GBST's platform for growth

Recommendation

It's said that one of the hardest things in investing is to buy stocks that have fallen in price; but rusted-on value investors such as ourselves typically find it pretty easy (sometimes too easy). The much harder thing is to buy stocks that have already risen sharply – but just as a falling price can tilt the price/value equation in your favour, so can a rising value.

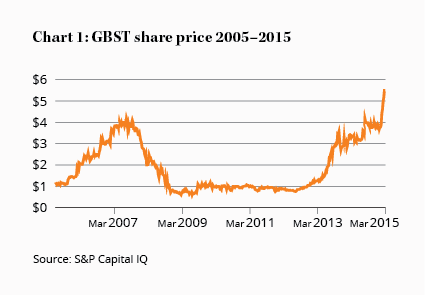

This is the situation we face with financial software provider GBST Holdings, whose share price has risen almost fivefold in the past two years, and 50% in the past two months. It's made harder by the fact that we looked at the stock a year ago in GBST gaining momentum (Hold – $3.23), including an interview with its chief operating officer), but held out for a lower price and missed the opportunity.

All that is just history, though, and right now we need to put it out of our mind and focus on the current relationship between price and value – the latter of which has risen sharply along with the former.

Key Points

Quality business with high barriers to entry and recurring revenue

Prospects for rapid growth in the UK

Raising price guide; BUY

GBST has a very attractive business, with leading market positions supplying software that automates the back-end processing of transactions in securities (served by its capital markets division) and wealth management (served by its ... wealth management division). As such, it adds a lot of value, is protected by high barriers to entry, and has a large proportion of recurring revenue.

Capital markets

The company's increased value is mostly due to wealth management, but we'll start at the beginning, with its capital markets business and specifically its Shares product, which was introduced in 1993 and was the first software to be aligned with the ASX's new CHESS clearing and settlement system in 1996. Shares now handles around 60% of all ASX trades – the remainder being shared between internally developed systems, and two other specialists, iBroker and Securitease.

The domestic Shares product was supplemented by a global capital markets product – 'Syn~' – with the acquisition of Coexis in 2008. Unlike Shares, Syn~ can handle all kinds of securities in all kinds of currency, and it thus forms GBST's spearhead for international growth.

Customers are big banks and brokers and they sign up for multi-year contracts, but typically stick around for much longer because of the difficulties involved in switching systems – changing this kind of back-end software has been likened to replacing the engine of a racing car whilst haring around the Nurburgring.

Revenues are earned on the initial installation and then as an annual rent for using the software, with maintenance and upgrades thrown in. The ongoing rent includes fixed licence fees as well as an element that depends on transaction volumes. Overall, these licence fees contribute about 80% of capital markets revenues.

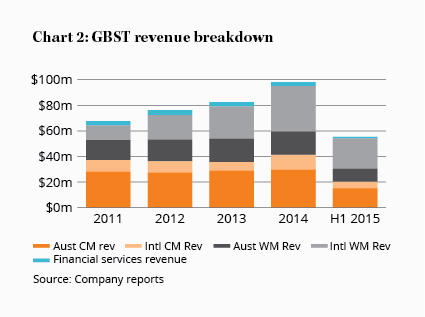

The Australian capital markets business is much more mature than the international business and revenues are thus relatively stable – drifting down from $32m in the year to June 2008 to $27m in 2012 before recovering over the past couple of years back to $30m. In 2015, we expect further gentle progress after a 2% rise to $15.1m in the first half.

The ongoing licences also provide higher margins than the installation work, so the Australian business enjoys high and relatively stable operating margins in the mid-thirties. Over time GBST aims to migrate its Australian clients to Syn~ and the first such transition is expected to take place this year. Moving clients over will doubtless be a slow process, but it should ultimately add to cost efficiencies, boosting margins and/or enhancing competitive advantages and increasing growth.

Lumpy progress

The timing of the Coexis acquisition – two months after the collapse of Lehman Brothers – was inauspicious, and it took longer than expected to kick the software into shape (resulting in a $5.5m impairment charge in 2010). But Syn~ is now enjoying some success, with its first deployment in the US – for Florida-based broker-dealer Raymond James Financial – being completed during the 2014 financial year. The company senses a further opportunity if and when the US eventually shifts from three-day ('T 3') settlement to T 2. An installation for HSBC also showcases the system's credentials, globally and in Asia, and the company hopes to get a sales boost from a new add-on – Syn~FTT – which can handle the new financial transfer taxes being launched in Europe.

Progress, though, has been lumpy, with revenues depending on the flow of large installation projects. In 2014, they rose 74% after a 28% fall in 2013, but they fell again – by 20% – in the six months to December. The division is also still loss-making as management spends hard to build up its development and sales capabilities, and losses more than doubled to $2m in the latest half, reflecting the operating leverage due to a relatively fixed cost base. Over time, though, we'd expect the international business to move into profit and ultimately move towards an operating margin of 20% plus.

