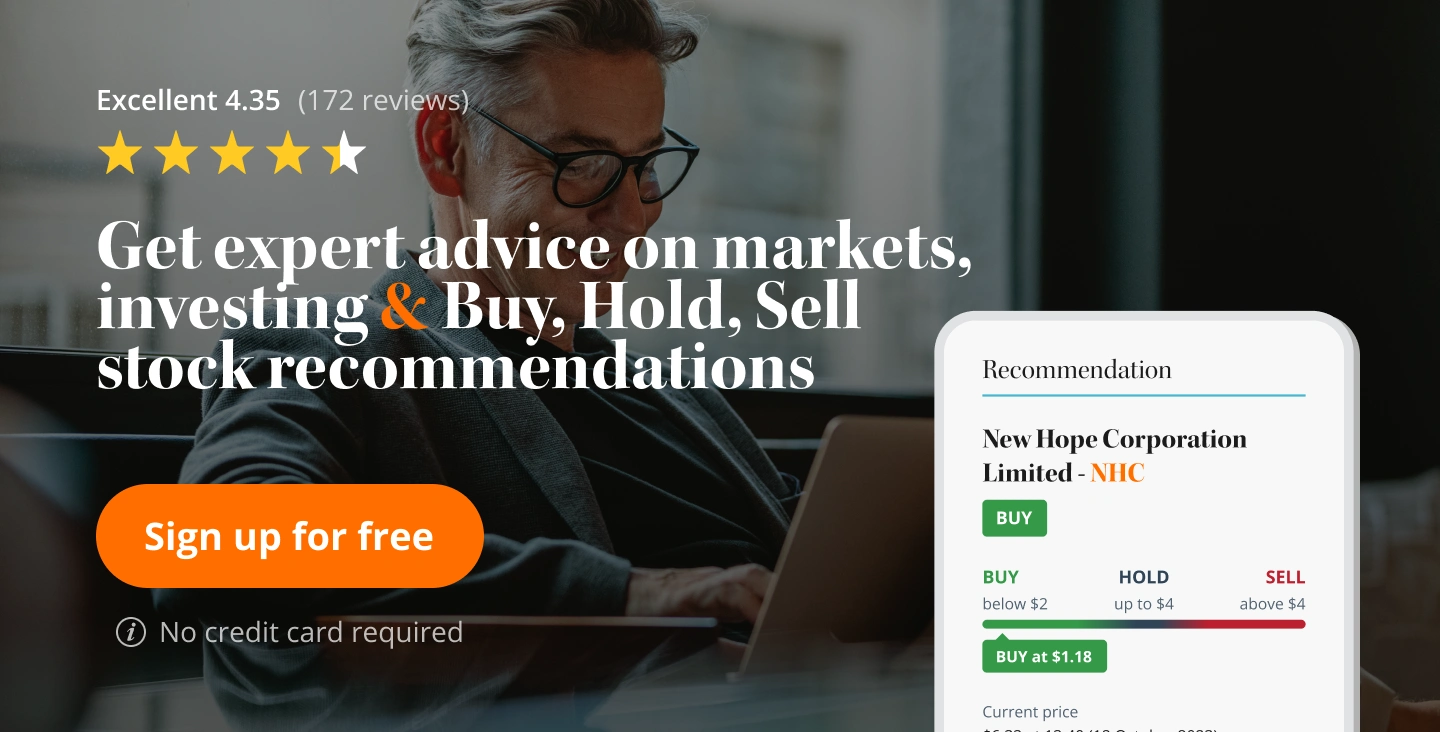

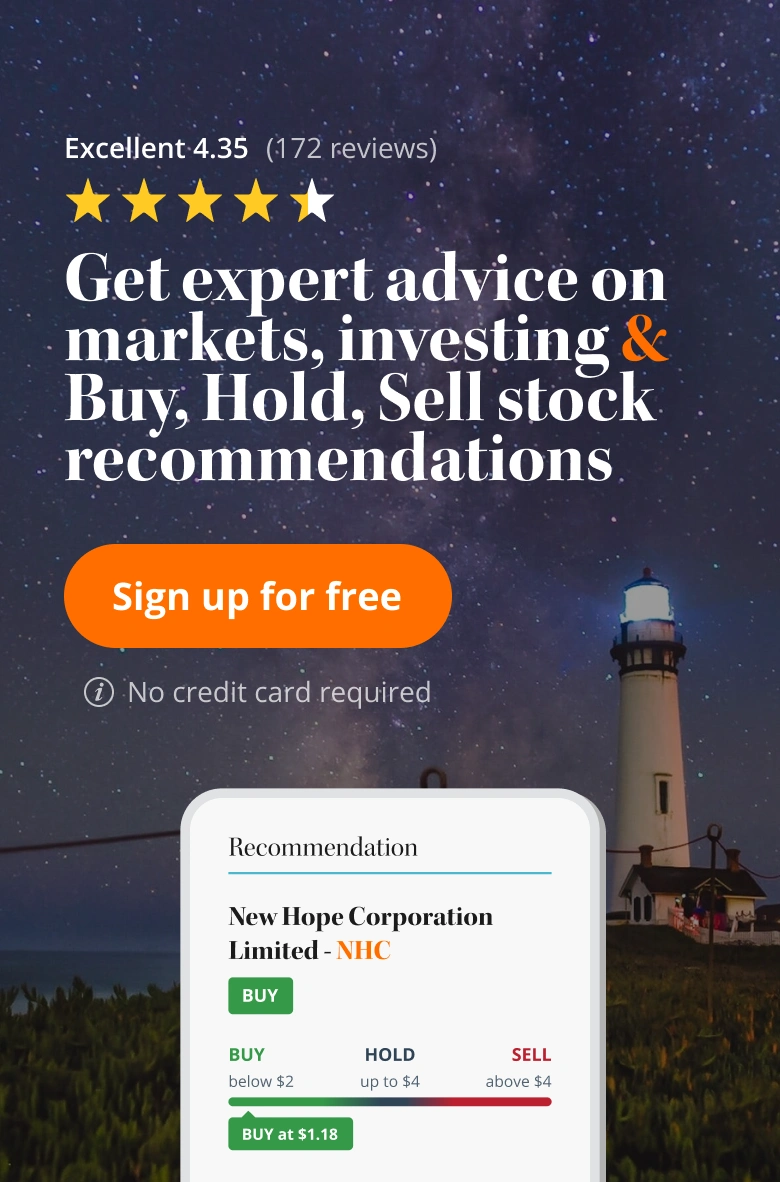

Someone willing to put in more time and effort may find they can get better performance by, for example, managing a direct share portfolio (to replace the Australian Shares allocation) with the assistance of our colleagues at Share Advisor.

But if you don’t fancy the workload that involves, these model portfolios are for you. Pick the one that best suits your goals and use the three measures – beating cash returns, inflation and the appropriate Morningstar Multi-sector Index - to determine how well we’re tracking.

Finally, remember that these portfolios have been constructed for the long term. We don’t expect to beat each of these criteria every single quarter but over the years, that’s our goal. And if we can do that – and we’re very confident of it - setting up an SMSF to avoid the tentacles of a rapacious industry will be one of the best financial decisions you’ve ever made.