Is Apple Watch another iPhone success story?

Apple (NASDAQ:AAPL) announces its fiscal third quarter earnings at 7am tomorrow (Australian Eastern Standard Time).

Apple (NASDAQ:AAPL) announces its fiscal third quarter earnings at 7am tomorrow (Australian Eastern Standard Time).

Only two members of Intelligent Investor's analytical team will be paying much attention (Apple shareholders Gaurav Sodhi and yours truly) but there will be plenty of interest from other quarters. This is the first quarter of Apple Watch sales and many will be looking for evidence of whether Apple has another hit on its hands.

Unfortunately, they're almost certainly not going to find it. Apple Watch sales will be lumped into a useful revenue category called 'Other', which also includes iPod, Apple TV and other accessories - basically Apple's rats and mice. Tomorrow morning Tim Cook may call Apple Watch sales 'fantastic' but what he means by that is anyone's guess.

And boy are their plenty of people guessing. An army of analysts and technology researchers are predicting first quarter sales of anything from 2 million to 6 million units but these figures are meaningless.

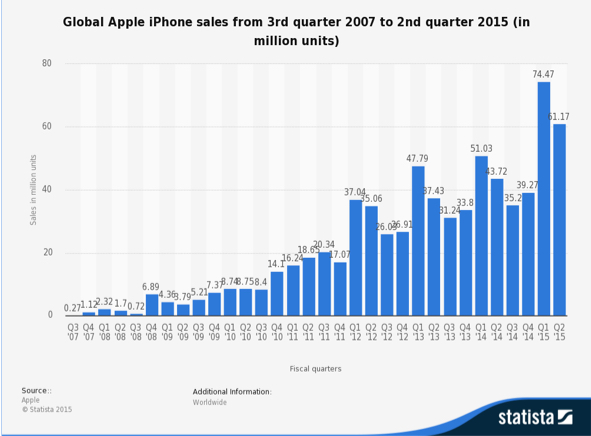

As the chart below shows, Apple launched the iPhone on 29 June 2007, selling just 1.12 million phones in the second quarter after launch. Nine months later it sold only 720,000. In fact, two years after the launch of the iPhone quarterly sales still were still only 7.8 million.

It took almost three years before iPhone sales really started to crank, and they have been in an upward trend ever since, now selling about 34,000 per hour. The same was true for the iPod which again only got going about three years after it launched in 2002.

None of this mean the Apple Watch will follow a similar trajectory. The watch category is new and many people are yet to see a strong case for it. Even before the iPhone, mobile phones were ubiquitous and everyone knew what they did. The smartphone was a step up whereas the Watch, like the iPod, is a step change.

Apple's installed base of 300 million iPhone users gives the Watch a head start but the comparison remains valid – it will be a few years before we know whether the Watch is a dud or not. Apple is sensibly trying to dampen down speculation by not revealing specific sales numbers because at this stage they're meaningless.

Still, as an Apple shareholder I'm still looking for hints, which is why Slice Intelligence research indicating Watch sales crashed 90% grabbed my attention. But the methodology was weak, if not entirely flawed.

So if Apple isn't going to release sales figures and other research methodologies assessing sales aren't reliable, what does give investors a hint about whether Apple has another hit on its hands or not?

Why not try travel one step up the chain and ask Apple Watch purchasers whether they think they've wasted their dough?

Wristly surveyed 800 Watch users and found that 31% were 'somewhat satisfied' and 66% were 'very satisfied/delighted'. These figures are higher than those enjoyed by the iPad when it launched in 2010 and the iPhone at its launch. Moreover, these figures aren't just Apple fan boys and geeks rhapsodising about their latest gadget. Casual users were even more satisfied with the Watch than 'tech insiders' and developers.

Again, this doesn't guarantee the product's success. But if ordinary people are buying the Watch and liking it, when Apple develops the product further, as it will, and native apps become available for it, Apple may well be on to another winner.

But right now it's simply too early to say. Potential Apple investors would be better served by buying the Watch and seeing how it works for them than wasting time reading all the predictions and forecasts that will hit us a few hours after Apple announces its results tomorrow morning.

To get more insights, stock research and BUY recommendations, take a 15 day free trial of Intelligent Investor now.