With a fair wind we wouldn't be shocked to see operating profits from the overall capital markets business doubling over the next five years to around $15m – although a weak environment could also see them shrink.

Wealth management

The current excitement over GBST, though, relates to its wealth management business, which provides the software for financial institutions to create and manage investment platforms (see Shoptalk). It is also based off a successful and mature local business, with a developing international business.

| Investment platforms are a service provided by wealth management businesses enabling customers to group different investment products together in one 'wrapper', saving on costs and hassle. The platform provider will often also be able to negotiate reduced investment management fees. Platforms come in different varieties depending on use, the most common categories being 'adviser-based', 'direct-to-consumer' and 'workplace' platforms. |

Australia and New Zealand are widely credited with inventing the platform market in the 1990s, with the goal of reducing costs and making life easier for investors (although a cynic might add that it enabled the wealth management industry to squeeze in another layer of fees).

Initially the software tended to be created in-house, but specialist providers also appeared, including InfoComp, which was purchased by GBST in 2007 and brought with it the Composer product as well as its founder Rob DeDominicis, who remains the chief executive of GBST's wealth management division. (Last year's annual report shows De Dominicis still holding 4% of GBST, although the company notes that he has sold a significant portion of these shares in recent weeks, to buy a house in the UK and for other personal reasons*. Founder and chairman John Puttick owns 7%, chief executive Stephen Lake owns 8% and a non-executive director, Joakim Sundell, owns 9%.)

GBST estimates that about 30% of the Australian platform market is now managed through a Composer system, with about 50% internally managed and the remaining 20% shared by other vendors, including Bravura Solutions and FNZ Group.

This gives GBST a dominant position but also plenty of scope for growth given the competitive advantages of Composer compared to in-house software. These include much-reduced development and installation times, as well as cost efficiencies due to scale, with the company able to make better use of its research and development spending (indeed a portion of development spending is funded by customers, with GBST retaining the intellectual property to use in future installations for others).

As with the capital markets business, revenues come from initial installations, as well as from fixed and volume-based licence fees. So GBST's local wealth management business should also benefit from long-term growth in the wealth management industry, with the possibility of a short-term kicker after the confusion surrounding the future of financial advice (FoFA) regulations settles down.

All up, we'd hope to see long-term revenue growth from the Australian wealth management business in the mid-single digits, with profit growth perhaps a point or two higher as additional scale boosts margins.

UK opportunity

The real 'juice', though, is in GBST's international wealth management business – most particularly in the UK. In 2013, the UK went live with its own version of FoFA, known as the Retail Distribution Review (RDR). Among other things, the RDR outlaws commissions, requires advisers to declare whether their advice is 'independent' or 'restricted' (it doesn't help the selling process when you have to start by declaring that your advice is the latter) and allows more flexibility over the handling of pensions in retirement.

The government has also mandated the 'auto-enrolment' of employees into workplace pension schemes, with default contributions to rise to 8% by 2018 (with employers adding a minimum of 3% to 5% employee contributions). Workers can opt out of these schemes, but only about 15% are expected to do so due to a combination of apathy and the employer contribution.

The new rules are expected to make life much harder for the UK's independent financial advisers (IFAs) – so much so that, with the average age of IFAs thought to be around 58, up to 40% are expected to leave the industry. This leaves the UK's financial institutions looking for new means of distribution to retail customers and – you've guessed it – the favoured option appears to be investment platforms.

Sweet spot

The UK may have come late to this particular party, but it's certainly making up for lost time. In its 2014 annual report, GBST notes that its UK sales have risen sixfold in the past five years, but that the 'market is still in its early stages' with the wrap and platform market 'expected to quadruple by 2020'.

The Australian and New Zealand specialist developers of platform software – notably GBST, Bravura and FNZ – have found themselves right at the heart of this sweet spot. Composer, though, claims a couple of important advantages over the competition: a multi-channel capability and a 'gating' facility, which enables the system to close off certain features to different categories of user – denying pension withdrawal options from those in the accumulation phase, for example.

This is particularly attractive to financial product providers, because it enables them to offer other products to captive audiences within workplace schemes. It also makes it easier for providers to offer single platforms that address the adviser-based, workplace and direct-to-consumer markets.

GBST Composer now supports three of the top six UK investment platforms, and clients include Aegon, Fidelity UK and leading SIPP provider AJ Bell.

If the UK platform market does indeed quadruple by 2020, and GBST takes its existing share of that, then it could propel the international wealth management division to revenues of around $140m (from $36m in 2014) and a sixfold increase in operating profit to about $43m (assuming the margin expands to 30%, compared to the 38% achieved in Australia in 2014). (See Table 1 below.)

Combined with the relatively pedestrian growth expected from the other divisions (including a tiny Financial Services division, which provides web tools and calculators and just about breaks even), that might mean underlying earnings per share of around 78 cents in 2020 (before the amortisation of acquired intangibles) – getting on for four times the 21.5 cents achieved in 2014.

