Making use of recent M&A trends

Avoca Investment Management shares analysis on trends in recent M&A activity.

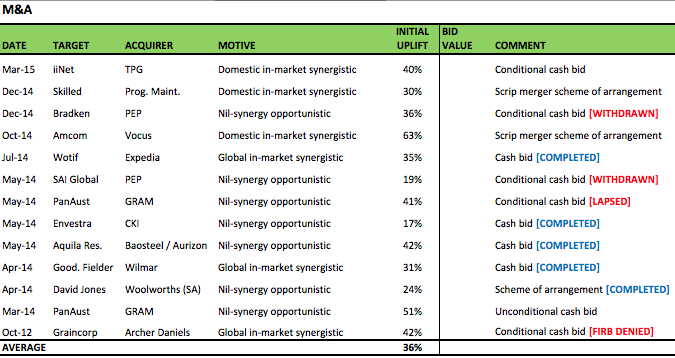

Avoca Investment Management has shared analysis on trends in recent M&A activity. The analysis classifies deals that have been launched over the past two years into three categories. These are listed as 1) highly synergistic in-market merger (E.G. TPG bid for IINet) 2) global in-market synergistic (E.G. Expedia bid for Wotif) and 3) nil synergy opportunistic - essentially some sort of timely value play.

Their review, as highlighted in the chart above, shows that 7 out of 13 deals over the past 2 years fall into the classification of 'nil synergy opportunistic'. Effectively, bidders targeting stocks during periods of sustained weakness and not excluding 'out of favour' sectors. Their full report provides further discussion, concluding that investing in stocks with 'through cycle value' will increasingly coincide with what corporates and Private Equity see as compelling opportunities. You rarely hear investors say it is possible to plan for M&A activity, this report highlights a tactic to do just this.