High-yield securities: eyes on the exits

Key Points

- High-yield credit globally, and hybrids in Australia, have seen astronomical levels of issuance in recent years

- Demand has been driven by ultra-low interest rates, but this may not last forever

- Smart money is starting to bet that it won’t

The intent of global central banks is clear: get interest rates low, and keep them there until economic growth emerges. ‘Extreme monetary policy’ is the name of the game.

The reaction to extreme monetary policy has been just as clear. We have seen an unprecedented flight to high-yield securities – junk and near-junk bonds, emerging markets securities and various forms of hybrids – as interest rates have failed to keep up with investors’ income needs.

The rush for junk has tightened credit spreads, generating large mark to market returns. In the US, the Barclays Capital US Corporate High Yield Index went from returning 4.98% in 2011 to 15.81% in 2012.

As Oaktree Capital Group chairman Howard Marks recently observed:

‘Investors are buying debt today with a 6 per cent yield that they wouldn’t have bought five years ago at 10 per cent. It’s never like that forever.’

Where will it all end?

The scale of the boom

Before tackling that question, let’s spend a moment getting our heads around the scale of the boom. Consider the following statistics:

- The US junk bond market has seen annual sales over $300bn. In the three years preceding the global financial crisis, a time when lending standards virtually evaporated, the average was about $140bn per year.

- According to Vanguard, 77 per cent of the last decade’s junk bond investing by individuals has occurred in the past three years.

- According to Morningstar, new issuance of listed debt and hybrid securities hit record levels in Australia in 2012 above $13 billion.

Junk bond investing – including (in Australia) hybrid investing – has become bigger than Ben Hur.

Where do the Australian regulators stand? To their credit, ASIC have raised concerns, although they haven’t gone the next step of actually doing anything about it. They also seem unconcerned at the idea of Standard & Poor’s moving the goalposts for hybrids issued by the likes of Origin and AGL.

On the other hand, APRA, the banking regulator, seems unfazed and happy to go about the business of protecting the deposits of retail investors by assuming they can impose losses on the hybrids of retail investors.

Government departments are known for being silos, but having one issuing warnings about an investment another is quasi-sponsoring takes it to a new level.

In the US, the Federal Reserve doesn’t seem to think it’s much of an issue. In a February 2013 speech, Jeremy Stein (a Federal Reserve Governor) said:

“Putting it all together, my reading of the evidence is that we are seeing a fairly significant pattern of reaching-for-yield behaviour emerging in corporate credit. However, even if this conjecture is correct, and even if it does not bode well for the expected returns to junk bond and leveraged-loan investors, it need not follow that this risk-taking has ominous systemic implications. That is, even if at some point junk bond investors suffer losses, without spill overs to other parts of the system, these losses may be confined and therefore less of a policy concern.”

He’s probably got the first part right – reaching for yield doesn’t bode well for expected returns – but we’ll wait and see on the second. One thing we learnt from the GFC is that global financial regulators aren’t very good at foreseeing systemic problems.

So the regulators, it seems, have a few concerns, but the flow of money is more worrying.

Shorts lining up

The junk bond market is considered by many to be overvalued and some professional investors are starting to bet it won’t stay that way.

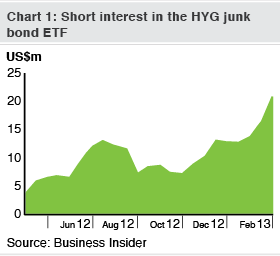

Business Insider recently produced a chart (see Chart 1) showing a surge in the volume of bets against the iShares High Yield Corporate Bond ETF (a US listed ETF which tracks a key high-yield debt index). Investors, it seems, are lining up to short this ETF.

Shorting a stock requires it first to be borrowed, typically from an investment bank. The demand to borrow this particular ETF has become so strong that investment banks have been able to charge borrowers more.

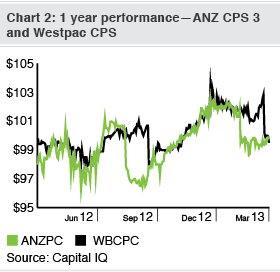

In Australia, over the same period, the prices of listed hybrids and subordinated debt have drifted back towards, or below, their issue prices. Some new issues, like yield to maturity on bank hybrids heads towards 8%, a leveraged property trust on a 6% yield is going to be a tough sell.

Bank shareholders might also be attracted to the idea of reducing their risk – and exposure to share price volatility – by switching from ordinary shares to hybrids. This will put downward pressure on share prices.

High-yield credit can’t be looked at in isolation. What’s bad for high-yield might also be bad for competing investments.

Action points

If you’ve got a portfolio laden with hybrids, bank shares, property trusts and other assets favoured for yield, you’ve got some decisions to make. The global chase for yield may continue but it’s starting to feel more and more like a crowded theatre with only one exit and someone about to yell ‘fire’.

Your choices are:

-

Stay seated. You might be enjoying the movie and figure life’s too short to spend every minute worrying about whether you’re about to get trampled. But if the professionals are putting their money against this market, you should at least know where the exits are.

-

Run. Like ‘staying seated’ this is an extreme approach. It ensures you’ll get out safely but also means you’ll miss the end of the movie.

-

Slow walk. The ‘slow walk’ approach means you still catch the movie but you’re a chance of getting out. If you’ve rolled your term deposits into hybrids, you should by now be rolling some back.

If you’re heavily invested in bank shares and property trusts, but aren’t ready to make the yield sacrifice of switching to cash or term deposits, hybrids offer a compromise solution, due to their decent yields and lower risk. They’ll still perform badly if the sharemarket takes a big dive, or interest rates rise, but, hopefully, not as badly.

The key is diversification. If a big chunk of your fixed interest portfolio is in hybrids, and your shares have a heavy weighting in banks, Telstra and property trusts, then you’re making a big bet on the global chase for yield continuing.

You don’t need a large-scale disaster to end up with a capital loss. A return of risk aversion, poor global junk bond performance, rising interest rates or some defaults might all cause your portfolio to take a big hit.

We’re not saying ‘sell everything’ – but you should have a good look at your portfolio weightings and adjust them if necessary.