Macquarie Group: Annual result 2015

Recommendation

Barely three years ago investors thought Macquarie was broken, 'ex-growth' and would never recover from the GFC, which forced management to ditch its highly leveraged satellite business model in favour of expanding its funds management business in the US.

Since then, the share price has increased four-fold and, along with its annual result, signifies redemption even though the share price still remains 25% below its pre-GFC high.

Macquarie's three annuity-style divisions are currently on fire (see Table 2), as strong financial markets boost funds under management and performance fees. The infrastructure division reported record funds under management of $66bn, and total funds under management increased 14% to $484bn. Asset management performance fees tripled to $667m.

Key Points

Best result in years

We're sticking with Hold...

...but selling the model portfolio stake

It's been a great few years for fund managers but don't expect a repeat performance, as valuations are now much higher around the world and interest rates may have bottomed in the US, UK and Europe.

A combination of increasing asset prices, acquisitions and improving economies in the US and Europe saw funds under management for the Corporate and Asset Finance division increase 13% to $29bn.

Recently ANZ has sold its Esanda vehicle and equipment business and US giant GE has sold its US$74bn portfolio of commercial real estate loans to Wells Fargo. The simplification strategies of major financial groups have worked out beautifully for acquirers like Macquarie, which has a genuine strength in this area. Macquarie's smaller size means these acquisitions also have a large impact on its performance.

| Full year ended 31 Mar 15 | Full year ended 31 Mar 14 | /- (%) | |

|---|---|---|---|

| Operating Income ($bn) | 9.3 | 8.1 | 15 |

| Net Profit ($bn) | 1.6 | 1.3 | 23 |

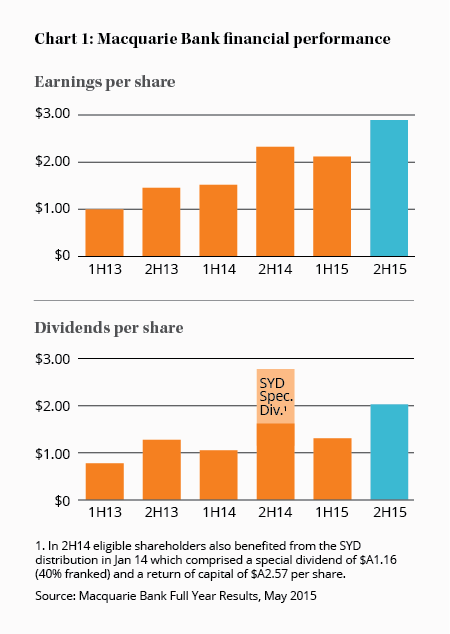

| EPS ($) | 5.02 | 3.84 | 31 |

| Return on equity (%) | 14 | 11.1 | 26 |

| Dividend ($) | 3.30 | 2.60 | 27 |

| 2H15 dividend | $2.00 40% franked, ex date 18 May | ||

Turning to the market-facing businesses, Macquarie Securities continues to struggle. The pressure on brokerage fees and volumes has seen many financial institutions sell or close their equities businesses, and we don't expect Macquarie's business to produce much growth given most players are prepared to offer their customers a full suite of services even though it's not very profitable.

The wave of merger and acquisition activity gave the Macquarie Capital division a much-needed boost. Given the weak revenue and profit outlook for many companies this could continue for a while yet. The Commodities and Financial Markets division also had a good year as commodity prices and interest rates become increasingly volatile.

Valuation

If Macquarie is going to continue to outperform then it needs to surprise the market with a better result than it has forecast, or investors must be willing to pay a higher multiple on those earnings. Management expects a flat underlying profit in 2016 but reported profits will increase slightly due to lower taxes. A lower Aussie dollar could help increase profits, but it's risky holding stocks purely based on unpredictable macroeconomic variables.

While the forecast price-to-earnings ratio of 17 might not seem high, it would quickly increase well into the twenties if markets took a turn for the worse. We offer no prediction as to when this might happen but it's clear there is no margin of safety in the current share price given earnings per share have increased around 150% in the past three years.

| Division | Full year ended 31 Mar 15 ($m) | Change from prior financial year (%) |

|---|---|---|

| Macquarie Asset Management | 2,447 | 27 |

| Corporate and Asset Finance | 1,594 | 32 |

| Banking and Financial Services | 1,345 | 2 |

| Macquarie Securities | 918 | 6 |

| Macquarie Capital | 1,054 | 29 |

| Commodities and Financial Markets | 1,831 | 9 |

| Total | 9,189 | 14 |

The bull market in the US is mature but we're not expecting an imminent collapse as interest rates remain low, the US economy is slowly recovering and corporate balance sheets are in good shape. But the key point is that paying a high multiple for cyclically high earnings is usually the fast way to the poor house.

We're increasing the Sell price to $90 as we're reluctant to sell a business that is performing so well, but if you want a large margin of safety in everything you own, or you own a large stake in Macquarie, then consider selling now or at least taking some profits. We're selling the 3% position in the model Growth Portfolio (see below) as the stock has performed far better than we expected and we're trying to reduce the number of small holdings in the portfolio. HOLD.

Note: We're selling 139 shares from the model Growth Portfolio at $80.39 per share, netting proceeds of $11,174.21.

Recommendation