Invocare: grave concerns?

Recommendation

They do death differently these days. Whether it's due to honouring the individual, the decline of religious observance, or the expectation of choice, the ‘death care' industry is changing.

Gone are the days when a funeral director told you what type of funeral your loved one would have. Back then dead men told no tales and the grief-stricken rarely put up any resistance.

Today standardisation is out and personalisation is in. You probably expect your funeral director to be an event planner who will help you celebrate your loved one's life. You might need catering, or video screens for a photographic tribute. You might even want a coffin adorned – if that's the word – with your loved one's team colours.

Key Points

-

Market share erosion worrying

-

Execution of Protect and Grow important

-

Strong position provides comfort

In its 2016 annual report, InvoCare, Australia's largest funeral company, acknowledged that customer preferences were changing and that it was losing market share as a result. At least the company committed itself to taking action: ‘Invocare must address and cater for these changes and this is the impetus behind the development of our Protect and Grow investment program'.

The market has lapped it up, with the stock rising 27% this year. It's a curious reaction to a company telling you it faces weaknesses in its customer offer.

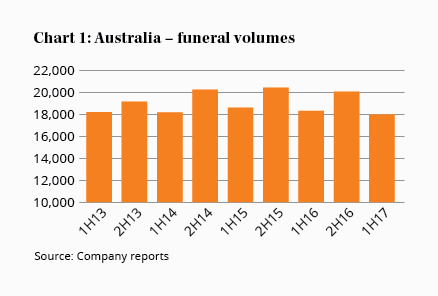

Minor market share losses continued into the first half of 2017 (InvoCare has a calendar year-end). You can see this in Chart 1, which shows Australian funeral volumes falling for the third consecutive half-year. Is it worth worrying about?

It's still difficult to be absolutely certain, although we reiterate our concerns from InvoCare: interim result 2017. We said then that ‘shareholders are on notice that our discomfort level has increased'. As good things happen to great businesses, we're inclined to take a wait and see approach. Over the next 18 months, though, we'll be keeping a close eye on how the situation unfolds.

Protect and Grow

The first thing we'll be watching is the implementation of the Protect and Grow investment program. Management expects to spend $200m over the four years to 2020, all of which will be funded by debt. This could be a significant impost on the company's balance sheet, particularly if the returns from the investment program are slow to arrive.

The company's management incentive plan will reward management for achieving 10% average earnings per share growth over a 5-year period from 2016 (this year InvoCare expects to produce ‘high single digit' EPS growth). An equity raising would make this growth harder to achieve, so it's little wonder management has chosen debt.

This year management expects to commence refurbishments of slightly less than 20% of the company's 250 sites. We'll be watching for signs of delays or disruption over the next 18 months.

Second on our list of issues to watch will be market share. Operational changes the company is making have been forecast to stabilise market share in 2017 and then improve it in 2018. How successful management is with market share stabilisation could flag whether there are underlying fundamental problems.

When it comes to market share, there's daylight between InvoCare and the second-ranked player, the curiously-named Propel Funeral Partners, which is listing on the ASX today. In Australia, InvoCare's market share is close to 40%, and focused on metropolitan areas, where the more regionally-focused Propel has a share of just 4% (and 7% in New Zealand).

Competitors under pressure

InvoCare's recent market share losses have been to smaller private operators that have been discounting, particularly in lower-end funerals. If these players are under pressure, discounting isn't necessarily concerning.

The third issue to watch will be how much profit growth InvoCare delivers in the next 18 months to two years – and more particularly the composition of that growth. One of our concerns is that InvoCare has flagged ‘consistent annual 3–4% pricing increments' as a key element of its business model.

|

What to watch over the next 18 months: 1. Implementation of Protect and Grow 2. Market share changes 3. Composition of profit growth |

While 3–4% annually might not sound like much, if competitors are growing by 2%, it won't be long before InvoCare's pricing is out of step. For what it's worth, Propel's price increase for the 2018 financial year looks to have been around 2%.

InvoCare might have lifted net profit by 14% in the first half of 2017, but it was driven by cost-cutting and one of those ‘pricing increments'. As the Protect and Grow program rolls out, interest charges and depreciation will start biting, so the company must produce decent underlying growth to offset these additional costs.

One of the downsides of investing in public companies is that management can become focused on delivering consistent profit growth rather than ‘widening the moat'. Ratcheting funeral prices up might help InvoCare deliver this growth but at the expense of becoming uncompetitive over time. It's why examining the composition of profit growth – rather than just its magnitude – will be important.

With these three issues to watch, we now have a road map for evaluating InvoCare's progress over the next 18 months to two years. The company is at a critical juncture and how the Protect and Grow program unfolds is vital.

Despite our concerns, it's worth reiterating InvoCare's competitive advantages. Protect and Grow isn't just defensive. It's also designed to help the company – which holds 40% of the market – to meet an increase in demand. By 2030 more than 200,000 Australians will be dying every year, up from 158,000 a year last year.

Unassailable position

The company's market position is almost unassailable. There's evidence smaller players are under pressure and it's probably no accident that Propel has been wary of entering metropolitan markets. InvoCare still has acquisition opportunities in Melbourne and Adelaide and the ability to expand its network elsewhere. The high-quality nature of this business means we're lifting our Sell price to $20 to allow room for potential upside surprises.

However, InvoCare is highly priced on a forecast 2017 price-earnings ratio of 33. If you're close to our maximum recommended portfolio weighting of 4%, or would be concerned by a 30% price fall if earnings disappoint, we suggest you trim your holding. There is no room for error.

Having sold out of quality companies in the past only to see them keep delivering, we're inclined to give InvoCare the benefit of the doubt (at least for now). HOLD, but it's one for the worry list.

Disclosure: The author owns shares in InvoCare.

Recommendation