Hansen, pining for the fjords

Recommendation

When tech-related acquisitions, international expansions and big price tags converge, our advice is generally stark and simple: Run. Run as fast as you can.

So what makes Hansen Technologies' latest acquisition any different? Hansen's billing software quite literally brings the money in for clients. Company executives are reluctant to fiddle with cash flow, which explains why only a handful of Hansen's customers have ever left after its software was installed.

Key Points

-

Major european expansion

-

Deregulation provides a tailwind

-

High PER but cost cuts likely

Hansen sticks to what it knows – billing software for utilities – and seeks companies with captive customers, recurring revenues and stable margins. Forecasts are easier, cost cutting opportunities are more readily identified, and Hansen is less likely to be caught overpaying. So far, we've never been disappointed by a Hansen acquisition.

The company's purchase of Enoro is true to form. The Norway-based developer of customer information systems (CIS) and meter data management (MDM) software is right in Hansen's sweet spot, and the company comes with 270 staff and 300 customers in the utility sector.

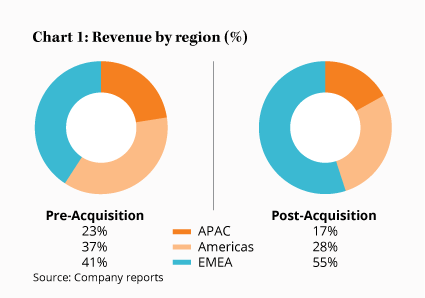

The acquisition of Enoro has a few immediate benefits – it beefs up Hansen's European presence (see chart 1), which was built on 2015's purchase of TeleBilling. Enoro's energy customers are spread all over Europe, including Norway, Sweden, Germany, Netherlands, and Switzerland.

Europe is fertile ground. Deregulation of energy utilities in Australia was rocket fuel for Hansen, and Europe is part way through the same process. Utilities are stodgy, stable businesses, but when markets change rapidly – as with deregulation – they need billing software that can handle flexible pricing and large information flows. As regional monopolies dissolve, the increased competition tends to force companies to implement better billing services to engage customers and improve service delivery. Many European ultilities, we expect, will throw out their old legacy systems and turn to billing software providers with experience in deregulated markets, such as Hansen.

Analytics boost

The main benefit of this acquisition, however, will only show itself over time: Hansen's ability to cross-sell products, rip out duplicate costs – such as head office and admin expenses – and renegotiate contracts to fully tap the pricing power associated with its captive customers.

One product, for example, should be an easy sell. Enoro comes with an analytics software tool ‘that analyses energy consumption data from MDM systems to enable energy providers to understand customer behaviour.'

One product, for example, should be an easy sell. Enoro comes with an analytics software tool ‘that analyses energy consumption data from MDM systems to enable energy providers to understand customer behaviour.'

Analytics hasn't been Hansen's strongest suit, and management said this new functionality will gradually be introduced to Hansen's existing customers. It should add plenty of value for them. What's more, adding new functions to Hansen's software further embeds it in the customer's business, making it harder for them to leave.

Pricy but profitable

The takeover announcement was light on financial data, but what was available points to the deal being another good one.

Enoro is expected to earn revenue of NOK355m in 2017, or around $55m, the bulk of which is considered ‘recurring'. Enoro will represent around 25% of Hansen's total sales on completion, making it the biggest fish since TeleBilling.

Enoro has ‘an extensive history of sustained growth, fresh product and technology offerings'. Hansen will pay NOK620m (roughly $96m) for the company, or around 11 times the $9m of earnings before interest, tax, depreciation and amortisation (EBITDA) forecast for 2017.

Without seeing the full accounts, it's hard to know what proportion of EBITDA will fall to Hansen's bottom line. However, Enoro operates on a lower EBITDA margin of 16% compared to Hansen's 25%, so it's reasonable to assume only a modest profit contribution in the first year. Over time, however, there's every reason to believe Hansen will be able to cut costs and boost profitability.

Nonetheless, this is still one of Hansen's more pricy acquisitions, where paying single-digit EBITDA multiples has been the norm. Even TeleBilling was purchased on a price-to-EBITDA ratio of just six, and a few smaller aquisitions before that got as low as three and four. Presumably chief executive Andrew Hansen believes that either Enoro's growth prospects are particularly juicy, or he thinks the potential for cost-cutting ‘synergies' are above average.

Capital raising

Hansen has a squeaky-clean balance sheet with net cash of $15m and a good $20m of free cash flow. It could afford to take on a little debt, but the company has instead opted for an equity raising. For Andrew Hansen, debt is very much a four-letter word (we're inclined to agree).

The company has completed a $40m placement with institutional investors and announced a $10m share purchase plan for everyone else. The share purchase plan entitles existing shareholders to subscribe for up to $5,000 worth of shares at $3.70 each, with the close date to be announced soon.

On valuation grounds, the offer doesn't make us salivate. However, for members who want to avoid dilution, the forward price-earnings ratio of 25 or so isn't unreasonable for a highly cash-generative company with captive customers and decent growth prospects. Our recommended maximum portfolio weighting is 5%.

The offer price is 5% below the current share price, so even if you don't want to increase your position you may be able to lower your average cost by simultaneously participating in the offer and selling a proportionate number of shares. For more on this nifty trick, see How to profit from share purchase plans.

It's important to consider your tax situation first because selling the stock will likely crystallise a capital gain. What's more, if the offer is oversubscribed, Hansen will roll-back the $5,000 – you may not get your full allocation of shares, which would leave you with a smaller holding than before.

Hansen's share price has more than doubled since we upgraded the stock to Buy on 29 Oct 14 (Buy – $1.52). With captive customers, a clean balance sheet, stable revenues and another solid acquisition, we continue to recommend you HOLD.

Note: The Intelligent Investor Growth Portfolio owns shares in Hansen. You can find out about investing directly in Intelligent Investor and InvestSMART portfolios by clicking here.

Disclosure: The author owns shares in Hansen Technologies and intends to participate in the offer.

Recommendation