Strong cash flow

If we plug in more conservative assumptions, including a mere doubling of international wealth management revenues and a margin of only 25%, underlying group earnings per share would just double by 2020. But even this would be a decent result, implying earnings growth of 11% a year on top of the stock's current free cash flow yield of over 4% (the company needs to invest hardly any capital to grow, so almost all its profits appear as free cash).

We should note that GBST enjoyed a very low tax rate of 16.5% in 2014, thanks to research and development concessions and the UK's 20% corporate tax rate. In both our 2020 scenarios, we've assumed its tax rate rises to 23%, in line with 2013.

| Bear in mind that GBST is a 'market-facing' business, whose fortunes will depend to a large extent on the health of securities markets around the world. A number of other stocks that we've recommended in recent years are similarly exposed, including ASX, Computershare, IOOF Holdings, IRESS, Macquarie Group, Platinum Asset Management and Perpetual. It would be wise to think about your overall exposure to these kinds of stock and consider the impact of market turmoil. We'd suggest you don't allow your overall weighting to these stocks to rise much above 20%. |

You can of course construct more bearish scenarios: risks would include the potential for reputational damage if there's a security problem on one of its platforms; a rise in the Australian dollar (compared to sterling in particular); and the possibility of consolidation among its client base. But unless you actually expect earnings to fall – which is hard given the company's sticky revenues, strong market positions and net cash – then that 4% free cash flow yield provides considerable protection.

Naturally we wish we'd picked up on this opportunity earlier, but we're not going let that make us miss the opportunity presented now. So we're raising our Buy price to $6.50, our Sell price to $10, and upgrading the stock to Buy. We're also adding the stock to both our Growth and Income portfolios (see details below).

The share price risk remains at High, but we'll take the business risk down to Medium, reflecting the company's recurring revenues and its recent move into a net cash position. We'll also raise the maximum recommended portfolio weighting to 5%. The stock has limited liquidity, though, and we'd recommend being patient building a position – if members rush to place orders it could cause the price to spike before collapsing again after orders are satisfied.

With those provisos, we think GBST looks like an excellent opportunity. BUY.

Note: We're buying 2,800 shares in GBST for our Growth Portfolio, and 1,800 shares for our Income Portfolio, at $5.75 each for total consideration of $16,100 and $10,350, respectively.

* Our original article stated that De Dominicis still held 4% of the company, but management contacted us following publication of this article to tell us that this was no longer the case. As he is not a director, the company is not bound to disclose his share transactions, although his shareholding is disclosed in the annual report as a key executive. We'll presumably get an updated figure in the 2015 annual report.

| 2012 | 2013 | 2014 | 2015 F | 2020F (conserv- ative) | 2020F (optimistic) | |

|---|---|---|---|---|---|---|

| Aust CM revenue ($m) | 27.4 | 28.8 | 29.8 | 30 | 30 | 34 |

| Aust CM EBITDA ($m) | 9.2 | 10.3 | 10.3 | 10 | 10 | 12 |

| Aust CM EBITDA margin | 33.6% | 35.8% | 34.6% | 34% | 33% | 36% |

| Intl CM revenue ($m) | 9.6 | 6.9 | 12.0 | 11 | 16 | 21 |

| Intl CM EBITDA ($m) | -3.2 | -4.6 | -2.5 | -3 | 1 | 3 |

| Intl CM EBITDA margin | -33.3% | -66.7% | -20.8% | -25% | 5% | 15% |

| Aust WM revenue ($m) | 17.0 | 18.2 | 18.2 | 20 | 24 | 32 |

| Aust WM EBITDA ($m) | n/a | n/a | 7.0 | 7 | 9 | 13 |

| Aust WM EBITDA margin | n/a | n/a | 38.3% | 38% | 38% | 40% |

| Intl WM revenue ($m) | 19.2 | 25.2 | 35.6 | 47 | 71 | 142 |

| Intl WM EBITDA ($m) | n/a | n/a | 6.6 | 9 | 18 | 43 |

| Intl WM EBITDA margin | n/a | n/a | 18.4% | 20% | 25% | 30% |

| Fin Serv revenue ($m) | 3.9 | 3.5 | 3.1 | 3 | 3 | 4 |

| Fin Serv EBITDA ($m) | 0.2 | 0.2 | -1.1 | 0 | 0 | 1 |

| Fin Serv EBITDA margin | 5.8% | 4.8% | -36.7% | 5% | 5% | 15% |

| Total group revenue ($m) | 77.1 | 83.0 | 98.5 | 111 | 143 | 234 |

| U'lying EBITA ($m) | 12.5 | 14.3 | 17.4 | 20 | 33 | 66 |

| U'lying NPAT ($m) | 9.2 | 11.0 | 14.3 | 17 | 27 | 52 |

| U'lying earnings per share (c) | 13.8 | 16.5 | 21.5 | 26 | 40 | 78 |

Recommendation