Hansen: The next Computershare?

Recommendation

Had you invested $10,000 in Computershare when it listed in 1994, including dividends you'd have more than $1,700,000 on your bank balance today. How did the company do it? Mainly from making more than 25 acquisitions over the past 30 years, adding share registry customers one buy-out at a time.

That makes it sound easy but it's far from it. When Rupert Murdoch paid $580m for social media network MySpace in 2005, investors relished the deal. MySpace was the go-to website for every teenager and would drive traffic to the rest of the News Corp empire. Then Facebook happened. MySpace was sold for just $35m in 2011.

The News Corp experience is more common than Computershare's. Acquisition-led growth is one of the hardest things to get right. QBE Insurance, which had a reputation for the successful integration of its many purchases, was subsequently revealed to have buried the many problems it purchased too.

Key Points

- Hansen and Computershare have high switching costs

- Hansen has good track record of not overpaying

- Strong balance sheet and increasing opportunities

In the tech sector, where hopes and price tags run high but the 'synergies' rarely materialise, acquisition-led growth is even harder. What makes Hansen Technologies different?

For Computershare's share registry clients, switching is a logistical nightmare and extremely expensive. The same argument applies to Hansen, as we explained in Hansen upgraded to Buy (Buy – $1.52). But there was no cost to prevent users switching from MySpace to Facebook once its service became more attractive.

Hansen's billing software is what, quite literally, brings the money in for its clients. Company managers are very reluctant to fiddle with cash flow, which explains why over the past ten years less than a handful of clients have left after Hansen's software was installed. When Hansen buys a company in a similar line of business, it knows the customers will stick around.

Know what you're buying

With captive customers, annuity-style revenue and stable margins, it's relatively straightforward for Hansen to establish the value of an acquisition target and accurately predict what it might be worth in, say, a decade.

The Computershare comparison makes the point. About 70% of Computershare's total revenue is strongly recurring, delivering a healthy operating margin of around 17%. The figure for Hansen is 75%. With annual price escalations built into most of its contracts, its operating margins are even higher at 22%.

Hansen doesn't just benefit from sticky, high margin customers. Acquisition targets are often unloved orphan businesses, a fact that chief executive and 24% shareholder Andrew Hansen must relish.

Naspers is a $70bn global media heavyweight operating in the publishing and distribution sectors and delivering internet services. It also owned pay TV billing operator ICC, which contributed less than 1/300th of its total annual revenues.

Hansen bought ICC in early 2013 for $20m. This was a big deal for Hansen – the division now makes up 25% of total revenue. For Naspers it was loose change. The main issue was to offload the thing, not the price it was prepared to accept to do so. Andrew Hansen gratefully took it off their hands for what looks like a bargain price and everyone was happy.

Hansen has made two more big purchases since 2012 – CIS and Utilisoft – that followed this script. Management haven't shared the details but given our estimates of incremental earnings and the $34m spent on the three businesses, we doubt the company paid a price-earnings multiple of more than 10. That's the glorious benefit of being a buyer in a buyer's market.

Stick to your niche

The next question is how many more ICC and Utilisoft-style orphans are still out there. Computershare built a global business in a very specific niche, culminating in the 2011 purchase of US-based BNY Mellon's shareowner services business – it's largest competitor in the US. What the company didn't do was expand into unrelated products and business models.

Hansen is following a similar path. It sticks to what it knows – billing software for utilities – then rips out costs and renegotiates contracts to fully tap the pricing power associated with captive customers. By sticking to this niche, expertise becomes transferable, cost cutting opportunities are clear-cut and the overall service becomes more attractive due to a broader geographic reach.

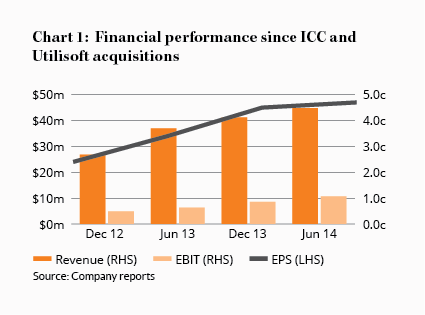

You can see the results of Hansen's recent acquisitions in Chart 1. Total revenue for the six months to June 2014 was 67% higher than the interim result prior to the acquisition of ICC and Utilisoft (Dec 2012). Earnings per share have doubled. Not bad for a company where organic growth is in the mid-single digits.

.png)

Let the good times roll

Management believes there are a lot more opportunities like ICC. This is a growing industry, driven by the worldwide trend towards deregulating and privatising utility and telecom companies.

An example is the roll-out of electricity smart meters across Australia that enable flexible pricing. As power shifts away from state-owned monopolies towards consumers, they demand more variety and price points – all of which leads to more complex billing.

Companies can either update their legacy software to something that can handle the complexity (Hansen's specialty) or 'sell' their in-house billing IT team to a specialist operator. Many are now considering the latter over the former.

Unlike share registries, the billing software industry is still dominated by in-house IT teams and small, local operators. We expect plenty more opportunity for Hansen to make sensible purchases and add a couple of percentage points to its organic growth of 4–7%. And with a clean balance sheet, little debt, and stable cash flows, Hansen has the financial firepower to take advantage of them.

Given the company's history and Andrew Hansen's sizeable shareholding, overpaying isn't a huge risk, either. Hansen might bite off more than it can chew but even then the risk is limited. Most of its software is tailor made for each customer – there are no grand illusions of 'synergy' to mess up valuation.

Hansen's share price has increased 14% since Hansen upgraded to Buy from 29 Oct 14 (Buy – $1.52), placing the stock on a price-earnings ratio of 20. Andrew Hansen isn't willing to overpay for great businesses and neither are we. We're downgrading until we see the company's interim result in late February, but we'd love another opportunity to put this stock back on the Buy list. HOLD.

Note: Our model Growth and Income portfolios own shares in Hansen Technologies.

Disclosure: The author owns shares in Hansen Technologies.

Recommendation