GBST's perfect storm

Recommendation

The past couple of years have been a perfect storm for GBST, and don't shareholders know it.

This financial software business looked set for greatness on the back of the growing UK platform market expected to quadruple by 2020. But a series of earnings downgrades have left its share price meandering around levels last seen three years ago. The question is whether this former angel has indeed fallen, or merely stumbled and is yet to get back to its feet.

Key Points

-

GBST's current woes rooted in past

-

Taking steps to improve matters

-

Could be vulnerable to a takeover

In an attempt to understand where GBST might be going, let's look at how it got to where it is today.

Looking back to look forward

Let's cast our attention back to early 2015, a time when GBST was flying high. It had just recorded a record interim profit and its prospects looked bright, with an attractive technology suite and many new contract opportunities. Despite the stock's rich valuation (an underlying forward price-earnings ratio of 22), we upgraded it to Buy.

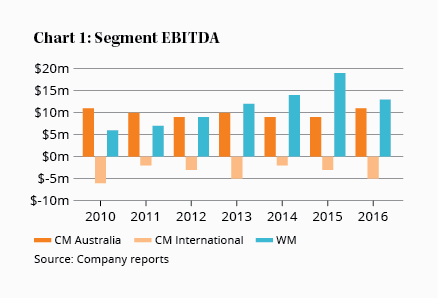

But unbeknownst to us and the market at the time, an internal struggle was raging within the company. The wealth management division was kicking big goals in the UK, but some insiders felt it wasn't getting the attention it deserved. The patchy capital markets division, by contrast, was getting more than its fair share.

By January 2016, the struggle had played out for all to see. The founding Chairman, a non-executive director, the CEO and the CFO had all left the company within months of each other.

They say science advances one funeral at a time, as ageing professors clutch to outdated ideas. At GBST, it took a complete reshuffle of the board and management for new ideas to see the light of day. Rob DeDomincis, the founder of the wealth management business, emerged as CEO, replacing Stephen Lake, the founder of the capital markets business. DeDominicis quickly got to work.

Ramping R&D

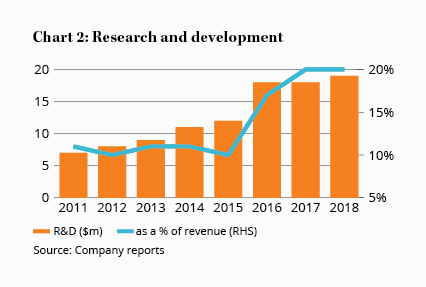

The first notable change he made was to research and development (R&D) expenditure. From its 10% of revenue average under previous management, DeDominicis quickly expanded it to 16% in 2016. It's set to increase to 20% this year. This decision is never taken lightly, as each additional dollar of spending reduces earnings by a commensurate amount, and that never pleases short-sighted shareholders.

We have attempted to find out who has better software out of GBST and its main competitor Bravura Solutions. We've met with both in the past few months but we think the numbers paint the most reliable picture. GBST's R&D ramp up suggests it has fallen behind Bravura and is now playing catch up – a delayed response to a revived Bravura, which had invested heavily as a private company in preparation for its IPO.

GBST's software issues have been compounded by intensifying competitive rivalry with Bravura. The later needed to build a good story for its IPO, and it was willing to price new contract tenders on a knife edge to do so. This has undoubtedly caused problems for GBST.

Bravura has claimed that it has won all tenders against GBST recently. While this may be true, we know from Bravura's prospectus that it priced early tenders so sharply that it lost money on them. Apparently, it has also had difficulty delivering them.

Whether this rivalry continues is up for debate. Funny behaviour can occur around IPOs (which is why we are not interested in Bravura, yet). But now that Bravura is listed, with a register of investors who want growing earnings and dividends, more rational competition is likely. Bravura has also started talking about scaling back its R&D, so it's possible the leaderboard could change again in a few years' time.

Cutting CM

The second change DeDominicis made was to the international capital markets division.

The division was narrowed to focus on Syn's capability with institutional banks, letting go of any other aspirations (in areas like retail broking, custody, and exchange) and the associated cost. This is already bearing fruit with a small profit in the first half of 2017, which is a stark contrast to years of losses.

Its relationship with HSBC points to this division's future. HSBC has adopted GBST's Syn for its Broker Outsourced Security Services (BOSS), a service where it offers its back-office systems to smaller brokers. In doing so, HSBC provides a less costly growth path for GBST, which benefits from growing licence fees as more brokers take up HSBC's service.

The international capital markets division might not have the small chance of big success that it once had, but it's unlikely to be a big drain.

Putting it all together

The last 12 months have been a perfect storm for GBST. A complete reshuffle of senior management and a significant ramp up in R&D came in a year when large projects were deferred by customers.

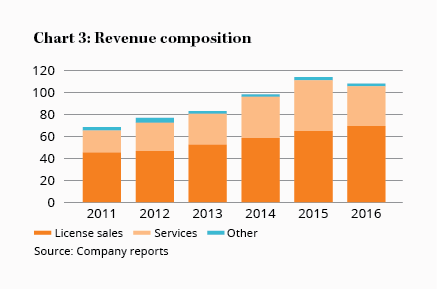

Encouragingly, licence revenue continues to power ahead, as we can see in Chart 3. This forms a robust foundation for the business. GBST's licence revenue is a much higher proportion of total revenue than Bravura's, which is another reason we favour the former.

We're never fans of placing too much emphasis on a potential takeover. It is often a weak hook to hang your hat on. But with the much-reduced share price, it isn't out of the question.

GBST has several natural buyers, like arch-rival Bravura as well as Broadridge and DST. Less obvious bidders like Tata Consulting Services, which competes in the UK pension market, and Temenos, could also be contenders.

The more acquisitive Iress is also on the list, especially after dipping its toe in GBST's market following its Financial Synergy acquisition. Iress trades on a far ritzier multiple, which would mean an acquisition could immediately increase its earnings even after paying a premium.

GBST has its share of threats and opportunities, though, so we think it's important to hold out for a bargain price. Our Buy price remains at $2.50. HOLD.

Note: The Intelligent Investor Growth and Equity Income portfolios own shares in GBST. You can find out about investing directly in Intelligent Investor and InvestSMART portfolios by clicking here.

Recommendation