Health insurers on the way out

Recommendation

Health insurers have been a great investment. Medibank Private is up 60% since listing in November 2014 and NIB Holdings has returned over 850% since it hit the boards in 2007.

These are strong, profitable franchises, at least from the outside. For many, private health insurance is a mandatory purchase, with the government providing incentives to those that sign up and penalties to those that don't. Customers are also sticky, often staying for years and bringing in new family members as time passes.

Key Points

-

Health insurers have a weak outlook

-

Prices above our price guide

-

Sell both Medibank and NIB

Profits have surged: Medibank's earnings are up almost 12% a year since 2015; NIB's almost 15%. Dividends have naturally risen over the period. With returns like these, why are we recommending you sell?

Touble ahead

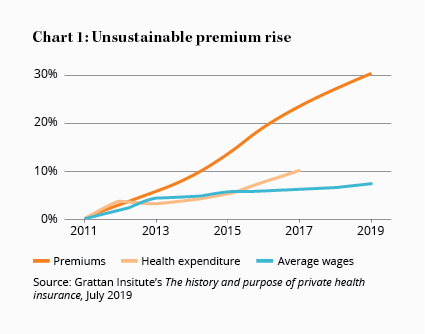

Put simply, the future is unlikely to resemble the past. The health insurance industry faces a number of challenges, some of which might prove insurmountable. The most visible is the rising cost of health insurance, which continues to outpace inflation and general wages growth.

When the price of a product rises at a rate much faster than wages, each year it becomes unaffordable to more people (see chart 1). This fact is implicitly recognised by the government's carrot and stick approach to the industry, with subsidies that have risen from $2.1bn in 2000-01 to $6bn in 2016.

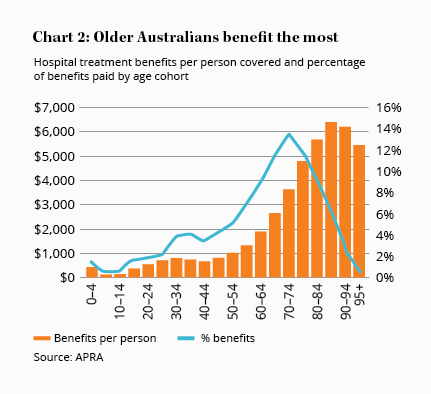

Relying on government largesse to support a private investment is worrying enough. In health insurance, the issue is exacerbated because the benefits of health cover accrue overwhelmingly to the old (see chart 2), who are effectively subsidised by the young.

It's no wonder that more people - especially the young - are reducing their level of cover or dropping out of private health insurance entirely.

The problem is that, as more people drop out or reduce health cover, the burden on those that remain increases. This places additional pressure on insurers to raise prices to maintain profit margins. It can turn into a vicious cycle, the risk of which isn't at all visible in industry metrics.

Peak margin

Medibank's average return on equity since listing has been an impressive 25% and NIB's 26%. The reason these numbers are currently so high is that, for several years, claims have grown less than predicted.

The impact shows up in net margins - profit before investment income as a proportion of premium revenue. At NIB they have risen from a mere 4.2% in 2014 to 8.8% in the six months to December 31, 2018. At Medibank, the net margins have similarly more than doubled to 8.7%.

Health funds can't fully explain the increase. What we can be (almost) sure of is that they won't last. A growing and aging population combined with new medical devices and procedures point to more healthcare spending. The cost burden would also increase if fewer young people decided to avoid the industry altogether.

At the moment, the market doesn't appear to be discounting this risk. Medibank and NIB trade on a prospective price-earnings ratio of 22 and 24 respectively. If margins fall and the market values these stocks on lower multiples, share prices could fall substantially. To say nothing of the Government of the day deciding that subsidising the industry was becoming too expensive.

Time to exit

Perhaps the Government, healthcare providers and insurers can come up with a sustainable solution. Or maybe they won't. Either way, the case that such high margins, sustaining equally high price-to-earnings ratios, will endure is weak.

Profit margins and higher earnings can persist for a while but the downside risk is rising. The prudent option is to move onto better opportunities like those on our Buy List.

Medibank and NIB are both well-managed health insurers, although we prefer NIB owing to its greater diversification and better growth options. Even so, we recommend SELLING both and will be CEASING COVERAGE until better value emerges.