Is Sirtex's $20,000 teaspoon enough?

Recommendation

Talk about scary statistics: in 2015, a financial literacy survey asked 4,000 Australians about 'diversification' as an investing principle – and just under two-thirds of respondents ticked 'I haven't heard of this' or 'I have heard of this but don't really understand it'. Yikes.

Sirtex Medical's management falls squarely in the other third of the population. Earlier this week, the company held its annual research & development (R&D) investor briefing and diversification was the big theme.

Historically, these meetings have been focused on the company's lone commercial product: a radiotherapy for liver cancer, catchily named SIR-Spheres microspheres. This time, though, the product was only mentioned three times during the 100-page slideshow presentation.

Key Points

-

New sepsis product close to trials

-

Early stage; significant existing competition

-

Main opportunity still SIR-Spheres

If you baulk at the cost of cough medicine these days, hold your breath: a single teaspoonful of SIR-Spheres – the typical dose size – has a price tag of close to $20,000. Sirtex may be a one-product company but, with a product like that, diversification was the last thing on most investors' minds.

That was, at least, until the stock plummeted 60% last year when a poorer-than-expected clinical trial suggested SIR-Spheres might never become a first line treatment for liver cancer, and instead remain as a last resort. Since then, diversifying the company's product line-up and revenue streams – or at least giving investors that impression – has been a priority.

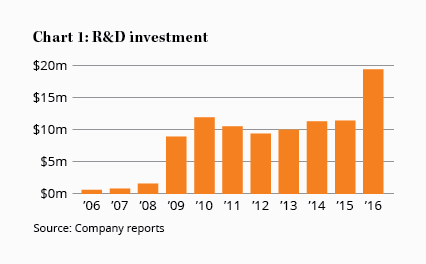

The company is spending close to 9% of revenue on research and clinical trials to expand its product pipeline, with $19.4m spent in the year to June (see Chart 1). The bulk of this was for trials that will hopefully improve acceptance of SIR-Spheres among doctors, but around $8.7m went on early-stage research into novel therapies.

How many syllables?

Of this early-stage research, the company has four primary projects: a special antioxidant that makes healthy tissue less sensitive to radiation; two separate programs researching nanoparticles, one to enhance medical imaging and another to deliver drugs more effectively; and the ‘Histone Inhibition Program'.

All four projects are in their infancy, so we'll focus on the Histone Inhibition Program in this article as it's the closest to commercialisation – which, it must be said, still resides somewhere between the far horizon and the moon.

All four projects are in their infancy, so we'll focus on the Histone Inhibition Program in this article as it's the closest to commercialisation – which, it must be said, still resides somewhere between the far horizon and the moon.

The Histone Inhibition Program is developing a compound – dubbed STC314 – to treat sepsis, a medical condition that causes more than 200,000 deaths in the US each year.

Sepsis is essentially where everyday inflammation to fight an infection gets out of hand and the inflammation spreads throughout the body. This can damage healthy organs and cause them to stop working. Sepsis is the most expensive condition to treat in hospitals and costs the system something in the order of US$20bn a year in the US, which will almost certainly be the product's major market.

Sirtex's compound inhibits toxic proteins (‘extracellular histones') that are released into the fluid around dying cells and can trigger the excess inflammation and damage tissue. It removes an important domino before the inflammation cascade gets underway.

Big potential

Sirtex's STC314 is exciting for a few reasons. Firstly, it already has a US patent out to 2030 and Sirtex has the commercial rights, though the product is being developed in partnership with the Australian National University.

Secondly, if it ever does reach commercialisation, the therapy may qualify for ‘orphan drug status' with the US Food & Drug Administration because it meets a largely unmet medical need. This special designation comes with accelerated regulatory approval and more generous marketing and pricing guidelines, so it would enjoy very high margins.

What's more, management expects that clinical trials will be much shorter than those for cancer drugs, which can stretch over several years, and it believes the potential market for the drug is around US$1–2bn in yearly sales.

But it's important we don't get ahead of ourselves. The drug in question is still in early research, with Phase 1 clinical trials expected to begin early next year. Only around 7% of drugs that begin Phase 1 trials ultimately get regulatory approval, and unless you're an expert in inflammatory proteins you probably can't judge the odds of success (it's a stab in the dark for us too).

Then there's the inconvenient fact that STC314 already has its share of competition, including a drug called Selepressin and a device that removes toxins from the blood called Toraymixin.

Though each works in a different way to Sirtex's histone inhibitor, the therapies still treat sepsis and so can be considered substitute products. Worse, they are already in Phase 3 clinical trials, so much closer to reaching the market. Not only will Sirtex need to show STC314 works, it will need to show it works better.

No track record

A final concern is that management doesn't have much of a track record with drug discovery and development. Chief executive Gilman Wong joined the company in 2005, three years after SIR-Spheres had already gained regulatory approval. Management has a strong sales and marketing background, and has certainly shown its worth at commercialising an approved product – but whether it can navigate the delicate risk-reward balance of funding early-stage research and clinical trials is yet to be seen.

The bottom line is that, at this stage of the game, the Histone Inhibition Program adds no more than a rounding error in our valuation of Sirtex. It may work out but we won't know for years whether the $8m spent each year on these long-shot programs will bear any fruit.

Diversification is an important investing principle, but so too is the cost of distraction. Given management's expertise and the success of SIR-Spheres, we'd prefer management to stay focused on Sirtex's real opportunity: the potential market for SIR-Spheres – patients with inoperable liver cancer – is around 500,000 people a year, yet the product is only used in around 2% of cases. Every 1% increase in that penetration rate by improving awareness and acceptance among doctors would add well over $100m to revenue. Management expects ‘double-digit sales growth' of SIR-Spheres in 2017.

Sirtex's share price has fallen 30% since late last year but has still nearly quintupled since we first upgraded the stock on 8 Nov 10 (Speculative Buy – $5.90). With a price-earnings ratio of 30, Sirtex looks expensive on traditional valuation metrics, but we think it deserves a premium price.

The company has a huge untapped market for SIR-Spheres, profitable sales growth and more than $100m of net cash to fund its clinical trial and research programs. Having a single product adds significant risk, but you can manage that by locking in profits as the share price rises and adhering to our recommended portfolio limit of 3%. HOLD.