Is it time to buy oil stocks? Pt 1

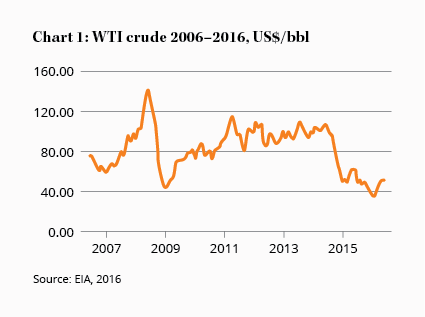

Oil prices have recovered from a calamitous fall earlier this year. From lows of US$26, prices have jumped to around US$50 a barrel and, while they remain at half their highs, the rise has been enough to pique the interest of investors. Oil is no longer a dirty word.

There were good reasons to shun oil stocks at lower prices. Producers carried high levels of debt, cash flow was falling and asset values plunged. Producers faced the prospect not merely of lower profits but of possible death.The existential threat is now mostly gone and, in some cases, balance sheets have been strengthened.

After indulging in ambition and vanity for so long, producers have returned to restraint by cutting capital expenditure, slashing costs and, finally, starting to pull back production. This is a promising first sign that the oil price crash may finally be over.

Key Points

-

Oil is on the radar

-

Shale industry is imploding

- Higher prices should be sustained

We've argued for a while that prices should return to US$70–80 a barrel over time (see What now for the oil price?), where we believe marginal production costs will bring supply and demand into balance. It's taking a while for that to happen because producers have been quick to cut costs and slow to cut output.

At the start of this year, despite oil prices being down more than 70% from their peak, global oil output had declined by less than 1%. It was a key reason why prices got as low as they did and stayed there for as long as they did.

That is now changing. Hedges, which shielded many producers from the worst of the decline, are running off; cash flow is drying up; and debt is being called in. More than US$2 trillion has been wiped from the value of energy producers globally as investors anticipate the inevitable: as the health of producers declines, production is starting to follow. For the first time in years, an oil price recovery is in sight, largely because of an expected decline in US shale output.

Where it all started

OPEC gets blamed for oil price crashes, with Saudi Arabia often condemned for flooding the market with supply. Since so many see OPEC as the source of the problem, they think the solution – lower output – must also come from there.

Yet those looking to OPEC to restore supply discipline are looking the wrong way. OPEC includes the lowest-cost producers in the industry. Their profits are lower because of lower prices but their existence isn't threatened. If acting rationally, there is no reason for OPEC to cut output. No, it was US shale that caused the glut and it will be from shale that supply is cut.

Why would that happen now when it hasn't happened earlier?

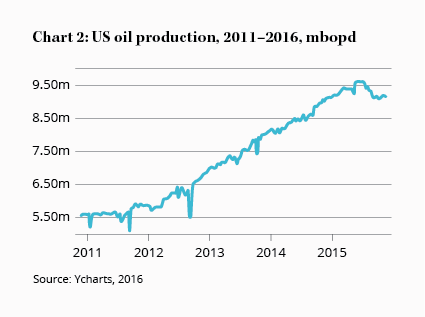

The decline has taken so long because of hedges and debt-funded capital expenditure. Now hedges are rolling off and debt is being called in: so far this year, over 160 shale producers have gone bust, hundreds of rigs have been demobilised and output has started to fall (see Chart 2).

The shale industry is shrinking. This month alone, shale output should decline by about 100,000 barrels of oil per day (bopd) and, because shales require constant drilling to maintain output, that decline will accelerate.

We expect that legacy shale wells will start to decline by about 250,000 bopd within months and, with drill rig numbers still falling (drill rig numbers are the lowest in almost 30 years) total shale output will delcine by almost 2m bopd by the end of the year, almost eliminating the oil surplus.

Many expect that, as oil prices recover, shale production that has been turned off will simply be turned back on again. That appears to be the hope of many producers who have drilled prospective locations and are now awaiting a profitable oil price to frack and produce additional barrels.

Thank the Fed

Higher oil prices will no doubt encourage some additional output but we don't expect a large-scale resurgence of US shale. Why not?

The shale revolution was made possible partly by advancements in drilling technology but also by ultra-low interest rates and a surfeit of lenders. In Texas, they thank God for putting oil in the ground; they ought to thank the Fed too, because zero interest rates and copious bank lending have helped sustain the shale boom.

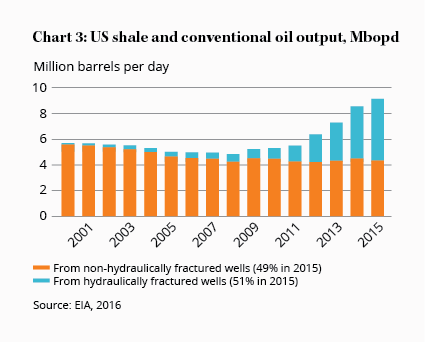

From 2006 to 2014, debt in the oil industry tripled from $1 trillion to US$3.3 tillion. That's three times the size of Australia's economy going to finance one industry. Over the same period, the largest 18 oil firms quadrupled their capital expenditure plans to almost $400bn, much of it being spent on expanding shale output (see Chart 3).

Conventional oil production actually decreased during that time, while shale output rose from 100,000 bopd to over 4m bopd. There is no doubt the cash poured into shale production created the oversupply.

It was cheap money that transformed shale from an experiment into a threat to the oil establishment. A lack of cheap financing could just as easily turn it back.

The end of shale?

Now the oil price is back where it was in 2004, yet the industry is still swimming in debt. Strained balance sheets will take years to repair and we should expect low investment for a long time – $380bn worth of projects have already been shelved and activity has ground to a halt.

Since peaking in 2011 at 2,000 rigs, the overall rig count in the US today is just 400. The Eagle Ford Shale, the epicentre of the boom with arguably the best economics in the US, boasted 217 rigs at its peak; that number has fallen to just 29.

Without balance sheet strength or bank support, production declines will be hard to arrest even at higher prices. Beyond that, we remain sceptical about the economics of shale production. We highlighted those concerns in Einhorn vs Klarmen: the future for shales which, in summary, argued that shale is uneconomic even at US$100 oil.

Not a single shale producer has sustainably generated free cash flow and the largest dozen producers have reported operating deficits of US$80bn which had to be financed from debt and asset sales. All that at US$100 oil. At lower prices, the economics don't improve.

Yet shale represents just 5% of global production and capital expenditure cuts are industry wide. Oil fields, as we know, decline without investment so the capex strike today is sowing the seeds of tomorrow's boom.

As barrels are produced but not replaced, global supply will ultimately shrink and prices will once again climb to encourage investment. This was a cyclical business in the boom and it is cyclical in the bust.

If we eventually expect oil prices to recover should we be buying energy stocks today? That is where we'll turn our attention next week in Part 2.