Macro Investing: Will the Australian dollar ever fall?

Our team consists mainly of stock analysts, not economists. And yet the GFC demonstrated that the economic environment is vitally important to investment decision making. So Intelligent Investor has teamed up with Macro Business, where they do this sort of thing for a living. Please check out their bios at the end of their first piece and let us know what you think in the comments below. If there's a theme you'd like them to address, we (and they) would love to know what it is and we'll do our best to accomodate it. The macro articles will appear in both Share Advisor and Super Advisor websites for the next 3 months and thereafter you can find them at the Super Advisor website.

Key Points

- Aussie dollar likely to hold up until evidence of US and Euro recovery is sustained

- Opportunities to invest in overseas stocks, with a preference for US markets

- If you’re overweight Australian assets, you’re taking unnecessary currency risks

The Australian economy is now in its 22nd uninterrupted year of growth. No other western nation has managed a performance like that. But not every country has a mining boom, now in its second instalment after the Chinese embarked on a huge policy stimulus in the wake of the GFC.

It wasn’t all the doing of the Chinese, though. The Australian government lent its balance sheet to the banks with government guarantees and embarked on dual stimulus packages. And the Reserve Bank cut rates rapidly. In hindsight, it was a textbook policy response.

Amid threat of defaults, structural weaknesses and depressions, to global investors and sovereign debt funds Australia took on an attractive hue.

Just feel the quality, they reasoned: A genuine AAA rating, relatively high interest rates (although recent cuts have undermined that argument) and comparably low government debt. If trouble struck, the government still had the fiscal space to head off trouble. The argument was powerful and ultimately, irresistible.

Safe harbour

With its safe harbour status, the Aussie dollar held up even in the face of declining commodity prices. Remember that the post-GFC low for the currency against the US dollar was 0.596.

The local currency is a safe harbour rather a safe haven for two reasons. First, the money parked in our backyard is here only while other jurisdictions struggle. When normal service resumes, it will move back into the mainstream of global markets.

Second, were the world to again face cyclonic conditions, the Aussie would probably be abandoned in favour of traditional safe haven currencies like the US dollar, Yen or Swiss franc, which, in the face of real chaos tend to rise.

So there’s a reasonable argument that either way—a more normal economic environment or a deep crisis—the Australian dollar is likely to fall.

The question then is how to profit from it. If foreign investors do take their money to other markets and the dollar falls, Australian-based investors already invested offshore will enjoy handsome returns.

This proposition won’t be anything new to Share Advisor members. For a few years now, it has been recommending an exposure to offshore markets, even going so far as to publish a special report (Ripe for the picking: eight overseas stocks to buy now, 28 June 2012).

So when might this strategy pay off?

Interest waning?

The Australian dollar’s high regard was recently confirmed by the IMF, which awarded it Reserve Status. This doesn’t mean it will stay high. The award is a reflection of what has been, not what is in train.

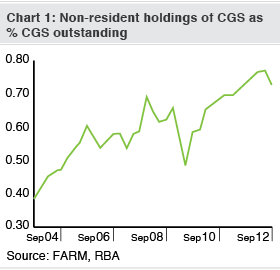

The Aussie has not reached a new high for more than a year and there are already some signals that foreign investor appetite for Australian dollar assets is waning. In the September quarter 2012, the foreign holdings of Australian Commonwealth Government Securities (CGS) actually started to fall, the first genuine sign of changing fortunes.

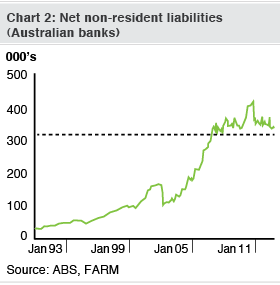

Likewise the high point for foreign holdings of Australian bank debt is now far from its peak.

The outlook is one where the likelihood of a sustainable fall is a function of markets and their interpretation of the relative merits of the local versus the global economy.

As a safe harbour asset, good news on the world economy is bad news for the Aussie dollar. If the current recovery in markets and the US economy continues, then Federal Reserve monetary easing will cease and the move away from the Aussie dollar safe harbour will gather pace.

However, the share market bounce and US recovery are fragile and the Aussie dollar will hold up until these recoveries are solid and sustained. At present, global equity markets, including those in the US, Europe and Japan, are all at recent peaks. More to the point, they are all correlating to one.

Combine this with very low market volatility during the recent market rise and the warning signs glow brighter still. To old time traders this suggests that the market is ripe for a pull-back.

Big risks falling

Since the European Central Bank committed to backing the euro the likelihood of a serious meltdown has been reduced, although renewed volatility provoked by doubts about global growth, the US housing recovery or China’s structural adjustment, will revitalise the Aussie bid.

There are also mounting challenges for the Australian dollar at home. First, the mining investment boom is expected to peak mid-year with no obvious growth engine set to replace it. Second, the national budget has failed to return to surplus despite S&P’s declaration that to not do so ‘across the cycle’ will affect the rating.

And the election marathon will likely see both parties brawling over who will cut spending the most, regardless of what the economy is doing. Finally, interest rate cuts haven’t had quite had the desired effect on consumer sentiment. People are paying back debt, not taking more. Rate cuts are making little difference to their spending.

The lacklustre Australian economy does not yet appear to be weighing upon the foreign appetite for the Australian currency. The failure of the currency to fall with interest rates last year suggests that lower rates were already priced in. But these risks are real and likely to grow through 2013.

US preference

So, is 2013 the year that Australian investors can benefit from the high dollar by moving money offshore? The answer is yes, but with some caveats.

In some markets the Aussie is clearly more over-valued than others. The US dollar seems likely to benefit this year with the Aussie dollar perhaps falling to 95-96 cents. That makes it a natural hedge for local investors looking at US investments.

On the other hand, the Aussie is likely to rise against the Yen and Pound. These two currencies are set for falls as Japan joins with gusto the global currency war and the endemic weakness of the UK economy continues. If looking at these markets, a more active currency hedge is wise.

A small rise or fall against the euro is also possible as the currents of global markets re-adjust to the new reality of a still weak European economy, albeit with a much reduced risk of dislocation arising from sovereign default or fragmentation.

As always, it’s a question of doing your homework, risk appetite and asset allocation. If you’re overweight in Australian assets, chances are you are taking unnecessary currency risks.

Background on the authors:

David Llewellyn-Smith is the founding publisher and former global economy editor of The Diplomat magazine, Asia Pacific’s leading geo-politics and economics website. He is also the co-author of The Great Crash of 2008 with Ross Garnaut and a regular economics and markets contributor for Fairfax and the ABC. David is the editor-in-chief and publisher of MacroBusiness.

Greg McKenna is the Principal of Lighthouse Securities and has 25 years’ experience in banking, trading and portfolio management. He holds a Masters of Applied Finance, is a Senior Associate of FINSIA and AFMA accredited. He was previously Head of Currency Strategy at the NAB and Westpac. He was also a Fund Manager with NSW State Super Fund and more recently was Treasurer of Newcastle Permanent Building Society.