FSA Group: good times, bad times

Recommendation

It starts like this: 'You are in default under your facilities and securities with Westpac because you are in arrears of payments currently $294,810.21. If the default is not remedied immediately, Westpac may sell any property described in the Securities Note'.

Letters of Demand are among the scariest things you can find in your mailbox. For FSA Group, though, they're the ignition switch to the company's profit engine: arranging bankruptcies and debt agreements.

FSA is Australia's largest provider of debt agreements, personal insolvency agreements and bankruptcy, and accounts for around half of the debt agreement market.

Key Points

-

Services could triple profit in recession

-

Lending is well managed

-

Share price compensates for risks

As you might expect, revenue from these insolvency services goes up when the Australian economy tanks and people find themselves in financial distress. But – and here's where it gets weird – FSA also benefits from a booming economy. In good times, lending standards decline and people are more likely to overspend, taking on more debt than they can handle.

FSA is an economic adrenaline junkie. The bigger the boom, or bust, the better. It's today's middling conditions that are problematic. Low interest rates, average unemployment and benign retail sales anchor revenue growth as people pay off their debts and borrow more conservatively.

Something's gotta give

Australia has around $1.7 trillion of household debt, or a bit over $70,000 for every man, woman and child. We're the most indebted country in the world according to the Reserve Bank of Australia, with household debts of 1.2 times GDP.

Our gargantuan mortgages are the main culprit. But what makes this scenario interesting is that although Australia's debt continues to rise, retail sales growth has been falling at the same time.

Our gargantuan mortgages are the main culprit. But what makes this scenario interesting is that although Australia's debt continues to rise, retail sales growth has been falling at the same time.

Retail sales increased 3.7% in the first few months of 2016, which is down from growth of around 6% in early 2014 and less than half what it was before the financial crisis. Consumers are having a difficult time consuming because they've maxed out their credit cards.

Recession impact

While interest rates are low, borrowers can keep up with repayments. As a proportion of total assets, less than 1% of loans are 90 days overdue at Australia's big four banks – the lowest since 2007. And it doesn't get much lower than that.

Low interest rates have made it difficult for FSA's Services division to find customers. In the six months to December the number of debt agreement clients fell 6%, though Services revenue fell only 0.5%.

So what could shareholders expect if Australia went into recession?

During the global financial crisis in 2008/9, the number of debt agreements jumped 30%, with revenue increasing about the same. Better yet, FSA's business has significant fixed costs, so most of the additional revenue fell straight to the bottom line. Pre-tax profit doubled.

But remember, Australia didn't actually go into recession in 2008/9, and non-performing loans didn't even hit 2% of assets.

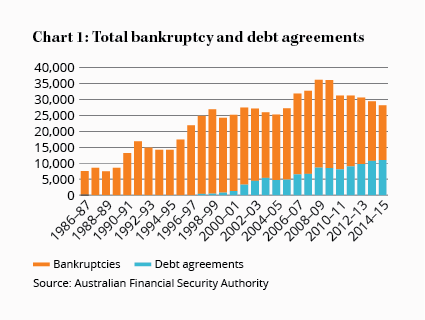

.png) During the recession of the early 1990s, however, problem loans reached almost 8% of assets – a nine-fold increase on where they are now. The number of bankruptcies shot from around 7,400 in 1989 to 16,800 in 1992.

During the recession of the early 1990s, however, problem loans reached almost 8% of assets – a nine-fold increase on where they are now. The number of bankruptcies shot from around 7,400 in 1989 to 16,800 in 1992.

Low interest rates are luring borrowers into debts they couldn't otherwise afford. If unemployment and interest rates rise, FSA should benefit from the deluge of new customers needing to consolidate their debts or arrange better terms with lenders. It's possible – if not probable – that Services revenue would double if Australia had a full-blown recession.

FSA's operating leverage should mean a significant proportion of that would reach the bottom line. In 2009, $7.8m of incremental revenue added $5.1m of incremental profit before tax. At that margin, if Services revenue doubled from the $52m earned over the past 12 months, it could produce a $34m increase in pre-tax profit.

Even if the company's Lending business imploded, FSA could still be earning close to $35m in net profit if the economy went belly up. Given today's market cap of $118m, today's investors would be in for a significant windfall.

Risks

There are, of course, risks. Businesses earning big profits from poor customers have a knack for irking politicians and the media. The Services division was born of changes to Part IX of the Bankruptcy Act in 1996, and future changes could just as quickly throw a spanner in the works.

However, FSA has a more diverse revenue stream than it did a few years ago and, being the largest debt solutions provider, it benefits from economies of scale and is well placed to adapt.

A greater worry is that right when Services is firing on all cylinders, the Lending division is likely to be at its weakest.

.png) FSA's lending is focused on homeowners with dodgy credit histories (tastefully known as the 'non-conforming' market by Aussie lenders). If unemployment or interest rates rose, defaults would inevitably increase, perhaps substantially so.

FSA's lending is focused on homeowners with dodgy credit histories (tastefully known as the 'non-conforming' market by Aussie lenders). If unemployment or interest rates rose, defaults would inevitably increase, perhaps substantially so.

However, the division is at least working from a position of strength. The average loan is $295,000 and has a loan-to-value ratio of 67%, meaning the average property would need to fall by 33% before FSA's capital was at risk. Within this, though, individual properties may be well above the average and pose greater risks. Even if the lending business did get into trouble, however, it is housed in a separate trust where the debts are non-recourse to FSA, so the services division should be able carry on merrily.

What's more, the company knows how to cherry-pick the best borrowers. Just 2.7% of FSA's loans were more than 30 days behind in repayments as of December, well below the average of 6.5% for Australian sub-prime mortgages. FSA has outperformed consistently, with arrears spiking to 8% at the height of the financial crisis, compared to the industry average of 17%. Still, you should prepare for a lot of red ink on this side of the business – and a bumpy share price – if defaults start to get out of hand.

All in all, until the next economic downturn, we don't expect much growth from FSA. In 2015, around 28,000 bankruptcies, debt agreements and personal insolvency agreements were arranged, which is only around 11% higher than in 2005 and roughly in line with population growth. Debt agreements, however, have increased their share from 18% to 39% as more people try to avoid the stigma of formal bankruptcy (the distinction, mind you, is lost on lenders).

Over the long term, we don't expect agreement numbers to grow much more than a few per cent a year. Nonetheless, with an earnings yield of 11.5%, FSA's stock is yielding more than its sub-prime mortgages. That's adequate compensation for the risks and we're sticking with SPECULATIVE BUY.

Note: With several substantial shareholders, FSA Group's stock is highly illiquid with a large spread between the bid and offer prices. To ensure you aren't caught overpaying, it's important that your purchase orders have a limit price and are not made 'At Market'.

Disclosure: The author owns shares in FSA Group.

Recommendation