GBST shows the profit in insight

This is an excerpt from Forager Funds' March Quarterly Report. You can download it or find out more about Forager at www.foragerfunds.com.

Once every decade or so, we get the opportunity to buy cheap stocks en masse. Having the courage to buy quality companies when everyone else is panicking can make a huge difference to investing returns. But the other nine years in every decade are important too.

To prosper in the absence of panic, we need to identify opportunities that the market has misunderstood. We need to find value that other investors have ignored, or identify growth that hasn't yet been anticipated.

An example can be found in technology stock GBST (GBT), by far the best performer in the Forager Australian Shares Fund over the last year.

Key Points

Identify misunderstood opportunities

Be alert for hidden earnings power

Fair value can be a high multiple of today's earnings

When we first came across GBST, a provider of software to the finance industry, it traded at 26 times statutory earnings and had a bit of a scruffy history. Its Australian operations were profitable and stable, but it had acquired an international capital markets business called Syn which was a disaster and was losing money. Offsetting this, the expansion of GBST's wealth management platform Composer into the UK looked to have some potential.

We deduced that underlying profitability was being hidden by the loss making Syn, and by amortisation charges being made in addition to heavy research and development expenses. Stripping those negative amounts out, GBST traded around 6 times pre-tax earnings - a cheap price we thought for a business with fairly stable customers and revenue, certainly much cheaper than peers like IRESS (IRE). Potentially the Australian business was also suffering from low trading volumes in capital markets which could recover, boosting earnings.

True value immense

That analysis was fair enough, but the true value of the UK business wasn't completely apparent to us. It was set to be immense. Changes to regulations were forcing the retirement industry, which traditionally had offered annuity-type pension products, to offer a far greater range of investment options, more like the superannuation system in Australia. The incumbents of the UK retirement industry had legacy software platforms unable to offer multiple investment products and were compelled to upgrade.

Like Hansen does in billing and invoicing, GBST runs a business where customers encounter very high costs to switch providers. This means revenue is rather 'sticky' - when customers join they often stick around for decades. That permits healthy profit margins. In the UK, GBST had the super-charged combination of high switching costs and an overwhelming driver for change. That pointed to a dramatic and permanent expansion in activities and huge value creation. Customers were forced to upgrade to remain in business and each one who signed-up potentially earns revenue for 20 years.

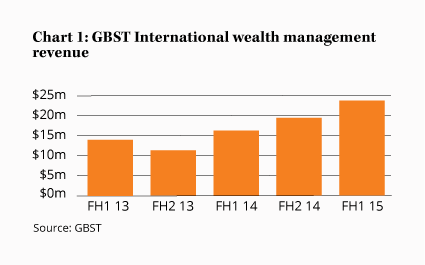

Alongside private-equity-owned rival Bravura, GBST's experience developing similar software for the Australian market gave it a huge head start in the UK market. You can see the results to date in the table below. That's growth every six months, not annualised, and will continue for years yet.

Bargain at twice the price

In early 2013, GBST was a bargain at twice the price. You had something like the opportunity that the market sees in front of accounting software provider Xero (XRO): enormous scale growth from which defensive revenues and high margins will flourish long-term. But, unlike Xero, the market hadn't understood the opportunity well, and GBST didn't trade at 30 times revenue.

Value investors must always demand a discount to fair value, but it's important to be aware that for some businesses fair value can be a high multiple of today's earnings (conversely for others it can be a very low one). The business model of a software company is a nothing at all like a supermarket or an asset intensive property trust where the capital gains on offer are either capped or incremental. Dramatic growth potential at high margin has a lot of value, as is becoming apparent. GBST shares finished the March quarter 58% higher at $5.98 and are now trading at more than four times the Fund's initial purchase price.

The lesson is to watch closely and be alert for hidden earnings power. A business trading at 15 times earnings can offer as much value as another trading at half tangible assets. These misunderstood opportunities are out there today.