Macquarie: Interim result 2019

Recommendation

There was lots to talk about in Macquarie's half-year result: outgoing chief executive Nicholas Moore's 44th and final results announcement; the passing of the baton to Shemara Wikramanayake (from 1 December); net profit growth of 5%; guidance for full-year growth of 10%.

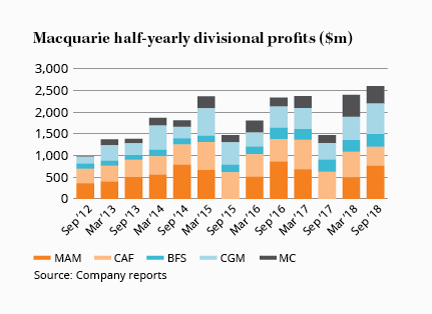

But the real highlight was arguably Macquarie's conglomerate structure. Just as its 'annuity-style' businesses have struggled for growth, its 'markets-facing' businesses have picked up the slack.

Key Points

-

Market-facing businesses double profits

-

Performance fees down

-

Raising price guide

The two markets-facing businesses, Commodities and Global Markets (CGM) and Macquarie Capital (MC) had boom conditions in the US to thank for the improvement, particularly in energy markets (for CGM) and mergers and acquisitions (for Macquarie Capital).

CGM increased its profit contribution by 85% to $700m, helped by a near-doubling of operating income from commodities.

Oil and gas pipeline infrastructure hasn't kept up with production in some parts of the US, leading to price differences and a greater demand for transport and storage, as well as hedging products. Chief financial officer Alex Harvey noted that a couple of acquisitions over the past decade had helped position it for this opportunity (notably of Constellation Energy's gas trading operations in 2009 and Cargill's petroleum trading business last year).

Macquarie Capital, meanwhile, more than doubled its profit to $406m, thanks to strong US debt markets and advisory work for mergers and acquisitions, especially in Europe and the US.

Performance fees down

Macquarie Asset Management (MAM) is the major contributor to what management calls its 'annuity-style' businesses, but its profits are nonetheless very lumpy. Performance fees are the key swing factor and in the six months to September they almost halved to $282m. That was as expected due to a very strong comparable period, but it still meant that divisional profit fell 36% to $762m. At an underlying level, though, the business continues to do well, with assets under management up 16% compared to a year ago, at $550bn.

The next biggest contributor to the annuity businesses is Corporate and Asset Finance, where profit fell 29% to $437m, due largely to the timing of prepayments and asset realisations and a 13% reduction in the size of the loan portfolio.

Banking and Financial Services, meanwhile, chalked up its 7th consecutive half of growth, increasing profits by 3% to $296m. Excluding the bank levy - which was in effect for the entire period, compared to only half of the prior period - the growth would have been 6%. Funds on Macquarie's platforms rose 12% to $88.1bn, while the loan portfolio increased 18% to $44.5bn and deposits rose 6% to $49.4bn.

After accounting for corporate costs, which fell 5% (excluding tax) to $917m, it all added up to a flat profit before tax of $1,705m. The 5% increase in net profit - to $1,310m - was entirely attributable to a fall in the tax rate, from 26.4% to 22.2%, due to US tax reform. Management had been guiding towards a 3-4% fall in the tax rate from historical levels (in 2017 it was 28%). So that was better than we expected and reflects the increased contribution from the US, where income jumped 36% to $1,777m (assisted by the weaker Australian dollar), taking it from 24% to 31% of the total.

| Six months to Sept | 2018 | 2017 | /(-) (%) |

|---|---|---|---|

| Divisional PBT | |||

| MAM | 762 | 1189 | (36) |

| CAF | 437 | 619 | (29) |

| Banking & FS | 296 | 286 | 3 |

| CGM | 700 | 378 | 85 |

| Mac. Capital | 406 | 190 | 114 |

| Total div. PBT | 2,601 | 2,662 | (2) |

| Corp. costs | (908) | (958) | (5) |

| Group PBT | 1,705 | 1,704 | 0 |

| Tax and minorities | (395) | (456) | (13) |

| Net Profit | 1310 | 1248 | 5 |

| Diluted EPS ($) | 3.83 | 3.60 | 6 |

| Interim DPS* ($) | 2.15 | 2.05 | 5 |

| *45% franked, ex date 12 Nov | |||

Although there was little growth in profit before tax, that still represented a decent performance given the 18% fall in the 'lumpy items' we wrote about when downgrading the stock to Sell in March (largely due to the fall in MAM's performance fees). Excluding the lumpy items, profit before tax rose an impressive 17%, which demonstrates Macquarie's ability to adapt its business and make money in different market conditions.

Guidance up

Incoming chief executive Shemara Wikramanayake took the stand to deliver the guidance for 10% growth in full-year net profit, which excludes any gains that might come from the sale of Quadrant Energy if it's approved in the half (which might add another 3% or so).

Wikramanayake confirmed that performance fees at MAM would be down for the full year but that base fees would rise due to the increase in assets under management. She also noted that the buoyant conditions for CGM and Macquarie Capital are expected to continue.

The guidance suggests a full-year net profit of around $2,820m, or about $8.20 per share - perhaps slightly more if the Quadrant Energy sale goes through and/or if Macquarie maintains its track record of beating guidance (you'd think outgoing chief Nicholas Moore would not be setting a difficult target for his protégé). Balanced against this is the fact that we think earnings are still around 10% higher than we'd expect on an underlying, across the cycle, level.

We were too hasty to sell the stock earlier in the year and we're again raising our price guide, with the Buy price moving from $70 to $80 and the Sell price from $110 to $130. As a result, we're moving back to HOLD.

Recommendation