James Hardie's stronger foundation

Recommendation

Woodpeckers aren't a big problem in Australia. Not so in the United States, where they can cause major damage to homes – along with the usual threats from termites, moisture, fire and wind. These threats can all be minimised by using fibre cement, a product made from cellulose fibre, cement, sand and water.

Fibre cement cladding – or 'siding' in the US – is the product for which James Hardie is most famous. Although some would argue that dubious honour should go to asbestos, the company's unfortunate legacy product (which will continue to cost it money, as we'll see later).

Key points

- Fibre cement taking market share

- US housing market recovering

- Best ASX-listed building materials stock

While James Hardie accounts for about 90% of the US fibre cement market, its competitors aren't really other fibre cement manufacturers. Rather, they're suppliers of alternative types of house cladding. Market shares vary by region but, across the US, vinyl siding accounts for about 27% of the cladding market, with fibre cement at around 17%. In descending order of market share, stucco, wood and brick are other competitors.

Importantly, vinyl siding appears to be in long-term decline. It has a cheap and cheerless reputation; the sort of product you'll use if you can't afford something better. James Hardie aims to lift its share of the cladding market to 35% over time, much of which should come from the continuing decline of vinyl. Of course, cladding competitors such as LP SmartSide, an engineered wood product, hope to contain Hardie's march upwards.

Volumes recovering

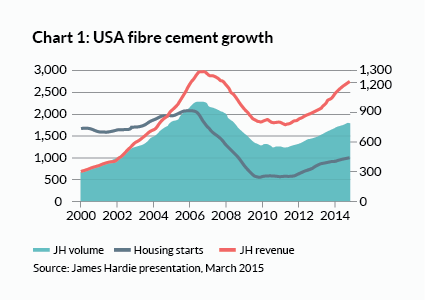

But the march continues apace, as Chart 1 shows. While James Hardie's volumes declined with the post-2007 downturn in the US housing market, they have recovered much faster than housing starts have. Price increases have also allowed the company's total annual sales to pass their 2007 high. Fibre cement is clearly taking market share.

Underlying market growth is all but baked in too, because US housing starts remain well below the long-term average of about 1.5m a year. In the year to 31 March 2016, James Hardie's management expects moderate growth in housing starts to between 1.1m and 1.2m. Strong housing and renovation markets in Australia and New Zealand should also do their bit.

With the US housing market recovery still in its infancy, James Hardie has been ramping up its capital expenditure program. In 2015 the company spent US$276m expanding production capacity and refurbishing and re-commissioning manufacturing facilities it shuttered during the downturn. The spending program will continue in 2016 and 2017 and appears necessary and sensible.

It's testament to the company's strong financial position that significant capital expenditure can take place at the same time as the company has lifted its dividend payout ratio (to between 50-70% of net profit excluding asbestos adjustments). While dividend payments will tend to swing around, over the past two years James Hardie has paid out US$1.45 in ordinary and special dividends (see Table 1). While debt levels will rise a little, the company's balance sheet can easily absorb the net debt of around US$600m we expect by 31 March 2016.

| Year ended 31 Mar. ($US) | 2012 | 2013 | 2014 | 2015 | 2016E |

| Revenue ($m) | 1,238 | 1,321 | 1,494 | 1,657 | 1,800 |

| Underlying EBIT ($m) | 195 | 181 | 253 | 304 | 350 |

| Underlying NPAT ($m) | 144 | 141 | 197 | 221 | 260 |

| EPS (c) | 33 | 32 | 44 | 50 | 58 |

| DPS (ord) (c) | 4 | 18 | 40 | 35 | 40 |

| DPS (special) (c) | 38 | 24 | 48 | 22 |

James Hardie's story appears compelling, particularly as the recovery of the US housing market is still largely to come.

The company now trades on a 2016 prospective PER of 23, expensive but earnings growth could be surprisingly strong over the next few years – even without a return to the US housing boom of pre-2007. Further, asbestos compensation payments appear to be under control.

Compensation payments

James Hardie, as a former producer of asbestos, is currently required to pay 35% of its free cash flow to the Asbestos Injuries Compensation Fund (AICF), a fund set up to compensate victims. The amount it pays will swing around from year to year, with a payment of US$63m required on 1 July 2015 (compared with US$113m last year).

Accounting firm KPMG actuarially reviews the asbestos liabilities of the AICF every year. While you should expect changes in this liability to affect the company's balance sheet and income statement, KPMG's estimate of total liabilities remained virtually stable at $1.6bn as at 31 March 2016. This is promising, although there is still a risk that mesothelioma claims – which have been above actuarial calculations over the past two years – might blow out.

To summarise, James Hardie is without question the best ASX-listed building materials stock. The company's inglorious past is behind it, and its asbestos liabilities look under control. This implies many, including ourselves, may have been too negative and that there is a price at which you should consider buying the stock.

At around $13.50, James Hardie would be trading on a 2016 enterprise value to earnings before interest, tax, depreciation and amortisation multiple of about 12. This seems fair for a high margin company with a superior product in a steadily recovering market. For now, we'll hope the share price falls victim to a cyclical wobble, providing an opportunity to upgrade. In the meantime, HOLD.

Recommendation